MATLAB: An Introduction with Applications

6th Edition

ISBN: 9781119256830

Author: Amos Gilat

Publisher: John Wiley & Sons Inc

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Almost all companies utilize some type of year-end performance review for their employees. Human Resources (HR) at a university's Health Science Center provides

guidelines for supervisors rating their subordinates. For example, raters are advised to examine their ratings for a tendency to be either too lenient or too harsh.

According to HR, "if you have this tendency, consider using a normal distribution-10% of employees (rated) exemplary, 20% distinguished, 40% competent, 20%

marginal, and 10% unacceptable." Suppose you are rating an employee's performance on a scale of 1 (lowest) to 100 (highest). Also, assume the ratings follow a

normal distribution with a mean of 50 and a standard deviation of 15. Complete parts a and b.

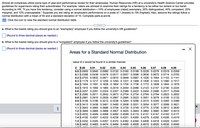

Click the icon to view the standard normal distribution table.

.....

a. What is the lowest rating you should give to an "exemplary" employee if you follow the university's HR guidelines?

(Round to three decimal places as needed.)

b. What is the lowest rating you should give to a "competent" employee if you follow the university's guidelines?

(Round to three decimal places as needed.)

Areas for a Standard Normal Distribution

value of z would be found in a similar manner.

z 0.00

0.0 0.0000 0.0040 0.0080 0.0120 0.0160 0.0199 0.0239 0.0279 0.0319 0.0359

0.1 0.0398 0.0438 0.0478 0.0517 0.0557 0.0596 0.0636 0.0675 0.0714 0.0753

0.2 0.0793 0.0832 0.0871 0.0910 0.0948 0.0987 0.1026 0.1064 0.1103 0.1141

0.3 0.1179 0.1217 0.1255 0.1293 0.1331 0.1368 0.1406 0.1443 0.1480 0.1517

0.4 0.1554 0.1591 0.1628 0.1664 0.1700 0.1736 0.1772 0.1808 0.1844 0.1879

0.5 0.1915 0.1950 0.1985 0.2019 0.2054 0.2088 0.2123 0.2157 0.2190 0.2224

0.6 0.2257 0.2291 0.2324 0.2357 0.2389 0.2422 0.2454 0.2486 0.2517 0.2549

0.7 0.2580 0.2611 0.2642 0.2673 0.2704 0.2734 0.2764 0.2794 0.2823 0.2852

0.8 0.2881 0.2910 0.2939 0.2967 0.2995 0.3023 0.3051 0.3078 0.3106 0.3133

0.9 0.3159 0.3186 0.3212 0.3238 0.3264 0.3289 0.3315 0.3340 0.3365 0.3389

1.0 0.3413 0.3438 0.3461 0.3485 0.3508 0.3531 0.3554 0.3577 0.3599 0.3621

1.1 0.3643 0.3665 0.3686 0.3708 0.3729 0.3749 0.3770 0.3790 0.3810 0.3830

1.2 0.3849 0.3869 0.3888 0.3907 0.3925 0.3944 0.3962 0.3980 0.3997 0.4015

1.3 0.4032 0.4049 0.4066 0.4082 0.4099 0.4115 0.4131 0.4147 0.4162 0.4177

1.4 0.4192 0.4207 0.4222 0.4236 0.4251 0.4265 0.4279 0.4292 0.4306 0.4319

1.5 0.4332 0.4345 0.4357 0.4370 0.4382 0.4394 0.4406 0.4418 0.4429 0.4441

1.6 0.4452 0.4463 0.4474 0.4484 0.4495 0.4505 0.4515 0.4525 0.4535 0.4545

0.01

0.02

0.03

0.04

0.05

0.06

0.07

0.08

0.09

Expert Solution

arrow_forward

Step 1

From the given information we find the rating.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Almost all companies utilize some type of year-end performance review for their employees. Human Resources (HR) at a university's Health Science Center provides guidelines for supervisors rating their subordinates. For example, raters are advised to examine their ratings for a tendency to be either too lenient or too harsh. According to HR, "if you have this tendency, consider using a normal distribution-10% of employees (rated) exemplary, 20% distinguished, 40% competent, 20% marginal, and 10% unacceptable." Suppose you are rating an employee's performance on a scale of 1 (lowest) to 100 (highest). Also, assume the ratings follow a normal distribution with a mean of 46 and a standard deviation of 13. Complete parts a and b. Click the icon to view the standard normal distribution table. a. What is the lowest rating you should give to an "exemplary" employee if you follow the university's HR guidelines? (Round to three decimal places as needed.) b. What is the lowest rating you should…arrow_forwardYou want to compare males and females in their use of coping strategies when engaged in conflict in relationships. You send surveys to couples obtained from marriage license application at the county clerk's office. You identify several distinct coping strategies on the survey and have the respondents rate their use of each strategy on a 7-point scale. You then compare scores that come from the two members of each relationship. If testing hypotheses about the effects of gender on use of coping strategies, it would be most appropriate to calculate a ... 1) independent-samples t 2) one sample t 3) paired samples t 4) z testarrow_forwardSocially conscious investors screen out stocks of alcohol and tobacco makers, firms with poor environmental records, and companies with poor labor practices. Some examples of "good," socially conscious companies are Johnson and Johnson, Dell Computers, Bank of America, and Home Depot. The question is, are such stocks overpriced? One measure of value is the P/E, or price-to-earnings ratio. High P/E ratios may indicate a stock is overpriced. For the S&P Stock Index of all major stocks, the mean P/E ratio is ? = 19.4. A random sample of 36 "socially conscious" stocks gave a P/E ratio sample mean of x = 17.7, with sample standard deviation s = 5.2. Does this indicate that the mean P/E ratio of all socially conscious stocks is different (either way) from the mean P/E ratio of the S&P Stock Index? Use ? = 0.05. (a) What is the level of significance?State the null and alternate hypotheses. H0: ? = 19.4; H1: ? < 19.4H0: ? ≠ 19.4; H1: ? = 19.4 H0: ? = 19.4; H1: ? ≠ 19.4H0: ?…arrow_forward

