Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

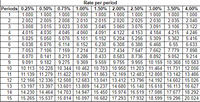

Transcribed Image Text:Rate per period

3.00% 3.50% 4.00%

1.000

2.035

3.106

Periods 0.25% 0.50% 0.75% 1.00% 1.50% 2.00% 2.50%

1.000

1

2.002

1.000

1.000

1.000

1.000

2.020

3.060

4.122

5.204

6.308

7.434

8.583

9.755

10.113 10.228 10.344 10.462 10.703 10.950 11.203 11.464 11.731 12.006

11.139 11.279 11.422 11.567 11.863 12.169 12.483 12.808 13.142 13.486

12.166 12.336 12.508 12.683 13.041 13.412 13.796 14.192 14.602 15.026

13.197 13.397 13.601 13.809 14.237 14.680 | 15.140 15.618 16.113 16.627

14.230 14.464 14.703 14.947 15.450 15.974 16.519 17.086 17.677 18.292

1.000

1.000

1.000

2.005

3.015

1.000

2.025

3.076

2.010| 2.015

3.030

4.060

5.101

6.152

7.214

8.286

9.369

2.008

3.023

2.030

2.040

3.008

3.045

3.091

3.122

4

4.015

4.030

4.045

4.091

4.153

5.256

4.184

4.215

4.246

5.309

5.362

6.55

7.779

9.052

9.955 10.159 10.368 10.583

5.025

5.050

6.076

7.106

8.141

9.182

5.076

5.152

5.416

6.

6.038

6.114

6.230

6.388

6.468

7.662

8.892

6.633

7.547

7.898

7

7.053

8.070

8

9.091

7.159

8.213

9.275

7.323

8.433

8.736

9.214

9.559

10

11

12

13

14

15

15.265 15.537 15.814 16.097 16.682 17.293 17.932 18.599 19.296 20.024

Transcribed Image Text:After carefully exmaining your budget, you determine you can manage to set aside $350 per year. You set up an annuity due of $350 annually at 6% annual interest.

How much will you have contributed after 22 years? What is the future value of the annuity after 22 years? How much interest will the annuity have earned?

Click the icon to view the Future Value of $1.00 Ordinary Annuity table.

Your contribution to the annuity will be S 7700.00 . (Round to the nearest cent as needed.)

The future value of the annuity is S

(Round to the nearest cent as needed.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Please help me with this and provide the working. thank youarrow_forwardYou have just won a lottery that promises an annual payment of $120000 beginning immediately. You will receive a total of 15 payments. If you can invest the cash flow in an investment that is paying 8% annually, what is the present value of this annuity?arrow_forward3. Use the annuity formula to calculate the future value of an annuity where you deposit $50 into an account gaining 5% interest for 3 years. Assume monthly deposits. Write out the formula first to show your work.arrow_forward

- Samuel wants to make regular annual payments of size P dollars into an annuity that pays interest of an annual rate of 0.25 or 25%. He wants to have 1.5 times the invested amount in the account after 5 years. A) Determine the size, P of the required annual payment. B) Create a table and do a step by step calculation to verify your answer in part Aarrow_forwardplease show the step by step solution. Do not skips steps. Explain your steps Please write on paperarrow_forwardWhat is the present value of a perpetuity that pays $50 annually and has an annual rate of return of 17%? note: round and show your answer to the nearest dollar.arrow_forward

- You are calculating the present value of $1,000 that you will receive five years from now.Which table will you use to obtain the present value factor to multiply to calculate thepresent value of that $1,000?a. Present Value of $1 tableb. Future Value of $1 tablec. Present Value of Ordinary Annuity of $1d. Future Value of Ordinary Annuity of $1arrow_forwardYou buy an annuity that will pay you $24,000 annually for 25 years. The payments are paid on the first day of each year. What is the value of this annuity today if the discount rate is 8.5 percent? 241309 266498 258319 251409 245621 A O BO .C DO E Oarrow_forwardMick Mitchell wishes to have $120,000 in seven years. If he can earn annual interest of 12%, how much must he invest today? Click the icon to view Present Value of Ordinary Annuity of $1 table.) (Click the icon to view Future Value of Ordinary Annuity of S1 table.) (Click the icon to view Present Value of S1 table.) (Click the icon to view Future Value of S1 table.) OA. $265,320 В. $1,210 OC $54,240 OD. S111,960arrow_forward

- Please assume an annuity due of $100,000 a year for 10 years. Assuming a discount rate of 6%, please find the present value of that annuity duearrow_forwardUse the excel and follow the step Like you did last question and please use excelarrow_forwardIf you start making $60 monthly contributions today and continue them for five years, what's their future value if the compounding rate is 10.25 percent APR? What is the present value of this annuity? Note: Do not round intermediate calculations and round your final answers to 2 decimal places.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education