FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Activity 6

In reconciling the cash balance on December 31,2019 with that shown in the bank balance, Red

Company gathered the following facts:

Balance per bank statement

4,000,000

Outstanding checks

600,000

Deposit in transit

475,000

Service charge

10,000

Proceeds of bank loan, December 1, discounted for 6 months at

12%, not recorded on company books

940,000

Customer’s check charged back by bank for absence of counter

signature

50,000

Deposit of P100,000 incorrectly recorded by bank as

10,000

Check of Rid Company charged by bank against Red Company

account

150,000

Customer’s note collected by bank in favor of Red Company.

Face 400,000

Interest 40,000

Total 440,000

Collection fee 5,000

435,000

Erroneous debit memo of December 28, to charge company’s

account with settlement of bank loan

200,000

Deposit of Rid Company credited to Red account

300,000

Requirement: Prepare a bank reconciliation.

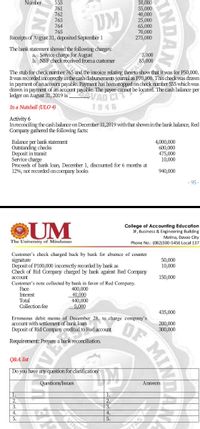

Transcribed Image Text:Number

555

10,000

55,000

40,000

25,000

65,000

70,000

275,000

761

762

763

764

165

Receipts of August 31, deposited September 1

UM

The bank statement showed the following charges:

a. Service charge for August

b. NSF check received froma customer

5,000

85,000

The stub for check number 765 and the invoice relating thereto show that it was for P50,000.

It was recorded incomectly inthe cash disbursements joumal as P70,000. This check was drawn

in payment of anaccOunt payable. Paymet has been stopped oncheck number 555 which was

drawn in payment of an account payable. The payee cannot be located. The cash balance per

ledger on August 31, 2019 is

VAD C

1946

In a Nutshell (ULO 4)

Activity 6

Inreconciling the cash balance on December 31,2019 with that showninthe bank balance, Red

Company gathered the following facts:

Balance per bank statement

Outstanding checks

Deposit in transit

Service charge

Proceeds of bank loan, December 1, discounted for 6 months at

12%, not recorded on company books

4,000,000

600,000

475,000

10,000

940,000

- 95-

OUM

College of Accounting Education

3F, Business & Engineering Building

Matina, Davao City

Phone No.: (082)300-5456 Local 137

The University of Mindanao

Customer's check charged back by bank for absence of counter

signature

Deposit of P100,000 incorrectly recorded by bank as

Check of Rid Company charged by bank against Red Company

50,000

10,000

150,000

account

Customer's note collected by bank in favor of Red Company.

Face

Interest

Total

Collection fee

400,000

40,000

440,000

5,000

435,000

Erroneous debit memo of December 28, to charge company's

account with settlement of bank loan

Deposit of Rid Company credited to Red account

200,000

300,000

Requirement: Prepare a bank reconciliation.

Q&A list

Do you have any question for clarification?

Questions/Issues

Arswers

1.

2.

3.

1

3.

4.

5.

4.

5.

INDAN

OF MI

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please give me correct optionarrow_forwardBank Reconciliation Zing Corp. prepares monthly bank reconciliations as part of its cash controls. Zing's bank provided the following about Zing's cash balance at the bank for the month of April 2022: Balance, April 30, 2022 $74,350 Service charge for April 75 Note ($3,000) and interest ($90) collected for Zing from a customer 3,090 Interest earned during April 140 NSF cheque from Orange Corp. (deposited by Zing) for goods purchased on account 470 Zing then analyzed its cash balance on its own set of books, revealing the following details: Chequing account balance per Zing’s books $72,329 Deposit in transit at April 30 2,100 Outstanding cheques as of April 30 1,400 Error in recording a cheque issued by Zing (Correct amount of the cheque is $737, but was recorded as a cash disbursement of $773. The cheque was issued to pay for merchandise originally purchased on account.) 36 Required: 1. Prepare a bank reconciliation at April 30, 2022, in proper form.…arrow_forwardQUESTION 21 In preparing its bank reconciliation for the month of April 2021, Delano, Inc. has available the following information. Balance per bank statement, 4/30/21 NSF check returned with 4/30/21 bank statement $78,600 940 Deposits in transit, 4/30/21 Outstanding checks, 4/30/21 Bank service charges for April 10,000 10,400 60 What should be the adjusted cash balance at April 30, 2021? $77,600. O $77,260. $78,020. $78,200.arrow_forward

