FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

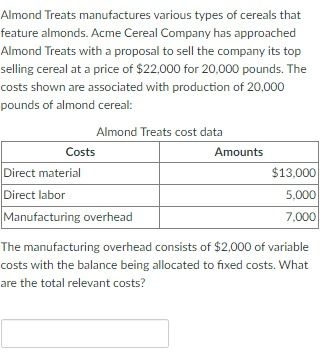

Transcribed Image Text:Almond Treats manufactures various types of cereals that

feature almonds. Acme Cereal Company has approached

Almond Treats with a proposal to sell the company its top

selling cereal at a price of $22,000 for 20,000 pounds. The

costs shown are associated with production of 20,000

pounds of almond cereal:

Almond Treats cost data

Costs

Direct material

Direct labor

Manufacturing overhead

Amounts

$13,000

5.000

7,000

The manufacturing overhead consists of $2,000 of variable

costs with the balance being allocated to fixed costs. What

are the total relevant costs?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- Almond Treats manufactures various types of cereals that feature almonds. Acme Cereal Company has approached Almond Treats with a proposal to sell the company its top selling cereal at a price of $22,000 for 20,000 pounds. The costs shown are associated with production of 20,000 pounds of almond cereal: Almond Treats cost data Costs Amounts Direct material $13,000 Direct labor 5,000 Manufacturing overhead 7,000 A) The manufacturing overhead consists of $2,000 of variable costs with the balance being allocated to fixed costs. What are the total relevant costs? B) The manufacturing overhead consists of $2,000 of variable costs with the balance being allocated to fixed costs. If Almond Treats buys the cereal, what is the effect on profit? If the effect is negative, use a dash - not parentheses ( ).arrow_forwardMay you please answer both questions (:arrow_forwardEvery year Blue Industries manufactures 7,300 units of part 231 for use in its production cycle. The per unit costs of part 231 are as follows: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Total (a) $3.00 Total relevant cost to make $ 11.00 Net relevant cost to buy $ 8.00 Cullumber, Inc., has offered to sell 7,300 units f part 231 to Blue for $33 per unit. If Blue accepts Cullumber's offer, its freed-up facilities could be used to earn $10,700 in contribution margin by manufacturing part 240. In addition, Blue would eliminate 50% of the fixed overhead applied to part 231. 10.00 $32.00 Calculate total relevant cost to make and net cost to buy.arrow_forward

- Adams Electronics currently produces the shipping containers it uses to deliver the electronics products it sells. The monthly cost of producing 9,100 containers follows. Unit-level materials $ 5,400 Unit-level labor 6,400 Unit-level overhead 3,900 Product-level costs* 10,500 Allocated facility-level costs 28,200 *One-third of these costs can be avoided by purchasing the containers.Russo Container Company has offered to sell comparable containers to Adams for $2.80 each.Required Calculate the total relevant cost. Should Adams continue to make the containers? Adams could lease the space it currently uses in the manufacturing process. If leasing would produce $12,500 per month, calculate the total avoidable costs. Should Adams continue to make the containers?arrow_forwardAholt Corporation makes 40,000 units per year of a part it uses in the products it manufactures. The unit product cost of this part is computed as follows: Alt Tex How would context to se (1-2 sentenc Direct materials Direct labor $11.30 22.70 Variable manufacturing overhead 1.20 Fixed manufacturing overhead 24.70 Unit product cost $59.90 An outside supplier has offered to sell the company all of these parts it needs for $46.20 a unit. If the company accepts this offer, the facilities now being used to make the part could be used to make more units of a product that is in high demand. The additional contribution margin on this other product would be $264,000 per year. If the part were purchased from the outside supplier, all of the direct labor cost of the part would be avoided. However, $21.90 of the fixed manufacturing overhead cost being applied to the part would continue even if the part were purchased from the outside supplier. This fixed manufacturing overhead cost would be…arrow_forwardEvery year Marigold Industries manufactures 6,100 units of part 231 for use in its production cycle. The per unit costs of part 231 are as follows: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Total (a) Total relevant cost to make $ $4.00 Net relevant cost to buy 10.00 Carla Vista, Inc., has offered to sell 6,100 units of part 231 to Marigold for $34 per unit. If Marigold accepts Carla Vista's offer, its freed-up facilities could be used to earn $10,700 in contribution margin by manufacturing part 240. In addition, Marigold would eliminate 40% of the fixed overhead applied to part 231. $ 6.00 10.00 Calculate total relevant cost to make and net cost to buy. $30.00arrow_forward

