Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

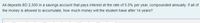

Transcribed Image Text:Ali deposits BD 2,500 in a savings account that pays interest at the rate of 5.5% per year, compounded annually. If all of

the money is allowed to accumulate, how much money will the student have after 14 years?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- It is Jerry's 14th birthday and his parents plan to invest some money so that they will have $17 000 on Jerry's 18th birthday for his post-secondary education. They invest in an RESP that pays 8.6% per year, compounded quarterly. How much money must Jerry's parents invest now to reach their goal?arrow_forwardShelly deposits the $2000 she got as a birthday gift from her grandmother into an account earning 3.6% interest compounded monthly. She decides to also deposit $200 at the end of each month into the same account. How much will be in the account in 10 years?arrow_forwardMegan takes out a car loan for $13,000. She intends to make monthly payments for 5 years to pay off her loan. If the bank charges her an annual interest rate of 4.2% computed monthly on the loan balance, how much will her monthly payments be?arrow_forward

- Pete Morton is planning to go to graduate school in a program of study that will take three years. Pete wants to have $13,000 available each year for various school and living expenses. If he earns 7 percent on his money, how much must be deposited at the start of his studies to be able to withdraw $13,000 a year for three years?arrow_forwardJoe has $1,500 in credit card debt but pays it in full every month from cash flow. He also pays her mortgage from cash flow ($2,000 principal). For savings, Joe saves $50 per month in an interest-bearing savings account. Annual interest earned and reinvested is $100. How much will his net worth increase in the current year?arrow_forwardStella deposits $54,000 in a savings account at a bank that offers interest of 5.3% on such accounts. What is the value of the money in her savings account in five years’ time?arrow_forward

- Alex will need $9860 per year for four years to support his daughters university tuition (first tuition is paid at the beginning of the 11th year). How much will Alex have to invest at the beginning of each year for the 10 years before his daughter begins her studies if their savings earn compound interest at 6 percent per year? A)$2,378.49 B)$2,593.46 C)$2,697.47 D)$2,400.74 E)$2,544.78arrow_forwardOliver currently has $2,200 in a savings account paying 4.0% interest. He has a goal of taking a year-long around the world vacation. He has decided to deposit $150 from each paycheck (24 a year) for the next two years. Then he will leave on his vacation and withdraw an amount at the beginning of each month while he is on his cruise. How much will he be able to withdraw each month of his voyage?arrow_forwardA couple plans to save for their child’s college education. What principal must be deposited by the parents when their child is born in order to have$80,000 when the child reaches the age of 18? Assume the money earns 8% interest, compounded quarterly.arrow_forward

- If Jackson deposits 100 dollars at the beginning of each month in a savings account earning interest at the rate of 8%/year compounded monthly, how much will he have on deposit in his savings account at the end of 6 yr, assuming that he makes no withdraws during that period?arrow_forwardPeter makes a deposit at the end of every three months into a savings account that earns interest at 4.6% compounded annually. He saves for 12 years, and then converts his savings into an annuity that pays him $400 at the beginning of each month for 15.5 years at the same interest rate. What size of the deposit Peter makes while he is savingarrow_forwardIn December 2018, Eric puts $1600 into a bank account. He then deposits an additional $1000 each year thereafter. The account earns 4% interest, compounded annually. When Eric has a total of at least $50,000 in his account at the beginning of a year he will buy a house. In what year will this happen?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education