FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

The T-Account and the Four-Column Ledger Account

Remember:

The t-account provides the basic account title, date,

debit amount, credit amount, and ending balance for each account.

The four-column ledger provides the same information as the t-account but adds additional detail of a running total and post reference information.

The ending balance should always be the same value for both the t-account and four-column ledger for a specific account.

Transcribed Image Text:4:50 -

×

Accounting Cycle Tutorial

3 Comparing Formats

Nov. 1

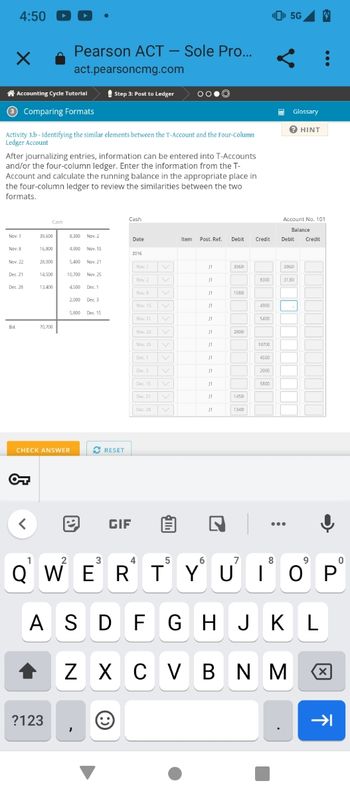

Activity 3.b - Identifying the similar elements between the T-Account and the Four-Column

Ledger Account

Nov. 8

After journalizing entries, information can be entered into T-Accounts

and/or the four-column ledger. Enter the information from the T-

Account and calculate the running balance in the appropriate place in

the four-column ledger to review the similarities between the two

formats.

Nov. 22

Dec. 21

Dec. 28

Bol.

<

Cash

39,600

16,800

28,000

14,500

13,400

70,700

Pearson ACT - Sole Pro...

act.pearsoncmg.com

?123

8,300 Nov. 2

4,900

CHECK ANSWER

5,400 Nov. 21

10,700 Nov. 25

4500 Dec. 1

2

Nov. 15

2,000 Dec. 3

5,800 Dec. 15

Step 3: Post to Ledger

✔ RESET

→ GIF

Cash

3

Date

2016

Nov. 1

Nov. 2

Nov. 8

Nov 15

Nov. 21

Nov. 22

Nov. 25

Dec. 1

Dec. 3

OO.Ⓒ

Dec 15

Dec 21

Dec. 28 V

Item Post. Ref. Debit

J1

11

J1

J1

J1

11

J1

11

J1

J1

J1

J1

3060

1680

2800

1450

1340

Credit

7

8300

4900

5400

10700

4500

2000

5800

¹5G 4

8

HE Glossary

? HINT

Account No. 101

Balance

5

6

QWERTYUIOP

ASDFGHJKL

Z XCVBNM

Debit Credit

39601

31301

.

9

8

X

→→

Transcribed Image Text:4:51

×

Pearson ACT - Sole Pro...

act.pearsoncmg.com

Accounting Cycle Tutorial

3 Comparing Formats

Step 3: Post to Ledger

Meason - Me

LESSON #3B: MORE PRACTICE WITH THE T-ACCOUNT VS. THE FOUR-COLUMN

LEDGER ACCOUNT

The T-Account and the Four-Column Ledger Account

OO.Ⓒ

Remember:

• The t-account provides the basic account title, date, debit amount, credit amount, and ending balance

for each account.

QWERTYU'I'O' P'

ASDFGHJKL

+7 XCVBNMO

• The four-column ledger provides the same information as the t-account but adds additional detail of a

running total and post reference information.

• The ending balance should always be the same value for both the t-account and four-column ledger for a

specific account.

