Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

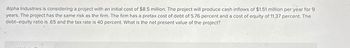

Transcribed Image Text:Alpha Industries is considering a project with an initial cost of $8.5 million. The project will produce cash inflows of $1.51 million per year for 9

years. The project has the same risk as the firm. The firm has a pretax cost of debt of 5.76 percent and a cost of equity of 11.37 percent. The

debt-equity ratio is .65 and the tax rate is 40 percent. What is the net present value of the project?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Ariana, Incorporated, is considering a project that will result in initial aftertax cash savings of $6.1 million at the end of the first year, and these savings will grow at a rate of 3 percent per year, indefinitely. The firm has a target debt-equity ratio of .60, a cost of equity of 13 percent, and an aftertax cost of debt of 5.5 percent. The cost-saving proposal is somewhat riskier than the usual project the firm undertakes; management uses the subjective approach and applies an adjustment factor of +3 percent to the cost of capital for such risky projects. a. Calculate the required return for the project. Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. b. What is the maximum cost the company would be willing to pay for this project? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. a. Project required return b. Maximum to pay 13.19 %arrow_forwardConsider a project with free cash flows in one year of $90,000 in a weak economy or $117,000 in a strong economy, with each outcome being equally likely. The initial investment required for the project is $80,000, and the project's cost of capital is 15%. The risk-free interest rate is 5%. c. Suppose that to raise the funds for the initial investment the firm borrows $45,000 at the risk-free rate and issues new equity to cover the remainder. In this situation, calculate the value of the firm's levered equity from the project. What is the cost of capital for the firm's levered equity? d. What is the basic goal of financial management with respect to capital structure? Is there an easily identifiable capital structure that will maximize the value of the firm? Why or why not?arrow_forwardAlpha Industries is considering a project with an initial cost of $8.1 million. The project will produce cash inflows of $1.46 million per year for 9 years. The project has the same risk as the firm. The firm has a pretax cost of debt of 5.64 percent and a cost of equity of 11.29 percent. The debtequity ratio is .61 and the tax rate is 39 percent. What is the net present value of the project?arrow_forward

- Caspian Sea Drinks is considering buying the J - Mix 2000. It will allow them to make and sell more product. The machine cost $1.92 million and create incremental cash flows of $582, 193.00 each year for the next five years. The cost of capital is 9.20 %. What is the profitability index for the J - Mix 2000?arrow_forwardAlpha Industries is considering a project with an initial cost of $8.8 million. The project will produce cash inflows of $1.68 million per year for 8 years. The project has the same risk as the firm. The firm has a pretax cost of debt of 5.85 percent and a cost of equity of 11.43 percent. The debt-equity ratio is .68 and the tax rate is 40 percent. What is the net present value of the project? O $695,448 O $772,720 O $662,331 $803,629 O $439,544 Aarrow_forwardNPV and IRR Benson Designs has prepared the following estimates for a long-term project it is considering. The initial investment is $41,150, and the project is expected to yield after-tax cash inflows of $9,000 per year for 7 years. The firm has a cost of capital of 8%. a. Determine the net present value (NPV) for the project. b. Determine the internal rate of return (IRR) for the project. c. Would you recommend that the firm accept or reject the project? a. The NPV of the project is $. (Round to the nearest cent.) Text dia Librai I Calculat Resource Enter vour answer in the answer box and then click Check Answer. Check Answer ic Study es Clear parts remaining nunication Tools > O Type here to search insert ( to |立arrow_forward

- (Ignore income taxes in this problem.) Your Company is considering an investment in a project that will have a three-year life. The project will provide a 4% internal rate of return and is expected to have a $40,000 cash inflow the first year and a $0 cash inflow in the second year, and $50,000 cash inflow in the third year. What investment is required in the project?arrow_forwardABC Corp is considering a new project: the project requires an initial cost of $375,000, and will not produce any cash flows for the first two years. Starting in year 3, the project will generate cash inflows of $528,000 a year for three years. This project has higher risk compared to other projects the firm has, so it is assigned with a discount rate of 18%. What is the project's net present value? $773,016.1 $218,693.6 $449,487.3 $824,487.3 Oa b. C₂ d.arrow_forwardConsider a project with free cash flows in one year of $90,000 in a weak economy or $117,000 in a strong economy, with each outcome being equally likely. The initial investment required for the project is $80,000, and the project's cost of capital is 15%. The risk-free interest rate is 5%. Suppose that to raise the funds for the initial investment the firm borrows $40,000 at the risk-free rate and issues new equity to cover the remainder. In this situation, the cost of capital for the firm's levered equity is closest to:arrow_forward

- | Frontier Corp. is considering a new product that would require an after-tax investment of $1,400,000 at t = 0. If the new product is well received, then the project would produce after-tax cash flows of $650,000 at the end of each of the next 3 years (t = 1, 2, 3), but if the market did not like the product, then the cash flows would be only $100,000 per year. There is a 70% probability that the market will be good. Tsai Corp. could delay the project for a year while it conducted a test to determine if demand would be strong or weak. The project's cost and expected annual cash flows are the same whether the project is delayed or not; however, the timing of the cash flows would change. (There would be the same number of cash flows-only the cash flows would be extended out one extra year.) The project's WACC is 10%. What is the value of the project after considering the investment timing option? a. $108,226.89 b. $137,743.32 c. $167,259.75 d. $196,776.18 e. $216,453.79arrow_forwardBlue Llama Mining Company is analyzing a project that requires an initial investment of $3,225,000. The project’s expected cash flows are: Year Cash Flow Year 1 $325,000 Year 2 –100,000 Year 3 425,000 Year 4 500,000 1. Blue Llama Mining Company’s WACC is 7%, and the project has the same risk as the firm’s average project. Calculate this project’s modified internal rate of return (MIRR): 17.53% -20.06% 22.14% 16.61% 2. If Blue Llama Mining Company’s managers select projects based on the MIRR criterion, they should accept or reject this independent project. 3. Which of the following statements about the relationship between the IRR and the MIRR is correct? A typical firm’s IRR will be equal to its MIRR. A typical firm’s IRR will be less than its MIRR. A typical firm’s IRR will be greater than its MIRR.arrow_forwardF1arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education