FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Deduce an Income staetment and a

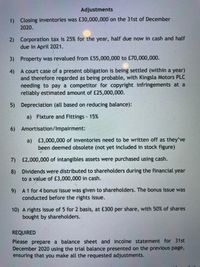

Transcribed Image Text:Adjustments

1) Closing inventories was £30,000,000 on the 31st of December

2020.

2) Corporation tax is 25% for the year, half due now in cash and half

due in April 2021.

3) Property was revalued from £55,000,000 to £70,000,000.

4) A court case of a present obligation is being settled (within a year)

and therefore regarded as being probable, with Kingsla Motors PLC

needing to pay a competitor for copyright infringements at a

reliably estimated amount of £25,000,000.

5) Depreciation (all based on reducing balance):

a) Fixture and Fittings 15%

6) Amortisation/Impairment:

a) £3,000,000 of inventories need to be written off as they've

been deemed obsolete (not yet included in stock figure)

7) £2,000,000 of intangibles assets were purchased using cash.

8) Dividends were distributed to shareholders during the financial year

to a value of £3,000,000 in cash.

9) A1 for 4 bonus issue was given to shareholders. The bonus issue was

conducted before the rights issue.

10) A rights issue of 5 for 2 basis, at £300 per share, with 50% of shares

bought by shareholders.

REQUIRED

Please prepare a balance sheet and income statement for 31st

December 2020 using the trial balance presented on the previous page,

ensuring that you make all the requested adjustments.

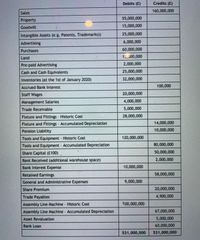

Transcribed Image Text:Debits (E)

Credits (E)

160,000,000

Sales

55,000,000

Property

Goodwill

15,000,000

Intangible Assets (e.g. Patents, Trademarks))

25,000,000

Advertising

6,000,000

Purchases

60,000,000

Land

15,000,000

Pre-paid Advertising

2,000,000

Cash and Cash Equivalents

25,000,000

Inventories (at the 1st of January 2020)

32,000,000

Accrued Bank Interest

100,000

Staff Wages

20,000,000

Management Salaries

4,000,000

Trade Receivable

5,000,000

Fixture and Fittings Historic Cost

28,000,000

Fixture and Fittings Accumulated Depreciation

14,000,000

Pension Liability

10,000,000

Tools and Equipment Historic Cost

Tools and Equipment Accumulated Depreciation

120,000,000

80,000,000

Share Capital (E100)

50,000,000

Rent Received (additional warehouse space)

2,000,000

Bank Interest Expense,

10,000,000

Retained Earnings

58,000,000

General and Administrative Expenses

9,000,000

Share Premium

20,000,000

Trade Payables

4,900,000

Assembly Line Machine Historic Cost

100,000,000

Assembly Line Machine Accumulated Depreciation

67,000,000

Asset Revaluation

5,000,000

Bank Loan

60,000,000

531,000,000

531,000,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education