FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

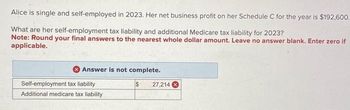

Transcribed Image Text:Alice is single and self-employed in 2023. Her net business profit on her Schedule C for the year is $192,600.

What are her self-employment tax liability and additional Medicare tax liability for 2023?

Note: Round your final answers to the nearest whole dollar amount. Leave no answer blank. Enter zero if

applicable.

Answer is not complete.

Self-employment tax liability

Additional medicare tax liability

$

27,214

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Calculate the total Social Security and Medicare tax burden on a sole proprietorship earning 2019 profit of $300,000, assuming a single sole proprietor with no other earned income. (Round your intermediate calculations to the nearest whole dollar amount.)arrow_forwardGrady received $8,880 of Social Security benefits this year. Grady also reported salary and interest income this year. What amount of the benefits must Grady include in his gross income under the following five independent situations? Note: Leave no answer blank. Enter zero if applicable. Required: a. Grady files single and reports salary of $13,800 and interest income of $420. b. Grady files single and reports salary of $23,870 and interest income of $770. c. Grady files married joint and reports salary of $78,400 and interest income of $670. d. Grady files married joint and reports salary of $44,000 and interest income of $870. e. Grady files married separate and reports salary of $23,870 and interest income of $770. Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Required E Grady files single and reports salary of $13,800 and interest income of $420. Amount to be included in gross incomearrow_forwardThe Chungs are married with one dependent child. They report the following information for 2022: Schedule C net profit $ 66,650 Interest income from certificate of deposit (CD) 2,100 Self-employment tax on Schedule C net profit 9,418 Dividend eligible for 15% rate 12,000 Lila Chung's salary from Brants Company 75,000 Dependent care credit 500 Itemized deductions 27,000 Required: Compute AGI, taxable income, and total tax liability (including self-employment tax). Assume that Schedule C net profit is qualified business income (non-service income) under Section 199A. Assume the taxable year is 2022. Use Individual Tax Rate Schedules and Standard Deduction Table. Note: Do not round intermediate computations. Round your final answers to the nearest whole dollar amount.arrow_forward

- Mario, a single taxpayer with two dependent children, has the following items of income and expense during 2020: Gross receipts from business $144,000 Business expenses 180,000 Net capital gain 22,000 Interest income 3,000 Itemized deductions (state taxes, residence interest, and contributions) 24,000 a. Determine Mario's taxable income or loss for 2020. Adjusted gross income Less: itemized deductions Less: Deduction for qualified business income Loss b. Indicate which items are adjustments to taxable income or loss when computing an NOL. Business receipts Business Expenses Net capital gain Interest income Itemized deductions c. Determine Mario's NOL for 2020. Mario's NOL is ?arrow_forwardhr.4arrow_forwardFor calendar year 2023, Giana was a self-employed consultant with no employees. She had $80,000 of net profit from consulting and paid $7,000 in medical insurance premiums on her policy covering 2023. How much of these premiums may Giana deduct as a deduction for AGI? As an itemized deduction? If an amount is zero, enter "0". Self-employed persons can deduct fill in the blank 1 % of their medical insurance premiums as a deduction for AGI in 2023. Thus, Giana may deduct $fill in the blank 2 as a deduction AGI and she may deduct $fill in the blank 4 as an itemized deduction (subject to the AGI floor).arrow_forward

- In 2023, Purple Company reports $200,000 in net income before deducting any compensation or other payment to its sole owner, Kirsten. Kirsten is single and she claims the $13,850 standard deduction for 2023 (she has no other deductions). Purple Company is Kirsten's only source of income. Ignoring any employment tax considerations, compute Kirsten's after-tax income if: (LO.1) a. Purple Company is a proprietorship and Kirsten withdraws $50,000 from the business during the year; Kirsten claims a $37,230 deduction for qualified business income. b. Purple Company is a C corporation and the corporation pays out all of its after- tax income as a dividend to Kirsten. c. Purple Company is a C corporation and the corporation pays Kirsten a salary of $158,000.arrow_forwardSubject - account Please help me. Thankyou.arrow_forwardMahmet earned wages of $148,800 during 2022. Mahmet qualifies to file as head of household and claims two dependents under the age of 17. How much FICA tax is Mahmet's employer responsible to remit in 2022? Multiple Choice $21,935.40. $21,123.20. $22,543.20arrow_forward

- Lorna Hall’s real estate tax of $2,010.88 was due on December 14, 2019. Lorna lost her job and could not pay her tax bill until February 27, 2020. The penalty for late payment is 612%612% ordinary interest. (Use Days in a year table.)a. What is the penalty Lorna must pay? (Round your answer to the nearest cent.) Penalty Pay b. What is the total amount Lorna must pay on February 27? (Round your answer to the nearest cent.) Total Amountarrow_forwardAlice is single and self-employed in 2022. Her net business profit on her Schedule C for the year is $166,000. What are her self-employment tax liability and additional Medicare tax liability for 2022?arrow_forwardSherina Smith (Social Security number 785-23-9873) lives at 536 West Lapham Street, Milwaukee, WI 53204, and is self-employed for 2020. She estimates her required annual estimated income tax payment for 2020 to be $8,468. She was required to pay $254 when she timely filed her prior year tax return. Complete the first quarter voucher below for Sherina for 2020. Form1040-ESDepartment of the TreasuryInternal Revenue Service 2020 Estimated Tax Payment Voucher 1 OMB No. 1545-0074 File only if you are making a payment of estimated tax by check or money order. Mail this voucher with your check or money order payable to “United States Treasury.” Write your social security number and “2020 Form 1040-ES” on your check or money order. Do not send cash. Enclose, but do not staple or attach, your payment with this voucher. Calendar year—Due April 15, 2020 Amount of estimated tax you are paying by check or money order. Dollars Cents fill in the blank 1arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education