FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

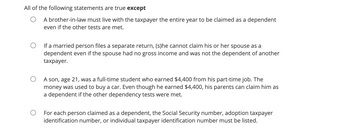

Transcribed Image Text:All of the following statements are true except

A brother-in-law must live with the taxpayer the entire year to be claimed as a dependent

even if the other tests are met.

If a married person files a separate return, (s)he cannot claim his or her spouse as a

dependent even if the spouse had no gross income and was not the dependent of another

taxpayer.

A son, age 21, was a full-time student who earned $4,400 from his part-time job. The

money was used to buy a car. Even though he earned $4,400, his parents can claim him as

a dependent if the other dependency tests were met.

For each person claimed as a dependent, the Social Security number, adoption taxpayer

identification number, or individual taxpayer identification number must be listed.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Doreen is single and has three dependent children aged 12, 14 and 16. The children are full time students and have no income. Doreen is not entitled to SAPTO. Her income for the 2022 year is as follows:Doreen$60,877 Taxable Income$29,999 RFBA (exempt employer)$ 5,200 RESC$22,344 HELP DebtWhat will Doreen’s compulsory HELP Debt Repayment be for the 2022 year?arrow_forwardKyra, a single taxpayer, owns and operates a bakery (as a sole proprietorship). The business is not a "specified services" business. In 2022, the business pays $100,000 in W–2 wages, has $150,000 of qualified property, and generates $350,000 of qualified business income. Kyra has no other items of income, deduction, or loss and will take the standard deduction of $12,950. Assume the QBI amount is net of the self-employment tax deduction. What is Kyra's qualified business income deduction?arrow_forwardRequired information [The following information applies to the questions displayed below.] Matt and Meg Comer are married and file a joint tax return. They do not have any children. Matt works as a history professor at a local university and earns a salary of $69,800. Meg works part time at the same university. She earns $43,200 a year. The couple does not itemize deductions. Other than salary, the Comers' only other source of income is from the disposition of various capital assets (mostly stocks). (Use the tax rate schedules, Dividends and Capital Gains Tax Rates.) Note: Round your final answers to the nearest whole dollar amount. a. What is the Comers' tax liability for 2023 if they report the following capital gains and losses for the year? Short-term capital gains Short-term capital losses Long-term capital gains Long-term capital losses Total tax liability $ 9,100 (2,100) 15,200 (6,200)arrow_forward

- Please don't provide hand writtin solution....arrow_forwardMunabhaiarrow_forwardDetermine the taxpayer's current-year (1) economic income and (2) gross income for tax purposes from the following events: (LO.1) a. Ja-ron's employment contract as chief executive of a large corporation was terminated, and he was paid $500,000 not to work for a competitor of the corporation for five years. b. Elliot, a six-year-old child, was paid $5,000 for appearing in a television commercial. His parents put the funds in a savings account for the child's education. c. Valery found a suitcase that contained $100,000. She could not determine who the owner was. d. Winn purchased a lottery ticket for $5 and won $750,000. e. Larry spent $1,000 to raise vegetables that he and his family consumed. The cost of the vegetables in a store would have been $2,400. f. Dawn purchased an automobile for $1,500 that was worth $3,500. The seller was in desperate need of cash.arrow_forward

- Suzanna earns $4000 in her summertime job; the rest of the year she attends college fulltime. Suzanna may claim an exemption from FIT withholding if: a.she also has a taxable scholarship (used for housing) = $15,000. b.her unearned income (interest) = $1698. c.her aunt claims her as a dependent and she has no unearned income. d.her unearned income (dividends) = $1800.arrow_forwardCharlotte is a partner in, and sales manager for, CD Partners, a domestic business that is not a "specified services" business. During the tax year, she receives guaranteed payments of $177,400 from CD Partners for her services to the partnership as its sales manager. In addition, her distributive share of CD Partners' ordinary income (its only item of income or loss) was $106,440. What is Charlotte's qualified business income? $fill in the blank 1 ______?arrow_forwardPlease don't provide hnad writtin solution.....arrow_forward

- For each of the following situations, indicate how much the taxpayer is required to include in gross income: Note: Leave no answer blank. Enter zero if applicable. Required: a. Steve was awarded a $7,050 scholarship to attend State Law School. The scholarship pays Steve's tuition and fees. b. Hal was awarded a $23,800 scholarship to attend State Hotel School. All scholarship students must work 20 hours per week at the School residency during the term.arrow_forwardCorbin(20) is a full time student eligible to be claimed as a dependent on his father's return. This year, Corbin incurred $1,600 in education expenses for his tuition. if Corbin's father chooses not to claim Corbin as a dependent on his return, which of the following is TRUE regarding Corbin's return? a)Corbin may not claim an education credit. b)Corbin may be eligible to claim an education credit.arrow_forward• Jeff, age 68 and Claire, age 63 elect to file Married Filing Jointly. Neither taxpayer is blind. • Jeff is retired. He received Social Security benefits and a pension. • Jeff and Claire's daughter Shelby, age 19, is a full-time college student in her second year of study. She is pursuing a degree in foreign studies and does not have a felony drug conviction. She received a Form 1098-T for 2022. Box 7 was not checked on her Form 1098-T for the previous tax year. • Shelby spent the summer at home with her parents but lived in an apartment near campus during the school year. • Shelby received a scholarship and the terms require that it be used to pay tuition. Jeff and Claire paid the cost of Shelby’s tuition and course-related books in 2022 not covered by scholarship. They paid $120 for a parking sticker, $5,500 for a meal plan, $750 for textbooks purchased at the college bookstore, and $100 for access to an online textbook. • Jeff and Claire…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education