FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

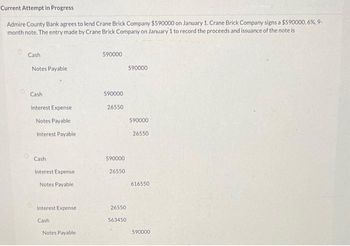

Transcribed Image Text:Current Attempt in Progress

Admire County Bank agrees to lend Crane Brick Company $590000 on January 1. Crane Brick Company signs a $590000,6%, 9-

month note. The entry made by Crane Brick Company on January 1 to record the proceeds and issuance of the note is

Cash

Notes Payable

Cash.

Interest Expense

Notes Payable

Interest Payable

Cash

Interest Expense

Notes Payable

Interest Expense

Cash

Notes Payable

590000

590000

26550

590000

26550

26550

563450

590000

590000

26550

616550

590000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Wisconsin Bank lends Local Furniture Company $80,000 on November 1. Local Furniture Company signs a $80,000, 6%, 4 month note. The fiscal year end of Local Furniture Company is December 31. The journal entry made by Local Furniture Company on December 31 is: A. debit Interest Expense and credit Cash for $800 B. debit Interest Payable and credit Interest Expense for $800 C. debit Interest Expense and credit Interest Payable for $800 D. debit Interest Payable and credit Cash for $800 thanks for helpa hpelaharrow_forwardtell me why the answer is cash and notes payable (last solution on multiple choice) as opposed to the other onesarrow_forwardOn May 22, Jarrett Company borrows 9, 200, signing a 90-day, 7% $9, 200 noteWhat is the journal entry made by Jarrett Company to record the payment of the note on the maturity date? Choice Notes Payable $9,200, credit interest Expense $161 credit Cash $9,039 Notes Payable 9.200 credit Cash $9.200 Debit Notes Payable $9,361, credit Cash $9.361arrow_forward

- Lyon County Bank agrees to len Grimwood Brick Company $100,000 on January 1. Grimwood Brick Company signs a $100,000, 8% 9-month note. The entry made by Grimwood Brick Company on January 1 to recor the proceeds and insurance of the note is?arrow_forwardWest County Bank agrees to lend Wildhorse Co. $472000 on January 1. Wildhorse Co. signs a $472000, 6%, 6-month note. What entry will Wildhorse Co. make to pay off the note and interest at maturity assuming that interest has been accrued to June 30? Notes Payable 486160 Cash 486160 Interest Payable 7080 Notes Payable 472000 Interest Expense 7080 Cash 486160 Notes Payable 472000 Interest Payable 14160 Cash 486160 Interest Expense 14160 Notes Payable 472000 Cash 486160arrow_forwardPresley Supply Co. has the following transaction related to notes receivable during the last 2 months of 2020. Nov. 1 Loaned $30,000 cash to Logan Ransey on a 1-year, 10% note. Dec. 11 Sold goods to be Joe Noland, Inc., receiving a $9,000, 90-day, 8% note. 16 Received a $4,000, 6-month, 9% note in exchange for Jane Brock's outstanding accounts receivable. 31 Accrued interest revenue on all notes receivable. (a) Your Answer Correct Answer (Used) Your answer is partially correct. Journalize the above transactions for Presley Supply Co. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Round interest to the nearest dollar.) (b) Date Account Titles and Explanation Nov. 1 Notes Receivable Cash Dec. 11 Notes Receivable Sales Revenue 16 Notes Receivable Accounts Receivable 31 Interest Receivable Interest Revenue eTextbook and Media Solution List of Accounts Debit 30000 9000 4000 667 Credit 30000 9000 4000 667 Attempts: 3 of 3 used Record the…arrow_forward

- Selkirk Company obtained a $24,000 note receivable from a customer on January 1, 2021. The note, along with interest at 8%, is due on July 1, 2021. On February 28, 2021, Selkirk discounted the note at Unionville Bank. The bank's discount rate is 10%. Required: Prepare the journal entries required on February 28, 2021, to accrue interest and to record the discounting for Selkirk. Assume that the discounting is accounted for as a sale. (do not round intermediate calculations. If no entry is required for a transaction/event, select "No journal entry required" in the first account field.). Tab 1) Record the accrued interest earned. Tab 2) Record the discounting of note receivable. Date General Journal Debit Credit February 28, 2021 ____________________________ ___________ ____________ _____________________________ ____________ ____________…arrow_forwardWisconsin Bank lends Local Furniture Company $80,000 on November 1. Local Furniture Company signs a $80,000, 6%, 4 - month note. The fiscal year end of Local Furniture Company is December 31. The journal entry made by Local Furniture Company on December 31 is: A. debit Interest Expense and credit Cash for $800 B. debit Interest Payable and credit Interest Expense for $800 C. debit Interest Expense and credit Interest Payable for $800 D. debit Interest Payable and credit Cash for $800 thanks for help apapreciatedarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education