✔ RESET

¹5G 4

HE Glossary

Privacy Policy Copyright ©2022 Pearson Education

Share

Edit

HINT

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Instructions Adele Corp., a wholesaler of music equipment, issued $31,400,000 of 20-year, 5% callable bonds on March 1, 20Y1, at their face amount, with interest payable on March 1 and September 1. The fiscal year of the company is the calendar year. Journalize the entries to record the following selected transactions Refer to the Chart of Accounts for exact wording of account fifles 20Y1 Mar. Sept. 20Y5 Sept. Chart of Accounts Journal 1 Issued the bonds for cash at their face amount. Paid the interest on the bonds 1 1 Called the bond issue at 103, the rate provided in the bond indenture. (Omit entry for payment of interest.) Xarrow_forwardListed below are the transactions of Joseph Moore, D.D.S., for the month of September. Sept. 1 2 4 4 5 8 10 14 18 19 20 25 30 30 Moore begins practice as a dentist, invests $20,030 cash and issues 2,003 shares of $10 par stock. Purchases dental equipment on account from Green Jacket Co. for $17,820. Pays rent for office space, $690 for the month. Employs a receptionist, Michael Bradley. Purchases dental supplies for cash, $900. Receives cash of $1,770 from patients for services performed. Pays miscellaneous office expenses, $420. Bills patients $5,950 for services performed. Pays Green Jacket Co. on account, $3,760. Pays a dividend of $3,090 cash. Receives $1,060 from patients on account. Bills patients $1,980 for services performed. Pays the following expenses in cash: Salaries and wages $1,700; miscellaneous office expenses $83. Dental supplies used during September, $320. Record depreciation using a 5-year life on the equipment, the straight-line method, and no salvage value.arrow_forwardWildhorse Corporation sells rock-climbing products and also operates an indoor climbing facility for climbing enthusiasts. During the last part of 2025. Wildhorse had the following transactions related to notes payable Sept. 1 Sept. 30 Oct. 1 Oct. 31 Nov. 1 Nov. 30 Dec. 1 Dec. 31 Issued a $13,200 note to Pippen to purchase inventory. The 3-month note payable bears interest of 9% and is due December 1. (Wildhorse uses a perpetual inventory system) Recorded accrued interest for the Pippen note. Issued a $22,800, 9%, 4-month note to Prime Bank to finance the purchase of a new climbing wall for advanced climbers. The note is due February 1. Recorded accrued interest for the Pippen note and the Prime Bank note. Issued a $24,000 note and paid $7,600 cash to purchase a vehicle to transport clients to nearby climbing sites as part of a new series of climbing classes. This note bears interest of 6% and matures in 12 months. Recorded accrued interest for the Pippen note, the Prime Bank note, and…arrow_forward

- Post the unadjusted balances and adjusting entries into the appropriate t-accounts.arrow_forwarda list of each customer account and thre balance owed is a:arrow_forwardInstructions Journalize the entries to record the following selected bond investment transactions for Hall Trust (refer to the Chart of Accounts for exact wording of account titles) Apr. June July 1 Purchased for cash $372,000 of Medina City 3% bonds at 100 plus accrued interest of $2,790, paying interest semiannually. Received first semiannual interest payment. 31 Sold $139,200 of the bonds at 98 plus accrued interest of $348. 30arrow_forward

- Please use the templates Thank you very much!arrow_forward7. Opening balances are entered: A. via the Gear menu B. on the day the expenses were incurred C. on the Chart of Accounts D. as a Journal Entry or directly into the account register 8. Which accounts in the Chart of Accounts CANNOT be deleted? A. Accounts added by other users B. Preset accounts or those linked to other features C. Asset accounts D. All of them 9. What type of account is a credit card account? A. Asset B. Liability C. Equity D. Revenuearrow_forwardShow a journal entry writing off an account using both the allowance method and the direct write-off method. NOTE: YOU CAN INCLUDE ANY AMOUNTS AS LONG AS THEY MAKE SENSE, BUT DO NOT FORGET TO INCLUDE ACTUAL NUMBERS FOR THIS JOURNAL SHOWING BOTH METHODS AS STATED ABOVE. THIS CAN BE MADE UP BUT DO NOT FORGET THE NUMBERS.arrow_forward

- Match each of the numbered descriptions with the term, title, or phrase that it best reflects. Indicate your answer by entering the letter A through J in the blank provided. A. General journal B. Special journal C. Subsidiary ledger D. Accounts receivable ledger E. Accounts payable ledger F. Controlling account G. Sales journal H. Cash receipts journal I. Purchases journal J. Cash payments journal 1. Used to record all cash payments. 2. Used to record all credit purchases. 3. Used to record all receipts of cash. 4. Used to record sales of inventory on credit. 5. Stores transaction data of individual customers. 6. Stores transaction data of individual suppliers. 7. Account that is said to control a specific subsidiary ledger. 8. Contains detailed information on a specific account from the general ledger. 9. Used to record and post transactions of similar type. 10. All-purpose journal in which any transaction can be recorded.arrow_forwardSubject - account Please help me. Thankyou.arrow_forwardNeed asaparrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education