FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

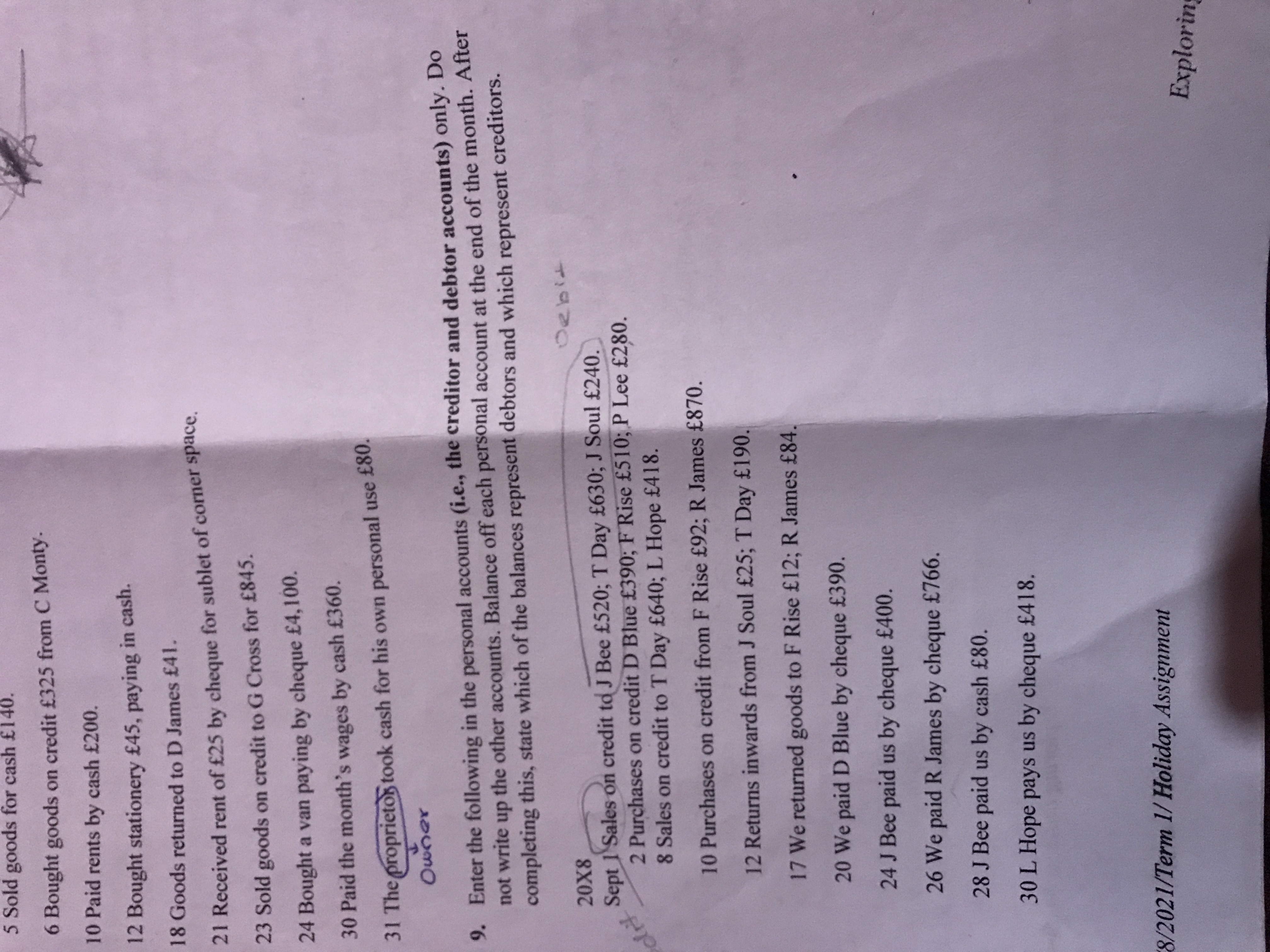

Transcribed Image Text:5 Sold goods for cash £140.

6 Bought goods on credit £325 from C Monty.

10 Paid rents by cash £200.

12Bought stationery £45, paying in cash.

18 Goods returned to D James £41.

21 Received rent of £25 by cheque for sublet of corner space.

23 Sold goods on credit to G Cross for £845.

24 Bought a van paying by cheque £4,100.

30 Paid the month's wages by cash £360.

31 The proprietor took cash for his own personal use £80.

9. Enter the following in the personal accounts (i.e., the creditor and debtor accounts) only. Do

not write up the other accounts. Balance off each personal account at the end of the month. After

completing this, state which of the balances represent debtors and which represent creditors.

Sept 1 Sales on credit td J Bee £520; T Day £630; J Soul £240.

2 Purchases on credit D Blue £390; F Rise £510; P Lee £280.

8 Sales on credit to T Day £640; L Hope £418.

10 Purchases on credit from F Rise £92; R James £870.

12 Returns inwards from J Soul £25; T Day £190.

17 We returned goods to F Rise £12; R James £84.

20 We paid D Blue by cheque £390.

24 J Bee paid us by cheque £400.

26 We paid R James by cheque £766.

28 J Bee paid us by cash £80.

30 L Hope pays us by cheque £4 18.

8/2021/Term 1/ Holiday Assignment

Exploring

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 8- A merchandise dealer bought an amount of (5,000) dinars in cash. 9- A merchandise dealer bought an amount of (5000) dinars on an account. 10- A merchandise dealer bought for (9000) dinars and paid half the price in cash and the rest at the expense of. 11- The dealer paid the transportation expenses of purchases an amount of 1500 dinars in cash. 12-A merchandise dealer sold for (1000) dinars in cash. 13- A merchant sold a merchandise to Walid for a sum of (1000) dinars, received 500 cash and the rest on the account. 14- A dealer paid an amount of 2,500 dinars in cash advertising. 15-A merchant bought a merchandise for 50,000 and paid for it with a check. 16- A furniture dealer bought an amount of (75,000) dinars by check. 17-A merchant paid an amount (100,000) of rent for a store by check. 18- A merchant drew $ 50,000 for personal use by check. 19- Merchant Nabil opened a current account in the bank and deposited 15,000 dinars into it cash Money. 20- Merchant Nabil sold goods for…arrow_forwardChoose the correct answer: 12. On November 10 of the current year, Al-Kamil Co. sold carpet to a customer for OR 8,000 with credit terms 2/10, n/30. Al-Kamil uses the gross method of accounting for cash discounts. What is the correct entry for Al-Kamil on November 10? Select one: a. Accounts receivable 8,000 Sales 8,000 b. Accounts receivable 8,000 cash discounts 160 Sales 7,840 c. Accounts receivable 7,840 cash discounts 160 Sales 8,000 d. Accounts receivable 7,840 Sales…arrow_forwardNov. 1 Dollar Store purchases merchandise for $1,300 on terms of 2/5, n/30, FOB shipping point, invoice dated November 1. 5 Dollar Store pays cash for the November 1 purchase. 7 Dollar Store discovers and returns $150 of defective merchandise purchased on November 1, and paid for on November 5, for a cash refund. 10 Dollar Store pays $65 cash for transportation costs for the November 1 purchase. 13 Dollar Store sells merchandise for $1,404 with terms n/30. The cost of the merchandise is $702. 16 Merchandise is returned to the Dollar Store from the November 13 transaction. The returned items are priced at $285 and cost $143; the items were not damaged and were returned to inventory.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education