FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

G2.

sales volume 15400

![Required information

Use the following information for the Problems below. (Algo)

[The following information applies to the questions displayed below]

Phoenix Company reports the following fixed budget. It is based on an expected production and sales volume of 15,40

units.

Sales

Costs

Direct materials

Direct labor

Sales staff commissions

Depreciation Machinery

Supervisory salaries

Income

Shipping

Sales staff salaries (fixed annual amount)

Administrative salaries

Depreciation-office equipment

Income

PHOENIX COMPANY

Fixed Budget

For Year Ended December 31

Direct materials

Direct labor

Sales staff commissions

Depreciation Machinery

Supervisory salaries

Problem 21-2A (Algo) Preparing a flexible budget performance report LO P1

Phoenix Company reports the following actual results. Actual sales were 18,400 units.

Sales (18,400 units)

Costs

Shipping

Sales staff salaries (fixed annual amount)

Administrative salaries

Depreciation-office equipment

Desuden da

$ 3,080,000

1,001,000

246,400

61,600

300,000

202,000

246,400

251,000

426,600

191,000

$ 154,000

$ 3,726,000

$1,210,720

301,760

64,400

300,000

215,000

286,120

268,000

433,600

191,000

455,400](https://content.bartleby.com/qna-images/question/4daeda3b-5278-4fa7-b2ce-c352b31ca222/39b413e4-d7eb-437e-8233-edd367dd17c4/ojuu53_thumbnail.jpeg)

Transcribed Image Text:Required information

Use the following information for the Problems below. (Algo)

[The following information applies to the questions displayed below]

Phoenix Company reports the following fixed budget. It is based on an expected production and sales volume of 15,40

units.

Sales

Costs

Direct materials

Direct labor

Sales staff commissions

Depreciation Machinery

Supervisory salaries

Income

Shipping

Sales staff salaries (fixed annual amount)

Administrative salaries

Depreciation-office equipment

Income

PHOENIX COMPANY

Fixed Budget

For Year Ended December 31

Direct materials

Direct labor

Sales staff commissions

Depreciation Machinery

Supervisory salaries

Problem 21-2A (Algo) Preparing a flexible budget performance report LO P1

Phoenix Company reports the following actual results. Actual sales were 18,400 units.

Sales (18,400 units)

Costs

Shipping

Sales staff salaries (fixed annual amount)

Administrative salaries

Depreciation-office equipment

Desuden da

$ 3,080,000

1,001,000

246,400

61,600

300,000

202,000

246,400

251,000

426,600

191,000

$ 154,000

$ 3,726,000

$1,210,720

301,760

64,400

300,000

215,000

286,120

268,000

433,600

191,000

455,400

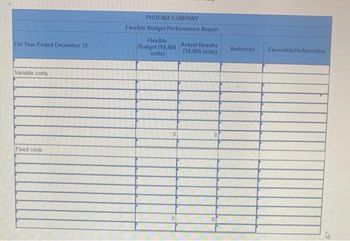

Transcribed Image Text:For Year Ended December 31

Variable costs

Fixed costs

PHOENIX COMPANY

Flexible Budget Performance Report

Flexible

Budget (18,400 Actual Results

(18,400 units)

units)

0

Variances

Favorable/Unfavorable

2

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Display Financial Statement What is the G/L account number for Inventory-Suspense (Heaven)? Please use the following: company code = US00, Ledger 0L = (Leading Ledger), Statement Version = G000, Statement Type = Normal (Actual – Actual), End Period = 8/ 2020, Comparison End Period = 1 /2016, currency = US00. Select one: A. 200500 B. 200532 C. 200200 D. 202422arrow_forwardE8.3B (LO 2) (LCM) Sunshine Company follows the practice of pricing its inventory at LCM, on an individual-item basis. Item No. A B с Ꭰ E F G H Cost per Quantity Unit 1,200 $8.10 600 6.00 200 5.50 700 7.25 1,000 2.10 500 4.05 2,000 8.75 300 9.95 Cost to Replace $8.00 5.60 5.00 7.50 2.00 4.00 8.15 9.00 Estimated Selling Price $9.00 6.00 7.00 8.00 2.80 5.00 9.00 10.50 Cost of Completion and Disposal $0.35 0.45 0.40 0.50 0.65 0.40 0.60 0.30 Instructions From the information above, determine the amount of Sunshine Company inventory. Normal Profit $0.90 0.50 1.00 0.90 0.20 0.75 0.50 1.00arrow_forwardGpu.8arrow_forward

- E9-9 Required: Determine the missing amounts. Cost of Gross Sales Net Ending Goods Profit Beg returns Sales Inventory Purchases Inventory Net Sales Sold (Loss) 1 5,000 80,000 24,000 130,000 38,000 2 126,000 6,000 48,000 145,000 46,500 3 7,200 264,800 167,000 62,800 186,200 4 345,000 8,600 114,000 141,000 179,000 5 468,000 458,800 155,000 270,000 228,000arrow_forwardHow to calculate this using the Periodic Weighted Formula method & the Perpetual FIFO methodarrow_forwardProblem 4-3 (ACP) collected charge amounted to P10.000. The account was within the discount period. Required: Prepare journal entries to record the transactions under the following freight terms: 1. FOB destination and freight collect 2. FOB destination and freight prepaid 3. FOB shipping point and freight collect 4. FOB shipping point and freight prepaidarrow_forward

- q(12+16)This multible choice question from ACCOUNTING PRINCIPLES I.just write for me the final answer.arrow_forwardacct9arrow_forward35 Which inventory issue must be disclosed in the notes to financial statements? Price changes for customers Suppliers' net assets Average costs of inventory Transactions with related parties BOOKMARKarrow_forward

- What about the cost of goods sold?arrow_forwardEx2\ Determine the missing amounts in each the following independent cases: Data حدد المبالغ المفقودة في كل من الحالات المستقلة التالية Case A Inventory \1 Inventory 31\12 Purchases of raw material Case B 15,000 30,000 Case C 20,000 90,000 100,000 70,000 Direct material used 85,000 95,000 100,000 Direct labor 125,000 160,000 Manufacturing overhead Total manufacturing Inventory work in process I\I Inventory work in process 31\12 Cost of goods manufacturing Inventory finished goods I\I Cost of goods available for sale Inventory finished goods 31\12 Cost of goods sold Sales 250,000 345,000 20,000 35,000 340,000 520,000 35,000 5,000 350,000 525,000 50,000 40,000 370,000 25,000 545,000 330,000 480,000 ? 255,000 Gross profit Selling and administrative expenses 170,000 75,000 Ex3 The following data refer to the Fresno fashions co. for the year 2016 Sales revemue 950,000 work in process inventory 3112 was 30,000 work in process inventory I\1 was 40,000 \ 200 000 duinictration ernenses 150.000…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education