ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

I would like help with the 6 questions in this problem

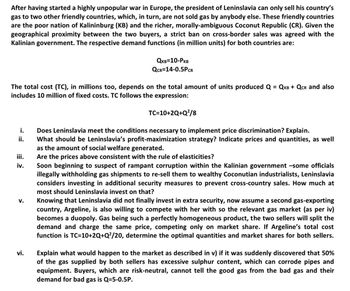

Transcribed Image Text:After having started a highly unpopular war in Europe, the president of Leninslavia can only sell his country's

gas to two other friendly countries, which, in turn, are not sold gas by anybody else. These friendly countries

are the poor nation of Kalininburg (KB) and the richer, morally-ambiguous Coconut Republic (CR). Given the

geographical proximity between the two buyers, a strict ban on cross-border sales was agreed with the

Kalinian government. The respective demand functions (in million units) for both countries are:

The total cost (TC), in millions too, depends on the total amount of units produced Q = QKB + QCR and also

includes 10 million of fixed costs. TC follows the expression:

TC=10+2Q+Q²/8

i.

ii.

iii.

iv.

V.

QKB=10-PKB

QCR=14-0.5PCR

vi.

Does Leninslavia meet the conditions necessary to implement price discrimination? Explain.

What should be Leninslavia's profit-maximization strategy? Indicate prices and quantities, as well

as the amount of social welfare generated.

Are the prices above consistent with the rule of elasticities?

Soon beginning to suspect of rampant corruption within the Kalinian government -some officials

illegally withholding gas shipments to re-sell them to wealthy Coconutian industrialists, Leninslavia

considers investing in additional security measures to prevent cross-country sales. How much at

most should Leninslavia invest on that?

Knowing that Leninslavia did not finally invest in extra security, now assume a second gas-exporting

country, Argeline, is also willing to compete with her with so the relevant gas market (as per iv)

becomes a duopoly. Gas being such a perfectly homogeneous product, the two sellers will split the

demand and charge the same price, competing only on market share. If Argeline's total cost

function is TC=10+2Q+Q²/20, determine the optimal quantities and market shares for both sellers.

Explain what would happen to the market as described in v) if it was suddenly discovered that 50%

of the gas supplied by both sellers has excessive sulphur content, which can corrode pipes and

equipment. Buyers, which are risk-neutral, cannot tell the good gas from the bad gas and their

demand for bad gas is Q-5-0.5P.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 7 steps with 5 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

I need help with only subparts iii to vi.

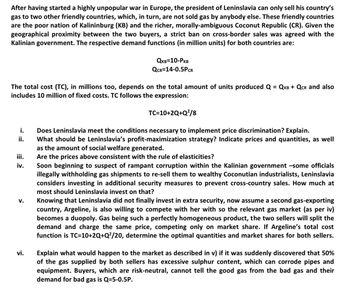

Transcribed Image Text:After having started a highly unpopular war in Europe, the president of Leninslavia can only sell his country's

gas to two other friendly countries, which, in turn, are not sold gas by anybody else. These friendly countries

are the poor nation of Kalininburg (KB) and the richer, morally-ambiguous Coconut Republic (CR). Given the

geographical proximity between the two buyers, a strict ban on cross-border sales was agreed with the

Kalinian government. The respective demand functions (in million units) for both countries are:

The total cost (TC), in millions too, depends on the total amount of units produced Q = QKB + QCR and also

includes 10 million of fixed costs. TC follows the expression:

TC=10+2Q+Q²/8

i.

ii.

iii.

iv.

V.

QKB=10-PKB

QCR=14-0.5PCR

vi.

Does Leninslavia meet the conditions necessary to implement price discrimination? Explain.

What should be Leninslavia's profit-maximization strategy? Indicate prices and quantities, as well

as the amount of social welfare generated.

Are the prices above consistent with the rule of elasticities?

Soon beginning to suspect of rampant corruption within the Kalinian government -some officials

illegally withholding gas shipments to re-sell them to wealthy Coconutian industrialists, Leninslavia

considers investing in additional security measures to prevent cross-country sales. How much at

most should Leninslavia invest on that?

Knowing that Leninslavia did not finally invest in extra security, now assume a second gas-exporting

country, Argeline, is also willing to compete with her with so the relevant gas market (as per iv)

becomes a duopoly. Gas being such a perfectly homogeneous product, the two sellers will split the

demand and charge the same price, competing only on market share. If Argeline's total cost

function is TC=10+2Q+Q²/20, determine the optimal quantities and market shares for both sellers.

Explain what would happen to the market as described in v) if it was suddenly discovered that 50%

of the gas supplied by both sellers has excessive sulphur content, which can corrode pipes and

equipment. Buyers, which are risk-neutral, cannot tell the good gas from the bad gas and their

demand for bad gas is Q-5-0.5P.

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

I need help with only subparts iii to vi.

