Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

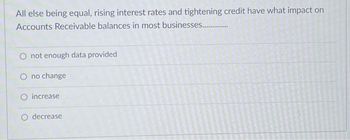

Transcribed Image Text:All else being equal, rising interest rates and tightening credit have what impact on

Accounts Receivable balances in most businesses.............

O not enough data provided

O no change

O increase

decrease

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- 14 Momentum Products Incorporated just recorded an adjusting journal entry for the current year's estimate of bad debts. Assuming all else is equal, this adjusting journal entry will cause: Multiple Choice the accounts receivable turnover ratio to increase. net income to increase. total assets to remain unchanged. net accounts receivable to increase.arrow_forwardsolve this pleasearrow_forwardon 3 ts) Based on our discussions, why was the Allowance for Bad Debt created? O To record the amount of accounts receivable written off during the period. O To record the net amount of accounts receivable that will be paid. To record the amount of accounts receivable that will most likely never be paid. O To record the net sales amount from the last period that will probably never be paid.arrow_forward

- Question If the % of uncollectible accounts does not change, there cannot be a savings for this concept simply because of a decrease in sales. true or false?arrow_forwardWhat does the accounts receivable turnover ratio measure? Multiple Choice Average balance of accounts receivables How quickly accounts receivable turn into cash How quickly inventory turns into accounts receivable How quickly the accounts receivable balance increasesarrow_forwardMULTIPLE CHOICE What is the effect of the following situations on the cost of accounts receivable financing? (A) A more thorough credit check is undertaken. (B) Receivables are sold without recourse. A. (A) Increase; (B) DecreaseB. (A) Decrease; (B) IncreaseC. (A) Decrease; (B) DecreaseD. (A) Increase; (B) IncreaseE. (A) Increase; (B) No effectarrow_forward

- (a) A company has determined that the length of time a receivable is outstanding is the most appropriate credit risk characteristic for determining expected credit losses. The following is an aging schedule for the company's accounts receivable as at December 31, 2023: Customer's name Aber Bohr Chow Datz Others Expected rate of credit loss Expected credit losses Total amount owed $28,000 50,000 42,000 eTextbook and Media 27,000 158,000 $305,000 $41,160 Current (not yet due) Account Titles and Explanation $50,000 15,000 95,000 $160,000 3% $4,800 1-30 12,000 $9,000 $19,000 15,000 $36,000 6% Number of days past due $2,160 31-60 13,000 10% $3,200 61-90 $15,000 15,000 Debit $32,000 $30,000 $47,000 25% Over 90 $7,500 $27,000 20,000 On December 31, 2023, the unadjusted balance in the Allowance for Expected Credit Losses (prior to the aging analysis) was a credit of $20,000. 50% Journalize the adjusting entry to record the expected credit losses on December 31, 2023. (Credit account titles are…arrow_forwardIn the year after the Credit Card Act of 2009 was passed, there was a(n) [increase | decrease] in the use of debit cards relative to credit cards. a. increas b. decreasearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education