FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

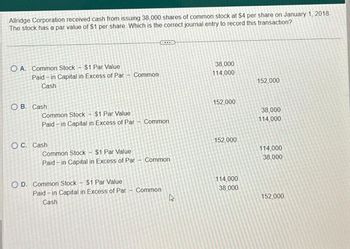

Transcribed Image Text:Allridge Corporation received cash from issuing 38,000 shares of common stock at $4 per share on January 1, 2018.

The stock has a par value of $1 per share. Which is the correct journal entry to record this transaction?

O A. Common Stock - $1 Par Value

Paid-in Capital in Excess of Par - Common

Cash

O B. Cash

Common Stock $1 Par Value

Paid-in Capital in Excess of Par - Common

OC. Cash

Common Stock - $1 Par Value

Paid-in Capital in Excess of Par

$1 Par Value

Paid-in Capital in Excess of Par

Cash

OD. Common Stock -

ID

Common

Common

4

38,000

114,000

152,000

152,000

114,000

38,000

152,000

38,000

114,000

114,000

38,000

152,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Subject :- Accountarrow_forwardOn January 1, 2017, Ehrlich Corporation had the following stockholders’ equity accounts.Common Stock ($10 par value, 100,000 shares issued and outstanding) $1,000,000Paid-in Capital in Excess of Par—Common Stock 200,000Retained Earnings 540,000During the year, the following transactions occurred.Jan. 15 Declared a $1 cash dividend per share to stockholders of record on January 31, payable February 15.Feb. 15 Paid the dividend declared in January.Apr. 15 Declared a 15% stock dividend to stockholders of record on April 30, distributable May 15. On April 15, the market price of the stock was $15 per share.May 15 Issued the shares for the stock dividend.Dec. 1 Declared a $0.50 per share cash dividend to stockholders of record on December 15, payable January 10, 2018. 31 Determined that net income for the year was $250,000.Instructions(a) Journalize the…arrow_forwardOn January 1, 2024, Dolar Incorporated had the following account balances in its shareholders' equity accounts. Common stock, $1 par, 241,000 shares issued $241,000 Paid-in capital-excess of par, common 482,000 Paid-in capital-excess of par, preferred. 195,000 Preferred stock, $100 par, 19,500 shares outstanding 1,950,000 Retained earnings Treasury stock, at cost, 4,100 shares 3,900,000 20,500 During 2024, Dolar Incorporated had several transactions relating to common stock. January 15: February 17: April 10: July 18: December 1: December 28: Required: Declared a property dividend of 100,000 shares of Burak Company (book value $11.9 per share, fair value $9.95 per share). Distributed the property dividend. A 2-for-1 stock split was declared and distributed on outstanding common stock and effected in the form of a stock dividend. (Dolar chose to reduce Paid-in capital-excess of par.) The fair value of the stock was $4 on this date.. Declared and distributed a 4% stock dividend on…arrow_forward

- please help asap pleasearrow_forwardThe stockholders' equity section of the January 1, 2031 balance sheet for XYZ Company is given below: Common stock, $14 par value ................. $525,000 Paid-in capital – common stock .............. $150,000 Treasury stock (14,000 shares @ $16 cost) ... $224,000 Paid-in capital – treasury stock ............ $ 13,000 Retained earnings ........................... $107,000 XYZ Company entered into the following transactions during 2031: a. Re-issued 2,000 of the treasury shares for $11 per share. b. Re-issued 3,000 of the treasury shares for $13 per share. c. Issued 5,000 shares of previously un-issued common stock for $21 per share. d. Re-issued 6,000 of the treasury shares for $19 per share. Calculate the balance in the retained earnings account after all four transactions above are recorded.arrow_forwardShown below is information relating to the stockholders' equity of Robertson Corporation at December 31, 2022: 12% cumulative preferred stock, $150 par Common stock, $1.50 par Additional paid-in capital: preferred stock Additional paid-in capital: common stock Treasury stock (at cost: 6,000 common shares) Retained earnings Refer to the above data. How many shares of common stock are outstanding? O a. 600,000 O b. 406,000 O c. 594,000 O d. 394,000 $1,500,000 600,000 300,000 900,000 180,000 1,350,000arrow_forward

- The following information is available for ConocoPhillips on December 31, 2022: Common Stock, $1.75 par, 400,000 shares authorized Additional Paid in Capital - Common Stock Retained Earnings Total Stockholders' Equity During 2023, ConocoPhillips completed these transactions (in chronological order): 1) Declared and issued a 2.0% stock dividend on the outstanding stock. At that time, the stock was quoted at a market price of $20 per share. 2) Issued 2,400 shares of common stock at the price of $18 per share. 3) Net Income for the year was $410,400. Determine the ending balance in the Additional Paid in Capital - Common Stock account on December 31, 2023: Select one: O O $651,000 840,000 756,000 $2,247.000 a. $1,014,780 b. $1,025,000 c. $1,032,000 d. $975,780 e. $879,000 4arrow_forwardDengararrow_forwardStockholders' equity accounts, arranged aphabetically are the ledger of Pina Colada Corp. at December 31, 2020. Common Stock ($5 stated value) $1,675,000 Paid-in capital inexcess of par-preferred stock 279,000 Paid-in capital in excess of stated value-common stock. 936,000 Preferred stock (8%, $103 par) 489,250 Ratained Earnings 1,120,000 Treasury Stock (12,000 common shares) 144,000 Prepare the stockholders' equity section of the balance sheet at December 31, 2020. *please solve and explain process. Thank youarrow_forward

- Kk28. help me solve june 8arrow_forwardBelton, Inc. had the following transactions in 2018, its first year of operations: Issued 37,000 shares of common stock. Stock has par value of $1.00 per share and was issued at $21.00 per share. Earned net income of $72,000. Paid no dividends. At the end of 2018, what is the total amount of paid-in capital? A. $777,000 B. $37,000 C. $849,000 D. $72,000arrow_forwardBradley Corporation issued 10,000 shares of common stock on January 1, 2013. The stock has par value of $0.01 per share and was sold for cash at par. The journal entry to record this transaction would O a. Debit Cash $10,000, credit Common stock $100, and credit Paid-in capital $9,900. O b. Debit Paid-in capital $9,900, and credit Common stock $9,900 O c. Credit Cash $10,000 and debit Common stock $10,000 O d. Debit Cash $100 and credit Common stock $100.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education