Concept explainers

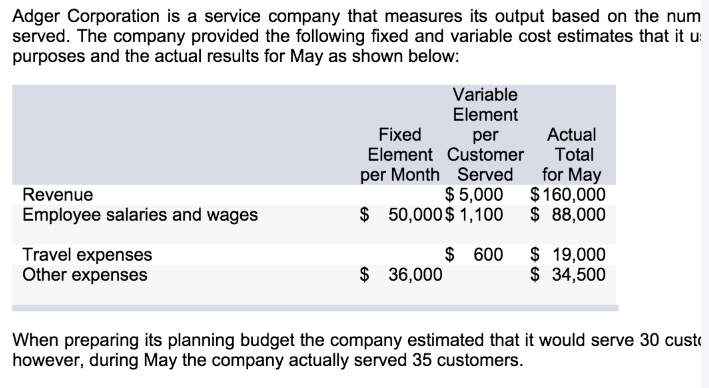

Show transcribed image text 15.What activity variances would Adger report with respect to each of its expenses? (Indicate the effect of each variance by selecting F for favorable, U for unfavorable, and None for no effect (i.e., zero variance). Input all amounts as positive values.) [The following information applies to the questions displayed below.] Adger Corporation is a service company that measures its output based on the number of customers served. The company provided the following fixed and variable cost estimates that it uses for budgeting purposes and the actual results for May as shown below: When preparing its planning budget the company estimated that it would serve 30 customers per month; however, during May the company actually served 35 customers.

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

- Which of the following statements is incorrect? a. Sales volume variance is the amount by which sales would have varied from the base sales if only the sales volume had changed. b. Sales price variance measures the impact on the firm’s gross profit of changes in the unit selling price. c. Cost volume variance is the amount by which cost of sales would have varied from the base cost of sales if only the units produced had changed. d. Cost price variance measures the impact on the firm’s gross profit of changes in the unit cost price or cost of sales.arrow_forwardThe contribution margin income statementa. reports expenses based on cost behavior pattern rather than cost function.b. unitizes fixed costs.c. shows contribution margin rather than operating income as the bottom line.d. is sometimes used for financial reporting purposes.e. none of the above.Use the following information for Questions 9 and 10.O’Brien, Inc.’s, 2013 contribution margin income statement shows thefollowing:Sales @ $10 per unit . . . . . . . . . . . . . $ 160,000Less: Variable expense . . . . . . . . . . . (128,000)Contribution margin. . . . . . . . . . . . . . $ 32,000Less: Fixed expenses . . . . . . . . . . . . (44,000)Operating income (loss) . . . . . . . . . . . $ (12,000)arrow_forwardQue. No. 1a. When production is greater than sales which method’s net operating income will be higher, AC or VC and why? Be precise and to the point in writing the answer. Que. No. 1b. Sharp Company manufactures a product for which the following data and information related to inventory is available. The company uses variable costing for internal management reports and absorption costing for external reports to the shareholders, creditors, and the government. The company has provided the following data:Year-1Year-2Year-3Inventories:Beginning (units)200160180Ending (units)160180220Variable Costing net operating income$1,080,400$1,032,400$996,400The company’s fixed manufacturing overhead per unit was constant at $650 for all the three years.Required: 1. Determine each year’s absorption costing net operating income. Present your answer in the form of a reconciliation report. (you must show all calculations)2. In year four, the company’s variable costing net operating income was $984,400…arrow_forward

- APPLY THE CONCEPTS: Target income (sales revenue) Another useful method for figuring out the type of performance your company will need to reach a target income is by using sales revenue. Rather than using the number of units, this method uses total sales revenue. In companies for which the total set of goods produced and sold is more varied, this would be the preferred method, as opposed to a business in which only one product is sold. Assume a company has pricing and cost information as follows: Price and Cost Information Amount Selling Price per Unit $30 Variable Cost per Unit $15 Total Fixed Cost $15,000 For the upcoming period, the company wishes to generate operating income of $40,000. Given the cost and pricing structure for the company’s product, how much sales revenue must it generate to attain its target income? Step 1: Calculate the contribution margin ratio: The contribution margin ratio is the contribution margin in proportion to the selling price on a…arrow_forwardThis Is Accounting Question Don't Use Chat GPTarrow_forwardPLEASE USE THIS TIME TO ANSWER THIS. AYAW NA PAGHULAT UG DEADLINE, TOMORROW IS ANOTHER DAY. PLEASE DEFINE AND GIVE THE FORMULA OF THE FOLLOWING (IF THERE IS ANY): PLEASE ANSWER HERE DIRECTLY 1. absorption costing 2. activity bases (drivers) 3. break-even polnt 4. contributlon margin 5. contributlon margin ratlo 6. cost behavlor 7. cost-volume-profit analysls 8. cost-volume-profit chartarrow_forward

- When using a contribution margin format for internal reporting purposes, the major distinction between segment manager performance and segment performance is: A direct variable cost of selling the product. B direct fixed cost controllable by others. C unallocated fixed cost. D New direct fixed cost controllable by the segment managerarrow_forwardYour company management wants you to compare the list of materials for HML and ABC analysis. For ABC classification they set the following criteria; Items below SR 100000 annual consumption shall be considered as C-items, items between SR 100000 and SR 150000 shall be considered as B-items, and items above SR 150000 shall be considered as A- items For HML classification they set the following criteria; Items below unit price SR 50 shall be considered as L-items, items between SR 50 and SR 100 unit price shall be considered as M-items, and items above SR 100 unit price shall be considered as H-items. Based upon your analysis suggest which classification shall be better for the company so that inventory can be optimized. Justify your answer. Consumption (Units) Annual Price/unit SR Consumption (SR) Annual Item H/M/L A/B/C A 2000 40 В 3000 65 C 2500 90 D 2400 100 E 2300 85 F 2600 110 G 2700 35 H 2300 105 I 2200 130 J 2500 45arrow_forwardWhich statement is true? A. Gross profit (GP) variance analysis, is an essential part of financial statements analysis that is used to evaluate the performance of a firm's departments responsible for the firm's line activities (functions). B. Increases and decreases in sales and cost of sales have direct relationship with increases and decreases in GP. C. If there is a negative sales price variance and there is no cost variance, the gross profit variance will be equal to the sales price variance. D. A zero cost variance indicates that there is no difference between the standard cost prices and actual cost prices. E. none of the abovearrow_forward

- Classify the performance measures below into the most likely balanced scorecard perspective towhich it relates: customer (C), internal processes (P), innovation and growth (I), or financial (F). Defective products madearrow_forwardhelp plearrow_forwardFill in the missing amounts in each of the eight case situations below. Each case Is Independent of the others. (Hint: One way to find the missing amounts would be to prepare a contribution format Income statement for each case, enter the known data, and then compute the missing items.) Required: a. Assume that only one product is being sold in each of the following four case situations: Unit sold Sales Variable expenses Fixed expenses Operating income (loss) Contribution margin per unit Sales Variable expenses Fixed expenses $ Operating income (loss) Average contribution margin (percentage) Case #1 20,400 244,800 163,200 68,000 $ $ 136,000 $ 10 Case #2 $ Case #1 536,000 43,520 10.880 $ 8,800 20% 10 $ 69 Case #3 Case #2 13,600 b. Assume that more than one product is being sold in each of the following four case situations: (Enter "Contribution margin ratio" in percent. Round your final answers to the nearest whole dollar amount.) 436.000 283.400 109.000 95,200 16,320 13 $ S CA Case #4…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education