- From the give Problem 2, What is the adjusted cash in bank on December 31?arrow_forwardA -1 Prepared by Reviewed by William, Inc. Bank Confirmation - General Account December 31, 2022 Balance per Bank at December 31, 2022 $20,200.22 * Deposit in Transit - per A-1-2 2,000.00 # Outstanding Checks - per A-1-3 (5,200.00) Other - Note Collected by Bank (10,000.00) ^ Bank Service Charge (9.50) Balance per Books at December 31, 2022 $8,990.72 * f f Column footed. ^ Amount agrees to amount recorded as a deposit on the bank statement and description agrees with receipt enclosed with 12/31/22 bank statement. This note is the Kristopher note receivable that was recorded as a receipt by the client in the cash receipts journal on January 3, 2023. The receivable was appropriately credited and properly reflected in the January cash receipts journal. No adjustment needed as bank and books simply record this in different periods. #Agreed to December 31,…arrow_forwardBalance, December 31, 2018 $3,340 ADD: Deposit in transit 100 3,440 LESS: Outstanding checks $400 400 Adjusted bank balance, December 31, 2018 $3,040 Book: Balance, December 31, 2018 $2,540 ADD: Bank collection $510 Interest revenue 20 530 3,070 LESS: Service charge $30 30 Adjusted book balance, December 31, 2018 $3,040arrow_forward

- QUESTION 20 Winter Gloves Company had checks outstanding totaling $12,800 on its May bank reconciliation. In June, Winter Gloves Company issued checks totaling $79,800. The July bank statement shows that $71,400 in checks cleared the bank in July. A check from one of Winter Gloves Company's customers for of $2,000 was also returned marked "NSF." The amount of outstanding checks on Winter Gloves Company's July bank reconciliation should be $19,200. $8,400. $21,200. $23,200.arrow_forwardaj.8arrow_forwardPart A - Reconciliation At the end of April 2021, Showtime Theatre's accounting records show a cash balance of $4,800. The April bank statement reports a cash balance of $3,700. The following information is gathered from the bank statement and company records: Checks outstanding Deposits outstanding Interest earned $1,900 1,600 70 Customer's NSF check Service fee $1,300 Required: 1) Prepare a bank reconciliation for the month of April 2021. 2) Prepare entries to update the balance of cash in the company's records. 200 In addition, Showtime discovered it correctly paid for advertising with a check for $220 but incorrectly recorded the check in the company's records for $250. The bank correctly processed the check for $220.arrow_forward

- QUESTION 9 The Gatedown Company's bank statement has an ending cash balance of $14,110.00. The cash account in the general ledger has a balance of $12,477.00. Based on the following reconciling items, prepare a bank reconciliation. a) Bank service charge of $20.00 b) Deposit in transit $3,190.00 c) A check was returned NSF $645.00 d) Outstanding check $688.00 e) Note collected by the bank, credit memoranda, $4,800.00 What is the total of subtractions to arrive at the book balance? A) 645.00 B) 555.00arrow_forwardBank Reconciliation Tiny Corp. prepares monthly bank reconciliations of its checking account balance. The bank statement indicated the following: Balance, beginning of the month $15,640 Service charge for October 65 Interest earned during October 80 NSF check from Green Corp. (deposited by Tiny) for goods purchased on account 615 Note ($2,500) and interest ($75) collected for Tiny from a customer 2,575 An analysis of canceled checks and deposits and the records of Tiny revealed the following items: Checking account balance per Tiny's books $12,951 Outstanding checks as of October 31 1,410 Deposit in transit at October 31 750 Error in recording a check issued by Tiny. (Correct amount of the check is $606, but was recorded as a cash disbursement of $660. The check was issued to pay for merchandise originally purchased on account). 54 1. Prepare a bank reconciliation at October 31, 2019, in proper form.arrow_forward18 The May 31 balance per bank statement was $12,400. The cash balance per books was $17,000. Outstanding checks amounted to $1,700, and deposits in transit were $4,800. The bank statement contained an NSF check for $1,100, a service charge for $50, and a debit memo for direct payment of the telephone bill of $350. Required: a. Prepare a bank reconciliation to determine the true cash balance at May 31. b. Indicate how each of the required adjusting entries impact the financial statements. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Indicate how each of the required adjusting entries impact the financial statements. Note: Enter any decreases to account balances and cash outflows with a minus sign. Leave cells blank if no input is needed. Outstanding checks Horizontal Statements Model Balance Sheet Income Statement Item Assets Liabilities Cash Accounts Receivables Stockholders' Equity Revenue Expenses Net Income Statement of Cash Flows (1.700)…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education