FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

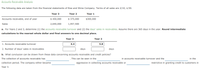

Transcribed Image Text:Accounts Receivable Analysis

The following data are taken from the financial statements of Rise and Shine Company. Terms of all sales are 2/10, n/30.

Year 3

Year 2

Year 1

Accounts receivable, end of year

$ 450,000

$ 375,000

$300,000

Sales

2,640,000

1,957,500

a. For Years 2 and 3, determine (1) the accounts receivable turnover and (2) the days' sales in receivables. Assume there are 365 days in the year. Round intermediate

calculations to the nearest whole dollar and final answers to one decimal place.

Year 3

Year 2

1. Accounts receivable turnover

6.4

5.8

2. Number of days' sales in receivables

days

days

b. What conclusion can be drawn from these data concerning accounts receivable and credit policies?

The collection of accounts receivable has

This can be seen in the

in accounts receivable turnover and the

in the

collection period. The company either became

aggressive in collecting accounts receivable or

restrictive in granting credit to customers in

Year 3.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The financial statements of the Sheffield Corp. reports net sales of $690150 and accounts receivable of $98000 and $31000 at the beginning of the year and end of year, respectively. What is the accounts receivable turnover for Sheffield Corp.? O 22.3 times O 5.4 times O 7.0 times O 10.7 timesarrow_forwardAccounts Receivable Analysis The following data are taken from the financial statements of Rise and Shine Company. Terms of all sales are 2/10, n/30. Year 3 Year 2 Year 1 Accounts receivable, end of year $ 450,000 $ 375,000 $300,000 Sales 2,640,000 1,957,500 a. For Years 2 and 3, determine (1) the accounts receivable turnover and (2) the days' sales in receivables. Assume there are 365 days in the year. Round intermediate calculations to the nearest whole dollar and final answers to one decimal place. Year 3 Year 2 1. Accounts receivable turnover fill in the blank 1 fill in the blank 2 2. Number of days' sales in receivables fill in the blank 3 days fill in the blank 4 daysarrow_forwardAccounts Receivable Analysis The following data are taken from the financial statements of Basinger Inc. Terms of all sales are 2/10, n/45. 20Y3 20Y2 20Y1 Accounts receivable, end of year $171,400 $179,000 $186,000 Sales on account 1,068,720 1,003,750 a. For 20Y2 and 20Y3, determine (1) the accounts receivable turnover and (2) the number of days' sales in receivables. Round interim calculations to the nearest dollar and final answers to one decimal place. Assume a 365-day year. 20Y3 20Y2 1. Accounts receivable turnover fill in the blank 1 fill in the blank 2 2. Number of days' sales in receivables fill in the blank 3 days fill in the blank 4 days b. The collection of accounts receivable has . This can be seen in both the in accounts receivable turnover and the in the collection period.arrow_forward

- westigate Paragraph S a. Accounts receivable turnover b. Number of days' sales in receivables Accounts receivable, end of year Sales on account EX.17-09.ALGO - Accounts Receivable Analysis The following data are taken from the financial statements of Sigmon Inc. 1. Accounts receivable turnover F5 2. Number of days' sales in receivables 2013 F6 W6-Financial Ratio Analysis - Exercise #1.docx Q Search 20Y2 $182,600 $197,000 1,043,900 1,001,560 For 20Y2 and 20Y3, determine (1) the accounts receivable turnover and (2) the number of days' sales in receivables. Round answers to one decimal place. Assume a 365-day year. 20Y3 F7 20 8 18.3 F8 I Styles days F9 20Y1 $211,800 Days prt sc F10 20Y2 DALL home F11 W Days end F12 insertarrow_forwardPlease do not give solution in image format thankuarrow_forwardThe following information was taken from the books of Olmeck, Inc. Year 2 Year 1 Sales $956,000 $992,000 Accounts receivable: Beginning of the year 120,500 136,400 End of the year 110,000 120,500 a. Determine the accounts receivable turnover for Year 2 and Year 1. Round your answers to one decimal place. Accounts ReceivableTurnover Year 2 fill in the blank 1 Year 1 fill in the blank 2 b. Determine the number of days’ sales in receivables for Year 2 and Year 1. Round your answers to one decimal place. Assume 365 days per year. Number of Days' Salesin Receivables Year 2 fill in the blank 3 days Year 1 fill in the blank 4 days c. The industry average for the accounts receivable turnover is 8.0. How does Olmeck, Inc. compare? In Year 2 Olmeck was the industry average. In Year 1, Olmeck was the industry average.arrow_forward

- A company reports the following: Sales $838,040 Average accounts receivable (net) 51,100 Round your answers to one decimal place. Assume a 365-day year. a. Determine the accounts receivable turnover. b. Determine the number of days' sales in receivables.arrow_forwardBased on the following data, what is the accounts receivable turnover? Line Item Description Amount Sales on account during year $481,916 Cost of goods sold during year 220,075 Accounts receivable, beginning of year 44,464 Accounts receivable, end of year 52,698 Inventory, beginning of year 82,460 Inventory, end of year 110,155 a. 4.4 b. 9.9 c. 2.2 d. 10.8arrow_forwardA company reports the following: Line Item Description Amount Sales $235,060 Average accounts receivable (net) 51,100 Determine (a) the accounts receivable turnover and (b) the days’ sales in receivables. When required, round your answers to one decimal place. Assume a 365-day year. Line Item Description Answer a. Accounts receivable turnover b. Days' Sales in Receivablesarrow_forward

- Accounts Receivable Turnover and Average Collection Period The Forrester Corporation disclosed the following financial information (in millions) in its recent annual report: Net Sales Beginning Accounts Receivable (net) Ending Accounts Receivable (net) Previous Year Current Year $67,096 3,896 3,696 $81,662 3,696 3,598 a. Calculate the accounts receivable turnover ratio for both years. (Round your answer to two decimal points.) b. Calculate the average collection period for both years. (Use 365 days for calculation. Round to the nearest whole number.) c. Is the company's accounts receivable management improving or deteriorating? a. Accounts receivable turnover b. Average collection period Previous Year 17.7 x Current Year 22.4 x 21▾ 16 c. The company's receivable management Improved Checkarrow_forwardUsing the following data for the current year, determine the accounts receivable turnover. Net sales on account during the year $ 457,065 Cost of merchandise sold during the year 461,280 Accounts receivable, beginning of year 75,290 Accounts receivable, end of year 26,280 Inventory, beginning of year 185,000 Inventory, end of year 169,570 a.7 b.8 c.10 d.9arrow_forwardplease solve with proper explanation , computation ,formula with steps answer in text thanksarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education