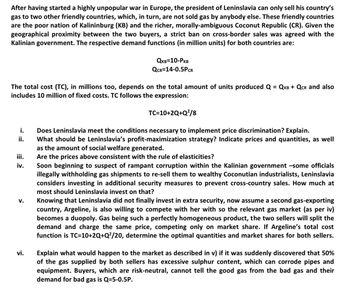

Transcribed Image Text:After having started a highly unpopular war in Europe, the president of Leninslavia can only sell his country's

gas to two other friendly countries, which, in turn, are not sold gas by anybody else. These friendly countries

are the poor nation of Kalininburg (KB) and the richer, morally-ambiguous Coconut Republic (CR). Given the

geographical proximity between the two buyers, a strict ban on cross-border sales was agreed with the

Kalinian government. The respective demand functions (in million units) for both countries are:

The total cost (TC), in millions too, depends on the total amount of units produced Q = QKB + QCR and also

includes 10 million of fixed costs. TC follows the expression:

TC=10+2Q+Q²/8

i.

ii.

iii.

iv.

V.

QKB=10-PKB

QCR=14-0.5PCR

vi.

Does Leninslavia meet the conditions necessary to implement price discrimination? Explain.

What should be Leninslavia's profit-maximization strategy? Indicate prices and quantities, as well

as the amount of social welfare generated.

Are the prices above consistent with the rule of elasticities?

Soon beginning to suspect of rampant corruption within the Kalinian government -some officials

illegally withholding gas shipments to re-sell them to wealthy Coconutian industrialists, Leninslavia

considers investing in additional security measures to prevent cross-country sales. How much at

most should Leninslavia invest on that?

Knowing that Leninslavia did not finally invest in extra security, now assume a second gas-exporting

country, Argeline, is also willing to compete with her with so the relevant gas market (as per iv)

becomes a duopoly. Gas being such a perfectly homogeneous product, the two sellers will split the

demand and charge the same price, competing only on market share. If Argeline's total cost

function is TC=10+2Q+Q²/20, determine the optimal quantities and market shares for both sellers.

Explain what would happen to the market as described in v) if it was suddenly discovered that 50%

of the gas supplied by both sellers has excessive sulphur content, which can corrode pipes and

equipment. Buyers, which are risk-neutral, cannot tell the good gas from the bad gas and their

demand for bad gas is Q-5-0.5P.

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- PLS HELP ASAP ON BOTHarrow_forwardDiscuss externalities and government policies aimed at addressing them. Please Don't use chatgpt or other ai tool. If you know correct answer then attempt if you gave wrong answer then i gave 24 dislikes for you and more from my friends accounts also.arrow_forwardHow can SoleRebels the company use sustainability to create greater competitive advantage in the future?arrow_forward

- 3arrow_forwardThe owner of a skating rink rents the rink for parties at $1200 if 60 or fewer skaters attend, so that the cost per person is $20 if 60 attend. For each 5 skaters above 60, she reduces the price per skater by $0.50. (a) Construct a table that gives the revenue generated if 60, 70, and 80 skaters attend. No. of skaters Total Revenue 60 70 80 Price per Skater $ $ $ (b) Does the owner's revenue from the rental of the rink increase or decrease as the number of skaters increases from 60 to 80? O The revenue increases. O The revenue decreases. (c) Write the equation that describes the revenue for parties with x groups of five skaters more than 60 skaters. R(x) = (d) Find the number of skaters that will maximize the revenue. skaters (e) Find the maximum revenue. $ (f) When the revenue is at the maximum possible, what price is paid per skater? $arrow_forwardPRICE (Dollars per room) 500 450 400 350 300 250 200 150 100 50 0 0 Demand + 50 100 150 200 250 300 350 400 450 500 QUANTITY (Hotel rooms) Graph Input Tool Market for Oceans's Hotel Rooms Price (Dollars per room) Quantity Demanded (Hotel rooms per night) Demand Factors Average Income (Thousands of dollars) Airfare from DSM to ACY (Dollars per roundtrip) Room Rate at Meadows (Dollars per night) 300 200 40 200 rooms per night to ,hotel rooms at the Oceans and hotel rooms at the Meadows are 200 For each of the following scenarios, begin by assuming that all demand factors are set to their original values and Oceans is charging $300 per room per night. If average household income increases by 50%, from $40,000 to $60,000 per year, the quantity of rooms demanded at the Oceans rooms per night to rooms per night. Therefore, the income elasticity of demand is Oceans are ? from meaning that hotel rooms at the If the price of a room at the Meadows were to decrease by 20%, from $200 to $160,…arrow_forward

- Pls help with this homeworkarrow_forwardplz solve both parts within 30-40 mins I'll give upvotearrow_forwardWhich of the following involve a trade-off? a. Buying a new car b. Going to college O c. Watching a football game on Saturday afternoon O d. Taking a nap Oe. All of the answer choices involve trade-offs. Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education