FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Please help

Transcribed Image Text:---

### Exercise on Preparing a Budget

In this exercise, you will prepare various financial budgets and statements for a company. Below is the given data and the tasks to be completed:

#### Provided Data

- **Salary expense (fixed):** $18,000

- **Sales commissions:** 5% of sales

- **Supplies expense:** (no amount given)

- **Utilities (fixed):** $1,400

- **Depreciation on store fixtures (fixed):** $4,000

- **Rent (fixed):** $12,000

- **Miscellaneous (fixed):** $1,200

>The capital expenditures budget indicates that Adams will spend $64,000 on October 1 for store fixtures, which are expected to have a $20,000 salvage value and a three-year (36-month) useful life.

Use this information to prepare a selling and administrative expenses budget.

#### Tasks:

a. **Prepare a selling and administrative expenses budget.**

b. Utilities and sales commissions are paid in the month they are incurred; all other expenses are paid in the month in which they are incurred. **Prepare a cash payments budget for selling and administrative expenses.**

c. Adams borrows funds, in increments of $1,000, and repays them on the last day of the month. Repayments may be made in any amount available. The company also pays its vendors on the last day of the month. It pays interest of 1 percent per month in cash on the cash balance. To prudently meet payment, the company desires to maintain a $12,000 cash cushion. **Prepare a cash budget.**

d. **Prepare a pro forma income statement for the quarter.**

e. **Prepare a pro forma balance sheet at the end of the quarter.**

f. **Prepare a pro forma statement of cash flows for the quarter.**

### Sales Budget

#### Requirement A

**October sales are estimated to be $200,000, of which 40 percent will be cash and 60 percent will be credit. The company expects sales to increase at the rate of 25 percent per month. Prepare a sales budget.**

**Sales Budget:**

| | October | November | December |

|---------|-----------|------------|------------|

| **Cash sales** | $80,000 | $100,000 | $125,000 |

| **Sales on account** | $

Transcribed Image Text:## Adams Company Case Study

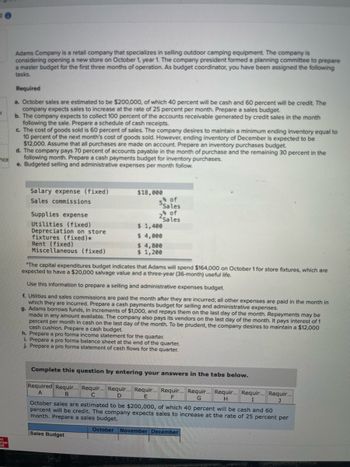

Adams Company is a retail company that specializes in selling outdoor camping equipment. The company is considering opening a new store on October 1, Year 1. The company president has formed a planning committee to prepare a master budget for the first three months of operation. As a budget coordinator, you have been assigned the following tasks:

### Required

**a. October sales are estimated to be $200,000**, of which 40 percent will be cash and 60 percent will be credit. The company expects sales to increase at the rate of 25 percent per month. Prepare a sales budget.

**b. The company expects to collect 100 percent of the accounts receivable generated by credit sales in the month following the sale. Prepare a schedule of cash receipts.**

**c. The cost of goods sold is 60 percent of sales.** The company desires to maintain a minimum ending inventory equal to 10 percent of the next month's cost of goods sold. However, ending inventory of December is expected to be $12,000. Assume that all purchases are made on account. Prepare an inventory purchases budget.

**d. The company pays 70 percent of accounts payable in the month of purchase and the remaining 30 percent in the following month. Prepare a cash payments budget for inventory purchases.**

**e. Budgeted selling and administrative expenses per month are as follows:**

- **Salary expense (fixed): $18,000**

- **Sales commissions: 5% of sales**

- **Supplies expense: 2% of sales**

- **Utilities (fixed): $1,000**

- **Depreciation on store fixtures (fixed)*: $4,800**

- **Rent (fixed): $4,000**

- **Miscellaneous (fixed): $1,200**

\*The capital expenditures budget indicates that Adams will spend $164,000 on October 1 for store fixtures, which are expected to have a $20,000 salvage value and a three-year (36-month) useful life.

Use this information to prepare a selling and administrative expenses budget.

**f. Utilities and sales commissions are paid the month after they are incurred; all other expenses are paid in the month in which they are incurred. Prepare a cash payments budget for selling and administrative expenses.**

**g. Adams borrows funds, in increments of $1,000, and repays them on the last day of the month. Repay

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education