- Specter Company makes 20,000 units per year of a part it uses in the products it manufactures.The unit product cost of this part is computed as follows:Direct materials $25.10Direct labour 18.20Variable manufacturing overhead 2.40Fixed manufacturing overhead 13.40Unit product cost $56.70An outside supplier has offered to sell the company all these parts it needs for $56.00 a unit. Ifthe company accepts this offer, the facilities now being used to make the part could be used tomake more units of a product that is in high demand. The additional contribution margin on thisother product would be $50,000 per year.If the part were purchased from the outside supplier, all the direct labour cost of the part wouldbe avoided. However, $5.10 of the fixed manufacturing overhead cost being applied to the partwould continue even if the part were purchased from the outside supplier. This fixedmanufacturing overhead cost would be applied to the company's remaining products.Required:Part a:Calculate…arrow_forwardVogel Inc. manufactures memory chips for electronic toys within a relevant range of 114,000 to 182,400 memory chips per year. Within this range, the following partially completed manufacturing cost schedule has been prepared. Complete the cost schedule below. When computing the cost per unit, round to two decimal places. Round all other values to the nearest dollar. Cost Report Components produced 114,000 144,000 182,400 Total costs: $ Total variable costs $49,020 (d) (j) Total fixed costs 54,720 (e) (k) $ $103,740 (f) (1) Total costs Cost per Unit $ Variable cost per unit (a) (g) (m) Fixed cost per unit (b) (h) (n) $ Total cost per unit (c) (i) (0)arrow_forwardJames Company makes flanges for its main product of widgets. The cost of making each widget is as follows: Another company has offered to sell to James Company the flanges for a price of $19.00 each. Should James Company buy the flanges from the other company or continue to make the flanges themselves? Show your computations.arrow_forward

- Jackson has received a request for a special order of 9,000 units of product "Michael" for $46.35 each. The normal selling price of this product is $51.26 each, but the units would need to be modified slightly for the customer. The normal unit product cost of product "Michael" is computed as follows: Direct materials $17.24 Dirct labor $6.29 Variable manufacturing overhead $3.78 Fixed manufacturing overhead $6.95 Direct labor is a variable cost. The special order would have no effect on the company's total fixed manufacturing overhead costs. The customer would like some modifications made to product "Michael"that would increase the variable costs by $6.32 per unit and that would require a one-time investment of $46288 in special molds that would have no salvage value. This special order would have no effect on the company's other sales. The company has ample spare capacity for producing the special order.Determine the effect on total net operating income of accepting the special order.…arrow_forwardRagemark Company produces 15,000 units of a component used in freezer. An outside supplier has offered to supply the part for $1.42. The unit cost is: Direct material $0.55 Direct labour 0.2 Variable overhead 0.1 Fixed overhead 2.45 Total unit cost $3.30 Required: 1. What are the alternatives for Ragemark Company? 2. Assume that none of the fixed cost is avoidable. List the relevant cost(s) of internal production and of external purchase. 3. Which alternative is more cost effective and by how much?arrow_forwardCantor Beverages produces bottled vegan smoothies. As part of the process, Cantor prepares and prints the labels used on the bottles. An outside supplier would provide Cantor with 20,000 pre-printed labels for $5.00 per label. Cantor estimates the company's current average cost of a label is $3.75 based upon the following information: Total cost Direct material $ 30,000 Direct labor $ 12,500 Variable overhead $ 18,750 Fixed overhead - Traceable $ 25,000 Fixed overhead - Allocated $ 7,500 $ 93,750 Outsourcing the labeling department will eliminate 80% of the Fixed overhead - Traceable expenses. Cantor expects to rent the space now available in its facility. For net income to remain constant, compute the MINIMUM rent Cantor would charge a tenant. HINT: Benefits = Costs results in no change in income. O $5,000 O $12,000 O $31,000 O $40,000 O None of the other answers are correctarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education