FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

HELP . ANSWER IN TEXT.

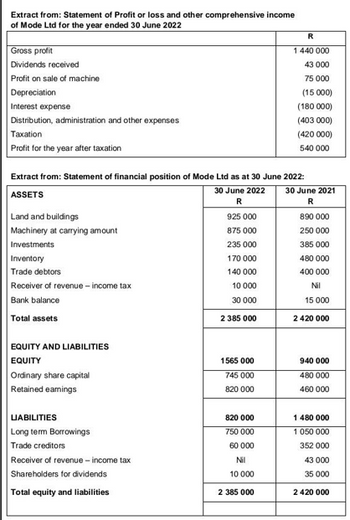

Transcribed Image Text:Extract from: Statement of Profit or loss and other comprehensive income

of Mode Ltd for the year ended 30 June 2022

Gross profit

Dividends received

Profit on sale of machine

Depreciation

Interest expense

Distribution, administration and other expenses

Taxation

Profit for the year after taxation

Land and buildings

Machinery at carrying amount

Investments

Inventory

Trade debtors

Receiver of revenue - income tax

Bank balance

Total assets

Extract from: Statement of financial position of Mode Ltd as at 30 June 2022:

30 June 2022

ASSETS

R

EQUITY AND LIABILITIES

EQUITY

Ordinary share capital

Retained earnings

LIABILITIES

Long term Borrowings

Trade creditors

Receiver of revenue - income tax

Shareholders for dividends

Total equity and liabilities

925 000

875 000

235 000

170 000

140 000

10 000

30

000

2 385 000

1565 000

745 000

820 000

820 000

750 000

60 000

Nil

10 000

R

1440 000

43 000

75 000

2 385 000

(15 000)

(180 000)

(403 000)

(420 000)

540 000

30 June 2021

R

890 000

250 000

385 000

480 000

400 000

Nil

15 000

2 420 000

940 000

480 000

460 000

1 480 000

1 050 000

352 000

43 000

35 000

2 420 000

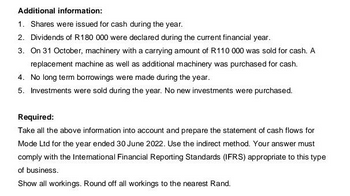

Transcribed Image Text:Additional information:

1. Shares were issued for cash during the year.

2. Dividends of R180 000 were declared during the current financial year.

3. On 31 October, machinery with a carrying amount of R110 000 was sold for cash. A

replacement machine as well as additional machinery was purchased for cash.

4. No long term borrowings were made during the year.

5. Investments were sold during the year. No new investments were purchased.

Required:

Take all the above information into account and prepare the statement of cash flows for

Mode Ltd for the year ended 30 June 2022. Use the indirect method. Your answer must

comply with the International Financial Reporting Standards (IFRS) appropriate to this type

of business.

Show all workings. Round off all workings to the nearest Rand.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education