Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

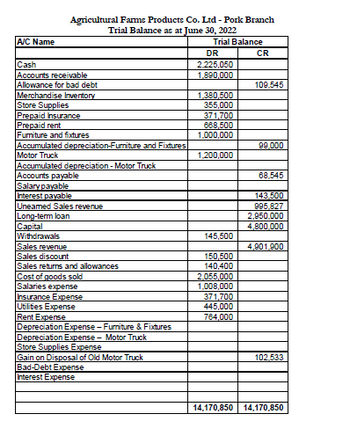

The following additional information is available at June 30, 2022:

• Store Supplies on hand at June 30, 2022 amounted to $55,000.

• Insurance of $371,700 was paid on April 1, 2022, for 9-months to December 2022

• Rent was prepaid on March 1, 2022, for 7-months to September 2022.

• The furniture and fixtures have an estimated useful life of 10 years and is being depreciated on the straight-line method down to a residual value of $10,000.

• The motor truck was acquired on December 1, 2021, and is being depreciated over 5 years on the double-declining balance method of depreciation, down to a residue of $15,000

• Salaries earned by employees not yet paid amounted to $308,000 at June 30, 2022.

• Accrued interest expense as of June 30, 2022, $143,500.

• On June 30, 2022, $68,122 of the previously unearned sales revenue had been earned.

• The aging of the Accounts Receivable schedule at June 30, 2022 indicated that the Allowance for Bad Debts should be $189,000.

• After making all other adjustments, a physical count of inventory was done, which reveals that there was $1,365,500 worth of inventory on hand at June 30,2022

Other data:

• The business is expected to make principal payments totalling $430,000 towards the loan during the fiscal year to June 30 ,2023.

Required:

Prepare the necessary adjusting journal entries on June 30, 2022.

Prepare the Adjusted Trial balance at June 30, 2022.

Prepare the company’s multiple-step income statement for the period ending June 30, 2022

Prepare the company’s statement of owner’s equity at June 30, 2022

Prepare the company’s classified balance sheet at June 30, 2022

Transcribed Image Text:Agricultural Farms Products Co. Ltd - Pork Branch

Trial Balance as at June 30, 2022

A/C Name

Cash

Accounts receivable

Trial Balance

DR

CR

2,225,050

1,890,000

Allowance for bad debt

Merchandise Inventory

Store Supplies

109,545

1,380,500

355,000

Prepaid Insurance

371,700

Prepaid rent

668,500

Furniture and fixtures

1,000,000

Accumulated depreciation-Furniture and Fixtures

99,000

Motor Truck

1,200,000

Accumulated depreciation-Motor Truck

Accounts payable

68,545

Salary payable

Interest payable

143,500

Uneamed Sales revenue

995,827

Long-term loan

Capital

Withdrawals

Sales revenue

Sales discount

Sales returns and allowances

Cost of goods sold

Salaries expense

2,950,000

4,800,000

145,500

4,901,900

150,500

140,400

2,055,000

1,008,000

Insurance Expense

371,700

445,000

764,000

Utilities Expense

Rent Expense

Depreciation Expense - Furniture & Fixtures

Depreciation Expense-Motor Truck

Store Supplies Expense

Gain on Disposal of Old Motor Truck

Bad-Debt Expense

Interest Expense

102,533

14,170,850 14,170,850

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Calculate: a. Average Receivable days/ Debtors collection periodb. Average Payable days/ Creditors collection periodarrow_forwardOn January 1, 2021, the general ledger of Freedom Fireworks includes the following account balances:Accounts Debit CreditCash $ 11,200Accounts Receivable 34,000Allowance for Uncollectible Accounts $ 1,800Inventory 152,000Land 67,300Buildings 120,000Accumulated Depreciation 9,600Accounts Payable 17,700Common Stock 200,000Retained Earnings 155,400Totals $384,500 $384,500During January 2021, the…arrow_forwardChapter : Adjustment financial statementsarrow_forward

