Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

None

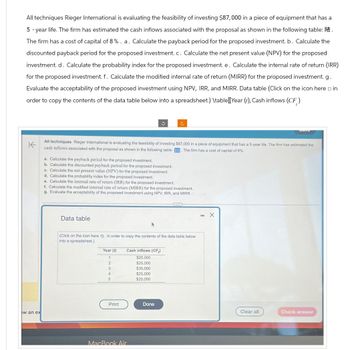

Transcribed Image Text:All techniques Rieger International is evaluating the feasibility of investing $87,000 in a piece of equipment that has a

5-year life. The firm has estimated the cash inflows associated with the proposal as shown in the following table:

The firm has a cost of capital of 8%. a. Calculate the payback period for the proposed investment. b. Calculate the

discounted payback period for the proposed investment. c. Calculate the net present value (NPV) for the proposed

investment. d. Calculate the probability index for the proposed investment. e. Calculate the internal rate of return (IRR)

for the proposed investment. f. Calculate the modified internal rate of return (MIRR) for the proposed investment. g.

Evaluate the acceptability of the proposed investment using NPV, IRR, and MIRR. Data table (Click on the icon here in

order to copy the contents of the data table below into a spreadsheet.) \table [Year(), Cash inflows (CF)

不

c

All techniques Rieger International is evaluating the feasibility of investing $87,000 in a piece of equipment that has a 5-year life. The firm has estimated the

cash inflows associated with the proposal as shown in the following table: The firm has a cost of capital of 8%.

a. Calculate the payback period for the proposed investment.

b. Calculate the discounted payback period for the proposed investment.

c. Calculate the net present value (NPV) for the proposed investment.

d. Calculate the probability index for the proposed investment.

e. Calculate the internal rate of return (IRR) for the proposed investment.

f. Calculate the modified internal rate of return (MIRR) for the proposed investment.

g. Evaluate the acceptability of the proposed investment using NPV, IRR, and MIRR

Data table

(Click on the icon here in order to copy the contents of the data table below

into a spreadsheet)

Year (f)

Cash inflows (CF)

1

$25,000

2

$25,000

3

$30,000

4

$25,000

5

$20,000

- X

Print

Done

Clear all

Check answer

ew an ex

MacBook Air

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Buena Vision Clinic is considering an investment that requires an outlay of 600,000 and promises a net cash inflow one year from now of 810,000. Assume the cost of capital is 10 percent. Required: 1. Break the 810,000 future cash inflow into three components: a. The return of the original investment b. The cost of capital c. The profit earned on the investment 2. Now, compute the present value of the profit earned on the investment. 3. Compute the NPV of the investment. Compare this with the present value of the profit computed in Requirement 2. What does this tell you about the meaning of NPV?arrow_forwardFoster Manufacturing is analyzing a capital investment project that is forecast to produce the following cash flows and net income: The payback period of this project will be: a. 2.5 years. b. 2.6 years. c. 3.0 years. d. 3.3 years.arrow_forwardFalkland, Inc., is considering the purchase of a patent that has a cost of $50,000 and an estimated revenue producing life of 4 years. Falkland has a cost of capital of 8%. The patent is expected to generate the following amounts of annual income and cash flows: A. What is the NPV of the investment? B. What happens if the required rate of return increases?arrow_forward

- Redbird Company is considering a project with an initial investment of $265,000 in new equipment that will yield annual net cash flows of $45,800 each year over its seven-year life. The companys minimum required rate of return is 8%. What is the internal rate of return? Should Redbird accept the project based on IRR?arrow_forwardFenton, Inc., has established a new strategic plan that calls for new capital investment. The company has a 9.8% required rate of return and an 8.3% cost of capital. Fenton currently has a return of 10% on its other investments. The proposed new investments have equal annual cash inflows expected. Management used a screening procedure of calculating a payback period for potential investments and annual cash flows, and the IRR for the 7 possible investments are displayed in image. Each investment has a 6-year expected useful life and no salvage value. A. Identify which project(s) is/are unacceptable and briefly state the conceptual justification as to why each of your choices is unacceptable. B. Assume Fenton has $330,000 available to spend. Which remaining projects should Fenton invest in and in what order? C. If Fenton was not limited to a spending amount, should they invest in all of the projects given the company is evaluated using return on investment?arrow_forwardAssume a company is going to make an investment of $450,000 in a machine and the following are the cash flows that two different products would bring in years one through four. Which of the two options would you choose based on the payback method?arrow_forward

- Gallant Sports s considering the purchase of a new rock-climbing facility. The company estimates that the construction will require an initial outlay of $350,000. Other cash flows are estimated as follows: Assuming the company limits its analysis to four years due to economic uncertainties, determine the net present value of the rock-climbing facility. Should the company develop the facility if the required rate of return is 6%?arrow_forwardMason, Inc., is considering the purchase of a patent that has a cost of $85000 and an estimated revenue producing lite of 4 years. Mason has a required rate of return that is 12% and a cost of capital of 11%. The patent is expected to generate the following amounts of annual income and cash flows: A. What is the NPV of the investment? B. What happens if the required rate of return increases?arrow_forwardYour company is planning to purchase a new log splitter for is lawn and garden business. The new splitter has an initial investment of $180,000. It is expected to generate $25,000 of annual cash flows, provide incremental cash revenues of $150,000, and incur incremental cash expenses of $100,000 annually. What is the payback period and accounting rate of return (ARR)?arrow_forward

- Jasmine Manufacturing is considering a project that will require an initial investment of $52,000 and is expected to generate future cash flows of $10,000 for years 1 through 3, $8,000 for years 4 and 5, and $2,000 for years 6 through 10. What is the payback period for this project?arrow_forwardThere are two projects under consideration by the Rainbow factory. Each of the projects will require an initial investment of $35,000 and is expected to generate the following cash flows: Use the information from the previous exercise to calculate the internal rate of return on both projects and make a recommendation on which one to accept. For further instructions on internal rate of return in Excel, see Appendix C.arrow_forwardAll techniques Rieger International is evaluating the feasibility of investing $107,000 in a piece of equipment that has a 5-year life. The firm has estimated the cash inflows associated with the proposal as shown in the following table: The firm has a cost of capital of 11%. a. Calculate the payback period for the proposed investment. b. Calculate the discounted payback period for the proposed investment. c. Calculate the net present value (NPV) for the proposed investment. d. Calculate the probability index for the proposed investment. e. Calculate the internal rate of return (IRR) for the proposed investment. f. Calculate the modified internal rate of return (MIRR) for the proposed investment. g. Evaluate the acceptability of the proposed investment using NPV, IRR, and MIRR. a. The payback period of the proposed investment is years. (Round to two decimal places.) View an example Get more help Data table (Click on the icon here in order to copy the contents of the data table below…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT