Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Provide Solution of the question

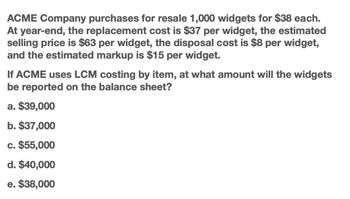

Transcribed Image Text:ACME Company purchases for resale 1,000 widgets for $38 each.

At year-end, the replacement cost is $37 per widget, the estimated

selling price is $63 per widget, the disposal cost is $8 per widget,

and the estimated markup is $15 per widget.

If ACME uses LCM costing by item, at what amount will the widgets

be reported on the balance sheet?

a. $39,000

b. $37,000

c. $55,000

d. $40,000

e. $38,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- ACME Company purchases for resale 1,000 widgets for $64 each. At year- end, the replacement cost is $63 per widget, the estimated selling price is $68 per widget, the disposal cost is $7 per widget, and the estimated markup is $10 per widget.[General Account] If ACME uses LCM costing by item, at what amount will the widgets be reported on the balance sheet? a. $63,000 b. $51,000 c. $64,000 d. $62,500 e. $61,000arrow_forwardcheck all details carefully and tell me true options with short detailsarrow_forwardA company is planning to manufacture rocking chairs. The fixed cost is $40,000 and the cost pre rocking chair is $80. Each rocking chair will be sold for $180. In the space below, type in the formula for the revenue function, R(x), from the sale of x rocking chairs.arrow_forward

- In April of 2021, Best Speaker Company expects to sell 470 bluetooth speaker units. Expenses are as follows: Cost of goods sold is P178 per unit Shipping costs are P31 per unit Miscellaneous costs are P10 per unit Salaries are P80,000 per month Rent is P20,000 per month Utilities are P10,000 per month Calculate the following for April 2021: A. Variable Operating Expense B. Fixed Operating Expense C. Total Operating Expensearrow_forwardA company wishes to establish an EOQ for an item for which the annual demandis $800,000, the ordering cost is $32, and the cost of carrying inventory is 20%.Calculate the following:a. The EOQ in dollars.b. Number of orders per year.c. Cost of ordering, cost of carrying inventory, and total cost.d. How do the costs of carrying inventory compare with the costs of ordering?arrow_forwardTiger Corporation purchases 1,400,000 units per year of one component. The fixed cost per order is $55. The annual carrying cost of the item is 27% of its $10 cost. Determine the EOQ if (1) the conditions stated above hold, (2) the order cost is $1 rather than $55, and (3) the order cost is $55 but the carrying cost is $0.01. What do your answers illustrate about the EOQ model? Explain.arrow_forward

- Urmilabenarrow_forwardThe purchase price of an item of inventory is $25 per unit. In each three month period the usage of the item is 20,000 units. The annual holding costs associated with one unit equate to 6% of its purchase price. The cost of placing an order for the item is $20. What is the Economic Order Quantity (EOQ) for the inventory item to the nearest whole unit?arrow_forwardRugged Outfitters purchases one model of mountain bike at a wholesale cost of $520 per unit and resells it to end consumers. The annual demand for the company’s product is 49,000 units. Ordering costs are $500 per order and carrying costs are $100 per bike per year, including $40 in the opportunity cost of holding inventory. Q. Compute (a) the number of orders per year and (b) the annual relevant total cost of ordering and carrying inventory.arrow_forward

- A merchandising company sells a particular product that is estimated to have approximately 1,500 sales this year. The purchasing department estimates that it will cost approximately $200 to place an order for this product: $180 fixed and $20 variable. The total annual carrying cost for this product is $1,500. What is the product’s EOQ? A. 775 B. 19 C. 735 D. 20arrow_forwardBlossom Company sells 320 units of its products for $20 each to Wildhorse inc. for cash. Blossom allows Wildhorse to return any unused product within 30 days and receive a full refund. The cost of each product is $11. To determine the transaction price, Blossom decides that the approach that is most predictive of the amount of consideration to which it will be entitled is the probability weighted amount. Using the probability-weighted amount. Blossom estimates that (1) 7 products will be returned, and (2) the returned products are expected to be resold at a profit. Prepare the journal entries for Blossom at the time of the sale to Wildhorse including any expected returns. The company follows IFRS. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter "0" for the amounts. List all debit entries before credit entries.) Account Titles and Explanation Cash (To record…arrow_forwardThe Retread Tire Company recaps tires. The fixed annual cost of the recapping operation is $60,000. The variable cost of recapping a tire is $9. The company charges $25 to recap a tire. a. For an annual volume of 12,000 tires, determine the total cost, total revenue, and profit. b. Determine the annual break-even volume for the Retread Tire Company operation.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning