FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:EX 9-27

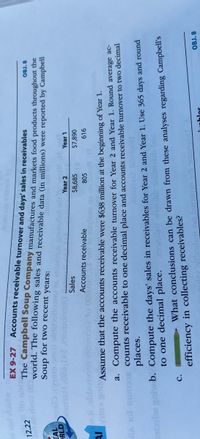

Accounts receivable turnover and days' sales in receivables

OL ccomup

The Campbell Soup Company manufactures and markets food products throughout the

12.22deso world. The following sales and receivable data (in millions) were reported by Campben

IGU O

OBJ. 8

Soup for two recent years:

nucoscopie (ouc corz): C

Sales

EAL

RLD

SCconur

Year 2

Year 1

$8,685

068'$

616

Accounts receivable

805

FO'000

डेश f

Assume that the accounts receivable were $638 million at the beginning of Year 1.

GUILA

a. Compute the accounts receivable turnover for Year 2 and Year 1. Round average ac-

counts receivable to one decimal place and accounts receivable turnover to two decimal

rCcom o II

places.

b. Compute the days' sales in receivables for Year 2 and Year 1. Use 365 days and round

to one decimal place.

Donprim yocomire

What conclusions can be drawn from these analyses regarding Campbell's

c.

efficiency in collecting receivables?

OBJ. 8

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 3arrow_forwardAccounts Receivable Turnover and Days' Sales in Receivables Rosco Co. manufactures and markets food products throughout the world. The following sales and receivable data were reported by Rosco for two recent years: Year 2 Year 1 Sales $7,259,850 $6,860,175 Accounts receivable 719,050 704,450 Assume that the accounts receivable were $602,250 at the beginning of Year 1. a. Compute the accounts receivable turnover for Year 2 and Year 1. Round your answers to one decimal place. Year 2: Year 1: b. Compute the days' sales receivables at the end of Year 2 and Year 1. Use 365 days per year your calculations. Round your answers to one decimal place. Year 2: days Year 1: days C. The change in the accounts receivable turnover from year 1 to year 2 indicates a(n) indicates a(n) - in the efficiency of collecting accounts receivable and is a(n) change. The change in the days' sales in receivables change. Check My Work Previousarrow_forwardThe following data are taken from the financial statements of Rise and Shine Company. Terms of all sales are 2/10, n/30. Year 3 Year 2 Year 1 Accounts receivable, end of year $113,600 $120,000 $128,200 Sales 700,800 682,550 a. For Years 2 and 3, determine (1) the accounts receivable turnover and (2) the number of days' sales in receivables. Assume there are 365 days in the year. Round intermediate calculations to the nearest whole dollar and final answers to one decimal place. Year 3 Year 2 1. Accounts receivable turnover fill in the blank 1 fill in the blank 2 2. Number of days' sales in receivables fill in the blank 3 days fill in the blank 4 days b. What conclusion can be drawn from these data concerning accounts receivable and credit policies?The collection of accounts receivable has . This can be seen in the in accounts receivable turnover and the in the collection period. The company either became aggressive in…arrow_forward

- Need answerarrow_forwardThe following information is from the annual financial statements of Raheem Company, Year 2 Year 3 $ 270,000 20,900 $ 201,000 16,700 Net sales Accounts receivable, net (year-end) (1) Compute its accounts receivable turnover for Year 2 and Year 3. (2) Assuming its competitor has a turnover of 20.5, is Raheem performing better or worse at collecting receivables than its competitor? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute its accounts receivable turnover for Year 2 and Year 3. Year 2: Year 3:1 Choose Numerator: 7 1 1 Accounts Receivable Turnover Choose Denominator: (Required 1 Year 1 $ 248,000 15,400 W Accounts Receivable Turnover Accounts receivable turnover = Required 2 > times timesarrow_forwardNumber 1arrow_forward

- K Accounts receivable management This table, shows that Blair Supply had an end-of-year accounts receivable balance of $300,000. The table also shows how much of the receivables balance originated in each of the previous six months. The company had annual sales of $2.40 million and it normally extends 30-day credit terms to its customers. a. Use the year-end total to evaluate the firm's collection system. b. If 70% of the firm's sales occur between July and December, would this affect the validity of your conclusion in part a? Explain. a. The average collection period is days. (Round to two decimal places.)arrow_forwardVikramarrow_forwardDetermination of credit sales Mervyn’s Fine Fashions has an average collection period of 30 days. The accounts receivable balance is $78,000. What is the value of its credit sales?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education