FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

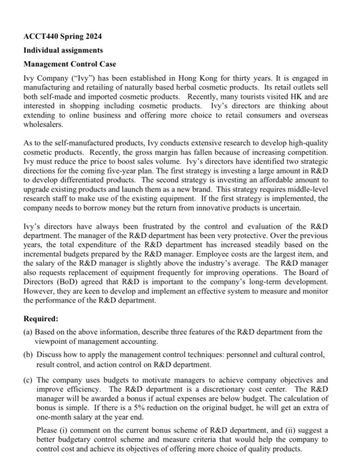

Transcribed Image Text:ACCT440 Spring 2024

Individual assignments

Management Control Case

Ivy Company ("Ivy") has been established in Hong Kong for thirty years. It is engaged in

manufacturing and retailing of naturally based herbal cosmetic products. Its retail outlets sell

both self-made and imported cosmetic products. Recently, many tourists visited HK and are

interested in shopping including cosmetic products. Ivy's directors are thinking about

extending to online business and offering more choice to retail consumers and overseas

wholesalers.

As to the self-manufactured products, Ivy conducts extensive research to develop high-quality

cosmetic products. Recently, the gross margin has fallen because of increasing competition.

Ivy must reduce the price to boost sales volume. Ivy's directors have identified two strategic

directions for the coming five-year plan. The first strategy is investing a large amount in R&D

to develop differentiated products. The second strategy is investing an affordable amount to

upgrade existing products and launch them as a new brand. This strategy requires middle-level

research staff to make use of the existing equipment. If the first strategy is implemented, the

company needs to borrow money but the return from innovative products is uncertain.

Ivy's directors have always been frustrated by the control and evaluation of the R&D

department. The manager of the R&D department has been very protective. Over the previous

years, the total expenditure of the R&D department has increased steadily based on the

incremental budgets prepared by the R&D manager. Employee costs are the largest item, and

the salary of the R&D manager is slightly above the industry's average. The R&D manager

also requests replacement of equipment frequently for improving operations. The Board of

Directors (BoD) agreed that R&D is important to the company's long-term development.

However, they are keen to develop and implement an effective system to measure and monitor

the performance of the R&D department.

Required:

(a) Based on the above information, describe three features of the R&D department from the

viewpoint of management accounting.

(b) Discuss how to apply the management control techniques: personnel and cultural control,

result control, and action control on R&D department.

(c) The company uses budgets to motivate managers to achieve company objectives and

improve efficiency. The R&D department is a discretionary cost center. The R&D

manager will be awarded a bonus if actual expenses are below budget. The calculation of

bonus is simple. If there is a 5% reduction on the original budget, he will get an extra of

one-month salary at the year end.

Please (i) comment on the current bonus scheme of R&D department, and (ii) suggest a

better budgetary control scheme and measure criteria that would help the company to

control cost and achieve its objectives of offering more choice of quality products.

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Question 17 Home Builder Supply, a retailer in the home improvement industry, currently operates seven retail outlets in Georgia and South Carolina. Management is contemplating building an eighth retail store across town from its most successful retail outlet. The company already owns the land for this store, which currently has an abandoned warehouse located on it. Last month, the marketing department spent $15,000 on market research to determine the extent of customer demand for the new store. Now Home Builder Supply must decide whether to build and open the new store. Which of the following should be included as part of the incremental earnings for the proposed new retail store? a. The original purchase price of the land where the store will be located. b. The cost of demolishing the abandoned warehouse and clearing the lot. c. The loss of sales in the existing retail outlet, if customers who previously drove across town to shop at the existing outlet become customers of…arrow_forwardsavitaarrow_forwardCurrent Attempt in Progress Natalie is busy establishing both divisions of her business (cookie classes and mixer sales) and completing her business degree. Her goals for the next 11 months are to sell one mixer per month and to give two to three classes per week. The cost of the fine European mixers is expected to increase. Natalie has just negotiated new terms with Kzinski that include shipping costs in the negotiated purchase price (mixers will be shipped FOB destination). Assume that Natalie has decided to use a periodic inventory system and now must choose a cost flow assumption for her mixer inventory. The following transactions occur in February to May 2022. Feb. 2 16 25 Mar. 2 30 31 Apr. 1 13. 30 May 4 27 Natalie buys two deluxe mixers on account from Kzinski Supply Co. for $1,170 ($585 each), FOB destination, terms n/30. She sells one deluxe mixer for $1.100 cash. She pays the amount owed to Kzinski. She buys one deluxe mixer on account from Kzinski Supply Co. for $603, FOB…arrow_forward

- View Policies Current Attempt in Progress Bramble Cheese Company has developed a new cheese slicer called Slim Slicer. The company plans to sell this slicer through its online website. Given market research, Bramble believes that it can charge $40 for the Slim Slicer, Prototypes of the Slim Slicer, however, are costing $43. By using cheaper materials and gaining efficiencies in mass production, Bramble believes it can reduce Slim Slicer's cost substantially. Bramble wishes to earn a return of 40% of the selling price. (a) Compute the target cost for the Slim Slicer. Target cost $ eTextbook and Medialarrow_forwardN10. Accountarrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forward

- Question is in the screenshotarrow_forwardDo not give answer in imagearrow_forwardAssessing going concern Columbia Metal Fabricators (CMF) makes steel components for the construction industry. It specializes in extreme precision manufacturing where tolerances are measured in distances of less than one millimeter. Its products are used in revolving restaurants, automatic doors, and similar construction components. In the past, the majority of its sales have been to international construction companies, particularly in the Middle East. A drop in the price of oil has slowed construction in the Middle East, and the extremely expensive buildings requiring high-precision steel components are becoming less popular. In addition, some of the technology used by CMF has been copied by companies in Southeast Asia, resulting in extreme price competition in this section of the construction industry for the first time. CMF is highly leveraged. Two years ago, the company borrowed a large sum of money to fund the purchase of new office headquarters and the latest laser-cutting…arrow_forward

- CVP Analysis of Multiple Products Alo Company produces commercial printers. One is the regular model, a basic model that is designed to copy and print in black and white. Another model, the deluxe model, is a color printer-scanner-copier. For the coming year, Alo expects to sell 100,000 regular models and 20,000 deluxe models. A segmented income statement for the two products is as follows: Regular Model Deluxe Model Total Sales $16,000,000 $13,400,000 $29,400,000 Less: Variable costs 9,600,000 8,040,000 17,640,000 Contribution margin $6,400,000 $5,360,000 $11,760,000 Less: Direct fixed costs 1,200,000 960,000 2,160,000 Segment margin $5,200,000 $4,400,000 $9,600,000 Less: Common fixed costs 1,720,800 Operating income $7,879,200 Required: 1. Compute the number of regular models and deluxe models that must be sold to break even. Round your answers to the nearest whole…arrow_forwardHh1. Accountarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education