FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

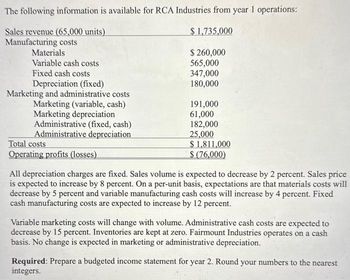

Transcribed Image Text:The following information is available for RCA Industries from year 1 operations:

Sales revenue (65,000 units)

Manufacturing costs

Materials

Variable cash costs

Fixed cash costs

Depreciation (fixed)

Marketing and administrative costs

Marketing (variable, cash)

Marketing depreciation

Administrative (fixed, cash)

Administrative depreciation

Total costs

Operating profits (losses)

$1,735,000

$ 260,000

565,000

347,000

180,000

191,000

61,000

182,000

25,000

$1,811,000

$ (76,000)

All depreciation charges are fixed. Sales volume is expected to decrease by 2 percent. Sales price

is expected to increase by 8 percent. On a per-unit basis, expectations are that materials costs will

decrease by 5 percent and variable manufacturing cash costs will increase by 4 percent. Fixed

cash manufacturing costs are expected to increase by 12 percent.

Variable marketing costs will change with volume. Administrative cash costs are expected to

decrease by 15 percent. Inventories are kept at zero. Fairmount Industries operates on a cash

basis. No change is expected in marketing or administrative depreciation.

Required: Prepare a budgeted income statement for year 2. Round your numbers to the nearest

integers.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- A proposed project has fixed costs of $35,000 per year. The operating cash flow at 14,000 units is $60,000. a. Ignoring the effect of taxes, what is the degree of operating leverage? b. If units sold rise from 14,000 to 14,400, what will be the increase in operating cash flow? c. What is the new degree of operating leverage?arrow_forwardSue Bee Honey is one of the largest processors of its product for the retail market. Assume that one of its plants has annual fixed costs totaling $16,317,500, of which $5,250,500 is for administrative and selling efforts. Sales are anticipated to be 950,000 cases a year. Variable costs for processing are $35 per case, and variable selling expenses are 10% of selling price. There are no variable administrative expenses If the company desires a pretax profit of $9,000,000, what is the selling price per case?arrow_forwardOre Company produces bookcases. Sales were good in 2019. However, with the slowdown in the economy, the Chief Financial Officer is concerned about the sales for 2020. The income statement for 2020 is as follows: Sales revenue $600,000 Less: Variable costs $360,000 Contribution margin $240,000 Less: Fixed costs $140,000 Net profit $100,000 The company expects to sell 60,000 units in 2020. Compare different types of cost behaviours to do the following: (a) Use cost-volume-profit analysis to determine the breakeven point in units and in dollars. (b) Use cost-volume-profit analysis to determine the margin of safety in units and in dollars. (c) Assuming that cost behaviour pattern remains unchanged, compute the decrease in net income if sales revenue dropped by $200,000 in 2020.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education