- The following information was taken from the accounts receivable records of Pina Colada Corporation as at December 31, 2020: OutstandingBalance Percentage Estimatedto be Uncollectible 0 – 30 days outstanding $154,000 0.5% 31 – 60 days outstanding 63,200 2.5% 61 – 90 days outstanding 39,100 4.0% 91 – 120 days outstanding 21,600 6.5% Over 120 days outstanding 5,300 10.0% (a) Prepare the year-end adjusting entry for bad debt expense, assuming allowance for doubtful accounts had a credit balance of $1,170 prior to the adjustment. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Debit Credit (b) Prepare the year-end adjusting entry for bad debt expense, assuming allowance for doubtful accounts had a debit balance of $3,990 prior to…arrow_forwardThe following information was taken from the accounts receivable records of Sarasota Corporation as at December 31, 2020: OutstandingBalance Percentage Estimatedto be Uncollectible 0 – 30 days outstanding $160,000 0.5% 31 – 60 days outstanding 66,000 2.5% 61 – 90 days outstanding 40,200 4.0% 91 – 120 days outstanding 20,600 6.5% Over 120 days outstanding 5,600 10.0% (a) Prepare the year-end adjusting entry for bad debt expense, assuming allowance for doubtful accounts had a credit balance of $1,200 prior to the adjustment (b) Prepare the year-end adjusting entry for bad debt expense, assuming allowance for doubtful accounts had a debit balance of $3,880 prior to the adjustment.arrow_forwardAl Hajar Co. provides you the following account balances for the year ended on 31 December 2019. Sales Revenue OMR 100,000 Cr. Accounts Receivable OMR 25,000 Dr. Allowance for Doubtful accounts OMR 1000 Cr. Scenario 1 Bad debts are estimated based on the aging schedule given below Aging class Receivable Balance (OMR) Estimate % of uncollectible 0–30 days 15,000 10 31–60 days 5,000 15 61–90 days 3,500 20 Over 90 days 1,500 25 Actual bad debt - OMR 1,100 and amount recovered - OMR 800. Scenario 2 Estimated amount of bad debts - 12% of receivables, Actual bad debt - OMR 1,500 and amount recovered later on - OMR 900. Scenario 3 Estimated amount of bad debts - 3.5% of Sales, Actual bad debt - OMR 1,300 and amount recovered - OMR 1000. Required: For each scenario given above; a)Estimate the uncollectible amounts. b)Pass adjusting entry to record the estimated uncollectible. c)Pass all the journal entries for actual write off and recovery…arrow_forward

- Here is information related to Mingenback Company for 2022. Total credit sales $2,500,000Accounts receivable at December 31 875,000Uncollectibles written off 33,000 Instructions a. What amount of bad debt expense will Mingenback Company report if it uses the direct write-off method of accounting for uncollectibles?b. Assume that Mingenback Company uses the percentage-of-receivables basis to record bad debt expense and concludes that 6% of accounts receivable will become uncollectible. What amount of bad debt expense will Mingenback record if Allowance for Doubtful Accounts has a credit balance of $3,000? b. Bad debt expense $49,500 c. Assume the same facts as in (b), except that there is a $3,000 debit balance in Allowance for Doubtful Accounts. What amount of bad debt expense will Mingenback record?d. What is the weakness of the direct write-off method of recording bad debt expense? Journalize entries to record transactions related to bad debts.arrow_forwardook int ences During 2020, Jesse Jericho Enterprises Corporation recorded credit sales of $786,000. At the beginning of the year, Accounts Receivable, Net of Allowance was $93,500. At the end of the year, after the Bad Debt Expense adjustment was recorded but before any bad debts had been written off, Accounts Receivable, Net of Allowance was $70,000. Required: 1. Assume that on December 31, 2020, accounts receivable totalling $10,000 for the year were determined to be uncollectible and written off. What was the receivables turnover ratio for 2020? (Round your answer to 1 decimal place.) Receivables turnover ratio 2. Assume instead that on December 31, 2020, $11,000 of accounts receivable was determined to be uncollectible and written off. What was the receivables turnover ratio for 2020? (Round your answer to 1 decimal place.) Receivables turnover ratioarrow_forwardHere is information related to Splish Company for 2022. Total credit sales $2,550,000 Accounts receivable at December 31 848,000 Uncollectibles written off 32,000 (a) What amount of bad debt expense will Splish Company report if it uses the direct write-off method of accounting for uncollectibles?$____________ (b) Assume that Splish Company uses the percentage-of-receivables basis to record bad debt expenseand concludes that 5% of accounts receivable will become uncollectible. What amount of bad debt expense will Splish record if Allowance for Doubtful Accounts has a credit balance of $3,700?$__________ (c) Assume that Splish Company uses the percentage-of-receivables basis to record bad debt expenseand concludes that 5% of accounts receivable will become uncollectible. What amount of bad debt expense will Splish record if Allowance for Doubtful Accounts has a debit balance of $3,700?$__________arrow_forward

