Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Financial accounting question

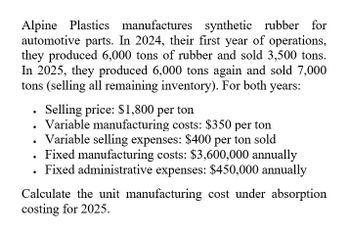

Transcribed Image Text:Alpine Plastics manufactures synthetic rubber for

automotive parts. In 2024, their first year of operations,

they produced 6,000 tons of rubber and sold 3,500 tons.

In 2025, they produced 6,000 tons again and sold 7,000

tons (selling all remaining inventory). For both years:

.

•

Selling price: $1,800 per ton

Variable manufacturing costs: $350 per ton

Variable selling expenses: $400 per ton sold

Fixed manufacturing costs: $3,600,000 annually

Fixed administrative expenses: $450,000 annually

Calculate the unit manufacturing cost under absorption

costing for 2025.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Stanczyk Inc. started operations in January 2025. The company produces and sells cabinets for $5,200 each. The following information pertains to the cost and sales of the cabinets each year: Variable manufacturing costs $2,300 per unit Variable operating costs $65 per unit Fixed manufacturing costs $25,000 Fixed operating costs $12,000 The company produced 25 units per year for 2025, 2026, and 2027. The company sold 22 units in 2025, 20 units in 2026, and 26 units in 2027. It reported no volume variances for the three-year period. For 2025, Question options: a) the operating income for absorption costing may be greater than, equal to or less than operating income under variable costing. b) the operating income for absorption costing equaled operating income for variable costing. c) variable costing operating income exceeded absorption costing operating income by $3,000.…arrow_forwardBuggs-Off Corporation produces and sells a line of mosquito repellants that are sold usually all year round.The product sells at $100 per box. The following cost data has been prepared for its estimated upper and lowerlimits of activity for the year ended December 31, 2020.Lower Limit Upper LimitProduction (# of boxes) 4,000 6,000Production Costs:Direct Materials …………………… $60,000 $90,000Direct Labour ………………………. 80,000 120,000Overhead:Indirect Materials…………... 25,000 37,500Indirect Labour ……………. 40,000 50,000Depreciation ………………. 20,000 20,000Selling & Administrative Expenses:Sales Salaries ……………………… 50,000 65,000Office Salaries ……………………… 30,000 30,000Advertising ………………………….. 45,000 45,000Other …………………………………………. __15,000 __20,000Total $365,000 $477,500 Required:a) Classify each cost element as either fixed, variable, or mixedarrow_forwardNeed answerarrow_forward

- NEED Help with this Questionarrow_forwardFast Track Auto produces and sells an auto part for S65 per unit. In 2020, 125,000 parts were produced and 80,000 units were sold. Other information for the year includes: Direct Materials $20 per unit Direct manufacturing labor $5 per unit Variable manufacturing costs $3 per unit Sales commissions $6 per part Fixed Manufacturing costs $790,000 per year Administrative expenses, all fixed $320,000 per year What is the inventoriable cost per unit using absorption costing? A. $28.00 B. $36.88 C. $34.32 D. $34.00arrow_forwardSantana Rey expects sales of Business Solutions’s line of computer workstation furniture to equal 300 workstations (at a sales price of $3,300 each) for 2019. The workstations’ manufacturing costs include the following. Direct materials $ 750 per unit Direct labor $ 400 per unit Variable overhead $ 60 per unit Fixed overhead $ 24,000 per year The selling expenses related to these workstations follow. Variable selling expenses $ 45 per unit Fixed selling expenses $ 3,500 per year Santana is considering how many workstations to produce in 2019. She is confident that she will be able to sell any workstations in her 2019 ending inventory during 2020. However, Santana does not want to overproduce as she does not have sufficient storage space for many more workstations.Required:1. Complete the following income statements using absorption costing.2. Complete the following income statements using variable costing.arrow_forward