- Consider the following data. Satisfaction level depended on the speed of execution. A portion of the survey results are as follows: Brokerage Satisfaction Speed Scottrade, Inc. 3.5 3.4 Charles Schwab 3.4 3.3 Fidelity Brokerage Services 3.9 3.4 TD Ameritrade 3.7 3.6 USAA Brokerage Services 2.9 3.22 | Page Vanguard Brokerage Services 2.6 2.6 Wells Fargo Investments 4.0 4.0 i. At the ��= 0.01 level, would you feel comfortable to use the estimated regression equation to relate the speed of execution and satisfaction level? What is your conclusion? (Use p-vale approach) ii. Estimate the 98% confidence interval for speed of executionarrow_forwardAlmost all companies utilize some type of year-end performance review for their employees. Human Resources (HR) at a university's Health Science Center provides guidelines for supervisors rating their subordinates. For example, raters are advised to examine their ratings for a tendency to be either too lenient or too harsh. According to HR, "if you have this tendency, consider using a normal distribution—10% of employees (rated) exemplary, 20% distinguished, 40% competent, 20% marginal, and 10% unacceptable." Suppose you are rating an employee's performance on a scale of 1 (lowest) to 100 (highest). Also, assume the ratings follow a normal distribution with a mean of 45 and a standard deviation of 13. What is the lowest rating you should give to a "competent" employee if you follow the university's guidelines?arrow_forwardI need help with 7, 8 and 9arrow_forward

- Why is Data literacy important when evaluating sources from a study?arrow_forwardAlmost all companies utilize some type of year-end performance review for their employees. Human Resources (HR) at a university's Health Science Center provides guidelines for supervisors rating their subordinates. For example, raters are advised to examine their ratings for a tendency to be either too lenient or too harsh. According to HR, "if you have this tendency, consider using a normal distribution-10% of employees (rated) exemplary, 20% distinguished, 40% competent, 20% marginal, and 10% unacceptable." Suppose you are rating an employee's performance on a scale of 1 (lowest) to 100 (highest). Also, assume the ratings follow a normal distribution with a mean of 45 and a standard deviation of 16. Complete parts a and b. Click the icon to view the standard normal distribution table. a. What is the lowest rating you should give to an "exemplary" employee if you follow the university's HR guidelines? (Round to three decimal places as needed.) b. What is the lowest rating you should…arrow_forwardSocially conscious investors screen out stocks of alcohol and tobacco makers, firms with poor environmental records, and companies with poor labor practices. Some examples of "good," socially conscious companies are Johnson and Johnson, Dell Computers, Bank of America, and Home Depot. The question is, are such stocks overpriced? One measure of value is the P/E, or price-to-earnings ratio. High P/E ratios may indicate a stock is overpriced. For the S&P Stock Index of all major stocks, the mean P/E ratio is ? = 19.4. A random sample of 36 "socially conscious" stocks gave a P/E ratio sample mean of x = 17.8, with sample standard deviation s = 5.8. Does this indicate that the mean P/E ratio of all socially conscious stocks is different (either way) from the mean P/E ratio of the S&P Stock Index? Use ? = 0.05. I need help with sketching (d) and (e)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning

Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning

Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON

Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman

The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman

Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman

MATLAB: An Introduction with Applications

Statistics

ISBN:9781119256830

Author:Amos Gilat

Publisher:John Wiley & Sons Inc

Probability and Statistics for Engineering and th...

Statistics

ISBN:9781305251809

Author:Jay L. Devore

Publisher:Cengage Learning

Statistics for The Behavioral Sciences (MindTap C...

Statistics

ISBN:9781305504912

Author:Frederick J Gravetter, Larry B. Wallnau

Publisher:Cengage Learning

Elementary Statistics: Picturing the World (7th E...

Statistics

ISBN:9780134683416

Author:Ron Larson, Betsy Farber

Publisher:PEARSON

The Basic Practice of Statistics

Statistics

ISBN:9781319042578

Author:David S. Moore, William I. Notz, Michael A. Fligner

Publisher:W. H. Freeman

Introduction to the Practice of Statistics

Statistics

ISBN:9781319013387

Author:David S. Moore, George P. McCabe, Bruce A. Craig

Publisher:W. H. Freeman