- ! Required information Exercise 9-24 (Algo) Complete the accounting cycle using long-term liability transactions (LO9-2, 9-8) [The following information applies to the questions displayed below.] On January 1, 2024, the general ledger of Freedom Fireworks includes the following account balances: Accounts Cash Accounts Receivable Allowance for Uncollectible Accounts Inventory Debit $ 11,300 34,200 Credit $ 1,900 152,100 Land Buildings Accumulated Depreciation Accounts Payable Common Stock Retained Earnings Totals 68,300 121,000 9,700 18,800 201,000 155,500 $ 386,900 $ 386,900 During January 2024, the following transactions occur: January 1 Borrow $101,000 from Captive Credit Corporation. The installment note bears interest at 6% annually and matures in 5 years. Payments of $1,953 are required at the end of each month for 60 months. January 4 January 10 Pay cash on accounts payable, $12,000. Receive $31,100 from customers on accounts receivable. January 15 Pay cash for salaries, $29,000.…arrow_forwardCullumber Company has these comparative balance sheet data: CULLUMBER COMPANYBalance SheetsDecember 31 2020 2019 Cash $ 16,350 $ 32,700 Accounts receivable (net) 76,300 65,400 Inventory 65,400 54,500 Plant assets (net) 218,000 196,200 $376,050 $348,800 Accounts payable $ 54,500 $ 65,400 Mortgage payable (15%) 109,000 109,000 Common stock, $10 par 152,600 130,800 Retained earnings 59,950 43,600 $376,050 $348,800 Additional information for 2020: 1. Net income was $34,000. 2. Sales on account were $383,300. Sales returns and allowances amounted to $26,600. 3. Cost of goods sold was $200,600. 4. Net cash provided by operating activities was $59,000. 5. Capital expenditures were $26,400, and cash dividends were $16,500. Compute the following ratios at December 31, 2020. (Round current ratio and inventory turnover to 2 decimal places, e.g.…arrow_forwardHere is information related to Ayayai Company for 2022. Total credit sales $2,571,000 Accounts receivable at December 31 830,000 Uncollectibles written off 32,300 (a) What amount of bad debt expense will Ayayai Company report if it uses the direct write-off method of accounting for uncollectibles?$__________ (b) Assume that Ayayai Company uses the percentage-of-receivables basis to record bad debt expenseand concludes that 6% of accounts receivable will become uncollectible. What amount of bad debt expense will Ayayai record if Allowance for Doubtful Accounts has a credit balance of $4,300?$__________ (c) Assume that Ayayai Company uses the percentage-of-receivables basis to record bad debt expenseand concludes that 6% of accounts receivable will become uncollectible. What amount of bad debt expense will Ayayai record if Allowance for Doubtful Accounts has a debit balance of $4,300?$__________arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College