- Siren Company builds custom fishing lures for sporting goods stores. In its first year of operations, 2020, the company incurred the following costs. Variable Costs per Unit Direct materials $10.50 Direct labor $4.83 Variable manufacturing overhead $8.12 Variable selling and administrative expenses $5.46 Fixed Costs per Year Fixed manufacturing overhead $322,000 Fixed selling and administrative expenses $294,140 Siren Company sells the fishing lures for $35.00. During 2020. the company sold 79.000 lures and produced 92,000 lures. (a) Assuming the company uses variable costing, calculate Siren's manufacturing cost per unit for 2020. (Round answer to 2 decimal places, e.g. 10.50.) Manufacturing cost per unitarrow_forward! Required information The following information applies to the questions displayed below] Shadee Corporation expects to sell 540 sun shades in May and 310 in June. Each shade sells for $156. Shadee's beginning and ending finished goods inventories for May are 65 and 55 shades, respectively. Ending finished goods inventory for June will be 50 shades. Each shade requires a total of $65.00 in direct materials that includes 4 adjustable poles that cost $5.00 each. Shadee expects to have 130 in direct materials inventory on May 1, 90 poles in inventory on May 31, and 100 poles in inventory on June 30. Required: Prepare Shadee's May and June purchases budget for the adjustable poles. Budgeted Cost of Poles Purchased May Junearrow_forwardJonfran Company manufactures three different models of paper shredders including the waste container, which serves as the base. While the shredder heads are different for all three models, the waste container is the same. The number of waste containers that Jonfran will need during the following years is estimated as follows: The equipment used to manufacture the waste container must be replaced because it is broken and cannot be repaired. The new equipment would have a purchase price of 945,000 with terms of 2/10, n/30; the companys policy is to take all purchase discounts. The freight on the equipment would be 11,000, and installation costs would total 22,900. The equipment would be purchased in December 20x4 and placed into service on January 1, 20x5. It would have a five-year economic life and would be treated as three-year property under MACRS. This equipment is expected to have a salvage value of 12,000 at the end of its economic life in 20x9. The new equipment would be more efficient than the old equipment, resulting in a 25 percent reduction in both direct materials and variable overhead. The savings in direct materials would result in an additional one-time decrease in working capital requirements of 2,500, resulting from a reduction in direct material inventories. This working capital reduction would be recognized at the time of equipment acquisition. The old equipment is fully depreciated and is not included in the fixed overhead. The old equipment from the plant can be sold for a salvage amount of 1,500. Rather than replace the equipment, one of Jonfrans production managers has suggested that the waste containers be purchased. One supplier has quoted a price of 27 per container. This price is 8 less than Jonfrans current manufacturing cost, which is as follows: Jonfran uses a plantwide fixed overhead rate in its operations. If the waste containers are purchased outside, the salary and benefits of one supervisor, included in fixed overhead at 45,000, would be eliminated. There would be no other changes in the other cash and noncash items included in fixed overhead except depreciation on the new equipment. Jonfran is subject to a 40 percent tax rate. Management assumes that all cash flows occur at the end of the year and uses a 12 percent after-tax discount rate. Required: 1. Prepare a schedule of cash flows for the make alternative. Calculate the NPV of the make alternative. 2. Prepare a schedule of cash flows for the buy alternative. Calculate the NPV of the buy alternative. 3. Which should Jonfran domake or buy the containers? What qualitative factors should be considered? (CMA adapted)arrow_forward

- Ottis, Inc., uses 640,000 plastic housing units each year in its production of paper shredders. The cost of placing an order is 30. The cost of holding one unit of inventory for one year is 15.00. Currently, Ottis places 160 orders of 4,000 plastic housing units per year. Required: 1. Compute the economic order quantity. 2. Compute the ordering, carrying, and total costs for the EOQ. 3. How much money does using the EOQ policy save the company over the policy of purchasing 4,000 plastic housing units per order?arrow_forwardRoadside Inc. manufactures the Megalite, and is reviewing the product's cost structure. Accounting records show these costs:factory space: $250,000 per yearinsurance: $47,000 per yearsupervisor salaries: $125,000 per yearmaterials: $5.00 per lampdirect labor: $2.69 per lamprecycling charge: $0.37 per lampRoadside Inc sells the Megalite to wholesalers for $13.69 each. Calculate Roadside's contribution margin as percent of selling price on the Megalite. (Rounding: tenth of a percent. Report 25.3%, for example, as "25.3".)arrow_forwardhe production cost information for Blossom's Salsa is as follows: Blossom's Salsa Production Costs April 2020 Production 23,000 Jars of Salsa Ingredient cost (variable) $13, 800 Labor cost (variable ) 9,660 Rent (fixed) 4, 300 Depreciation (fixed) 6,000 Other (fixed) 1,400 Total $35, 160 The company is currently producing and selling 345,000 jars of salsa annually. The jars sell for $7.00 each. The company is considering lowering the price to $6.30. Suppose this action will increase sales to 391, 000 jars. What is the incremental cost associated with producing an extra 46, 000 jars of salsa?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning