FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

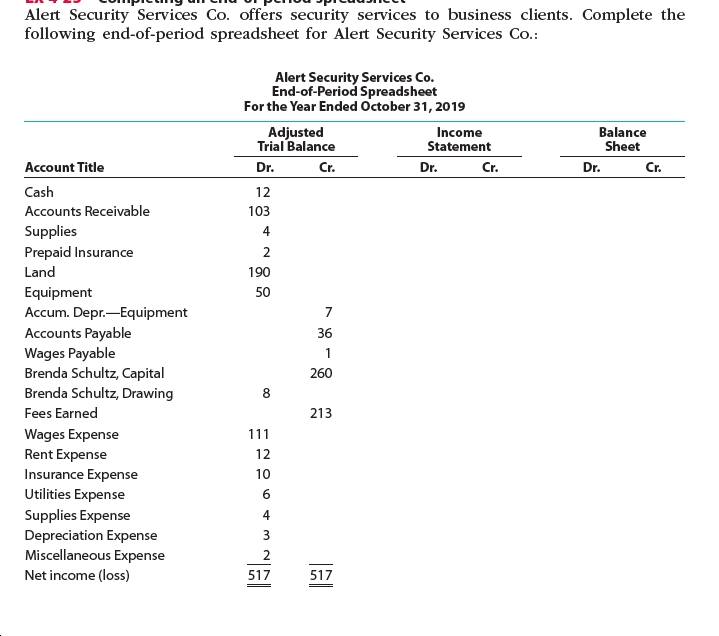

Transcribed Image Text:Alert Security Services Co. offers security services to business clients. Complete the

following end-of-period spreadsheet for Alert Security Services Co.:

Alert Security Services Co.

End-of-Period Spreadsheet

For the Year Ended October 31, 2019

Balance

Sheet

Adjusted

Trial Balance

Income

Statement

Account Title

Dr.

Cr.

Dr.

Cr.

Dr.

Cr.

Cash

12

Accounts Receivable

103

Supplies

Prepaid Insurance

4

2

Land

190

Equipment

50

Accum. Depr.-Equipment

Accounts Payable

36

Wages Payable

Brenda Schultz, Capital

Brenda Schultz, Drawing

260

8

Fees Earned

213

Wages Expense

111

Rent Expense

Insurance Expense

12

10

Utilities Expense

6.

Supplies Expense

Depreciation Expense

Miscellaneous Expense

Net income (loss)

4

3

517

517

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Similar questions

- How do I record the current transaction?arrow_forwardcreate a t account for this montharrow_forwardCourses =HCS380 Week 1 Terminology Matching Accounts Receivable Terminology Matching Note Payable Bonds Payable Common Stock Income Statement Balance Sheet Retained Earnings Statement Statement of Cash Flow Basic Accounting Equation multimedia.phoenix.edu Annual Report View Assessment HCS/380: Week 1 - Terminology Matching - Academic Resources Owed to a bank for the money borrowed Bill customer/patient for services HCS Debt securities sold to investors that must be repaid at a particular date in the future A AOL PASSV REQUIRED Enter your password for "kaylakı Accounts. Prepared by corporate management to present financial information, management discussion, notes, and auditor's report Used by creditors to determine if they will be paid Assets Liabilities+Stockholder's Equity Used by creditors and investors to analyze the organization's cash position Used by investors to evaluate the organization's history of paying high dividends The total amount paid in by stockholders for the share…arrow_forward

- 1. Prepare a Classified Statement of Assets & Liabilities as at 30th June 2023 Cash receipts and payments for the year ended 30th June 2023: Cash Receipts: Subscriptions 11,000 Bar sales Hire of function room $ Bank Bar inventory 30,000 5,300 Assets & Liabilities as at $46,300 Subscription in arrears Subscription in advance Bar equipment - at cost Accumulated depreciation bar equipment Bank Loan (Due 30/6/17) Accounts payable (bar) Accrued bar wages Prepaid rent expense Cash Payments: Bar purchases 12,000 Payments to accounts payable Telephone Insurance Cleaner's wages Electricity Bar wages Bank Loan interest Rent paid 1 July 2022 15,000 2,600 220 800 35,000 5,000 16,000 1,000 O 0 $ ? 6,000 900 1,200 1,500 800 5,000 2,900 10,000 $40,300 30 June 2023 2,400 880 270 35,000 6,000 16,000 2,000 100 500arrow_forwardPrepare a statement of owner's equity and a classified balance sheet from the partial worksheet for Jamar Companyarrow_forwardPrepare a) Income Statement for the year ended 31 December 2022 b) Statement of Owner's equity for the year ended 31 December 2022 c) Balance sheet as at December 31, 2022arrow_forward

- You are provided with the following information form the accounts of BBS Ltd for the year ending 30 June 2019Cash Sales950 000Cost of Goods Sold35 000Amount received in advance for services to be performed in August 20199 500Rent expenses for year ended 30 June 20199 000Rent Prepaid for two months to 31 August 20191 200Doubtful debts expenses1 200Amount provided in 2019 for employees’ long-service leave entitlements5 000Goodwill impairment expenses7 000Required:Calculate the taxable profit and accounting profit for the year ending 30 June 2019. my confusion : not sure if LSL will be 50%of or not?arrow_forwardSample Worksheet Work Sheet For the Month Ended January 31, 2020 Trial Balance Adjustments Adj. T/Balance Income Statement Balance Sheet Account Title Dr. Cr. Dr. Cr. Dr. Cr. Dr. Cr. Dr. Cr. 13,200 22,000 5,400 29,250 22,000 5,400 Cash 20,000 b-h 3,950 29,250 22,000 a CD'S Other Securities 5,400 Loan Payable Owner' Equity 25,000 15,600 b 25,000 15,100 25,000 15,100 500 Revenue a 20,000 20,000 20,000 Interest Income Utilities expense Internet & Telephone Advertising Expense C 300 300 300 150 150 150 e 300 300 300 Rent Expense f 2,000 2,000 2,000 Supplies expense 450 450 450 Insurance expense 250 250 250 40,100 16,550 56,650 40,600 23,950 60,100 3,450 16,550 20,000 40,600 23,950 60,100 20,000 56,650 Net income 20,000 56,650 1. Cash is overstate by 500.00 and Owners Equity is overstated by $500.00. 2. Utilities Expense of $300.00 was paid on January 25. 3. Insurance expense of $250.00 was paid on January 27. 4. supplies for the month in the amount of $450.00 was purchased. 5. Rent for…arrow_forwardHow do I record the current transaction?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education