FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

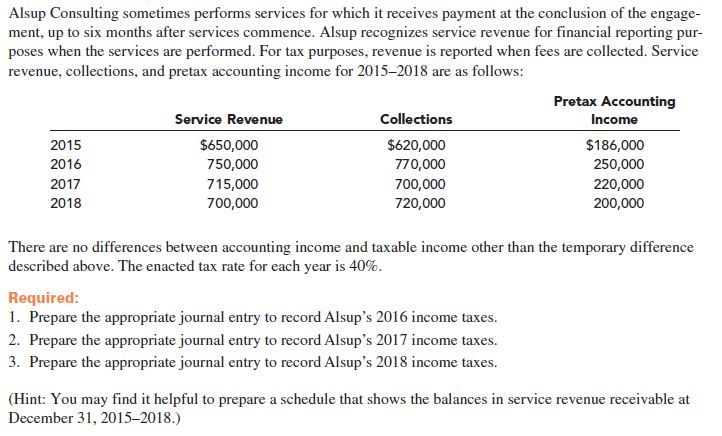

Transcribed Image Text:Alsup Consulting sometimes performs services for which it receives payment at the conclusion of the engage-

ment, up to six months after services commence. Alsup recognizes service revenue for financial reporting pur-

poses when the services are performed. For tax purposes, revenue is reported when fees are collected. Service

revenue, collections, and pretax accounting income for 2015-2018 are as follows:

Pretax Accounting

Collections

Service Revenue

Income

$650,000

750,000

$620,000

$186,000

2015

2016

770,000

250,000

2017

715,000

700,000

220,000

2018

700,000

720,000

200,000

There are no differences between accounting income and taxable income other than the temporary difference

described above. The enacted tax rate for each year is 40%.

Required:

1. Prepare the appropriate journal entry to record Alsup's 2016 income taxes.

2. Prepare the appropriate journal entry to record Alsup's 2017 income taxes.

3. Prepare the appropriate journal entry to record Alsup's 2018 income taxes.

(Hint: You may find it helpful to prepare a schedule that shows the balances in service revenue receivable at

December 31, 2015–2018.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 3 images

Knowledge Booster

Similar questions

- In December 2022, J-Matt, Inc. collected rent in advance from tenants who will begin occupying the rental space in January 2023. For financial reporting purposes, J-Matt recorded the rent as deferred revenue when received in 2022 and will record the rent as revenue in January 2023 when the tenants occupy the rental space. For tax reporting, the rent is taxable in 2022 when collected. The deferred portion of the rent collected in 2022 was $122 million. Taxable income is $540 million in 2022. No temporary differences existed at the beginning of the year, and the tax rate is 25%. Prepare the appropriate journal entry to record J-Matt's provision for income taxes in 2022.arrow_forwardLewes Company appropriately uses the installment sales method for tax purposes and the accrual method for revenue recognition for accounting purposes. Pertinent data at December 31, 2016, the close of the first year of operations, are as follows: Revenue Recognized Revenue Recognized Customer for Accounting Purposes for Tax Purposes Lowe's Builders $200,000 $100,000 Top Down Plumbing 500,000 350,000 Glass Plus Windows 600,000 350,000 Lewes's tax rate is 30%. What amount should be included in the deferred tax account at December 31, 2016 for these installment sales?arrow_forwardPlease help.Thank youarrow_forward

- Mitchell and O’Brien, CPAs, P.C., prepared 600 business and personal tax returns for the filing season ending April 15, 2019, for total billings of $135,000. On May 1, 2020, Mitchell and O’Brien wrote off $2,600 related to the services performed in 2019. The firm determined that, based on past experience, approximately 3% of fees would be uncollectible. Prepare the adjusting journal entry for bad debt on 12/31/2019. Prepare the journal entry to record the defaulted amount on 5/1/2020. Prior to the posting of the adjusting journal entry in #1 above, the balance in the Allowance for Doubtful Accounts is $3,500 (credit). What is the balance in the account at the end of 2019, after the adjusting entry is posted? What is the balance in the account after the entry on May 1, 2020 is posted?arrow_forwardIvanhoe pays a weekly payroll of $250000 that includes federal income taxes withheld of $38100, FICA taxes withheld of $23970, and 401(k) withholdings of $26500. What is the effect on assets and liabilities from this transaction? Assets decrease $187930 and liabilities decrease $62070. Assets decrease $187930 and liabilities increase $62070. Assets decrease $161430 and liabilities increase $88570. Assets decrease $250000 and liabilities do not change.arrow_forwardLuxco is closing its 2012 records. Luxco has engaged Ey to perform the audit of its 2012 annual accounts and the preparation of its 2012 corporate tax returns. The agreed fees are 10.000€ (excl VAT) for the audit and 3000€(excl Vat) for the preparation of the corporate tax returns. These services will be provided in 2013. Make the journal entryarrow_forward

- In December of 2019, a company received consulting services of $100,000. No entry was recorded for these service in 2019. The invoice for the services was received in January 2020 and recorded by debiting consulting expense and crediting accounts payable. This error was discovered in 2020 and was determined to be a material error. What is the impact of the error on the net income of 2019 and 2020? Provide the proper correcting journal enntry assuming a 30% tax rate.arrow_forwardXYZ Company manufactures equipment that are sold through installment. XYZ recognizes revenue on the year of sale for financial reporting and when installment payments are received for income tax purposes. In 2020, the company earned a gross profit of P6,000,000 for accounting and P1,500,000 for income tax purposes. In relation to its sales, XYZ also provides warranties for its equipment. Warranty costs are accrued as expense for financial reporting and recognized as deductible expense in the income tax return when paid. Accrued warranty expense for 2020 is P2,500,000, but only P500,000 of warranty costs are actually paid during the year.In addition, XYZ also earned P500,000 of interest, net of final withholding taxes, from its bank deposits. Interest income subject to final withholding taxes is non-taxable income for income tax purposes. The entity also paid P100,000 insurance premium on the life of its president in relation to an insurance policy where XYZ Company is the beneficiary.…arrow_forwardMusic Media Ltd. prepares statements quarterly. Part A: Required: 1. Based on 2022 results, Music's estimated tax liability for 2023 is $345, 960. Music will accrue 1/32 of this amount at the end of each month (assume the installments are paid the next day). Prepare the entry on January 31, 2023, to accrue the tax liability and on February 1 to record the payment.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education