FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

EX 9-3

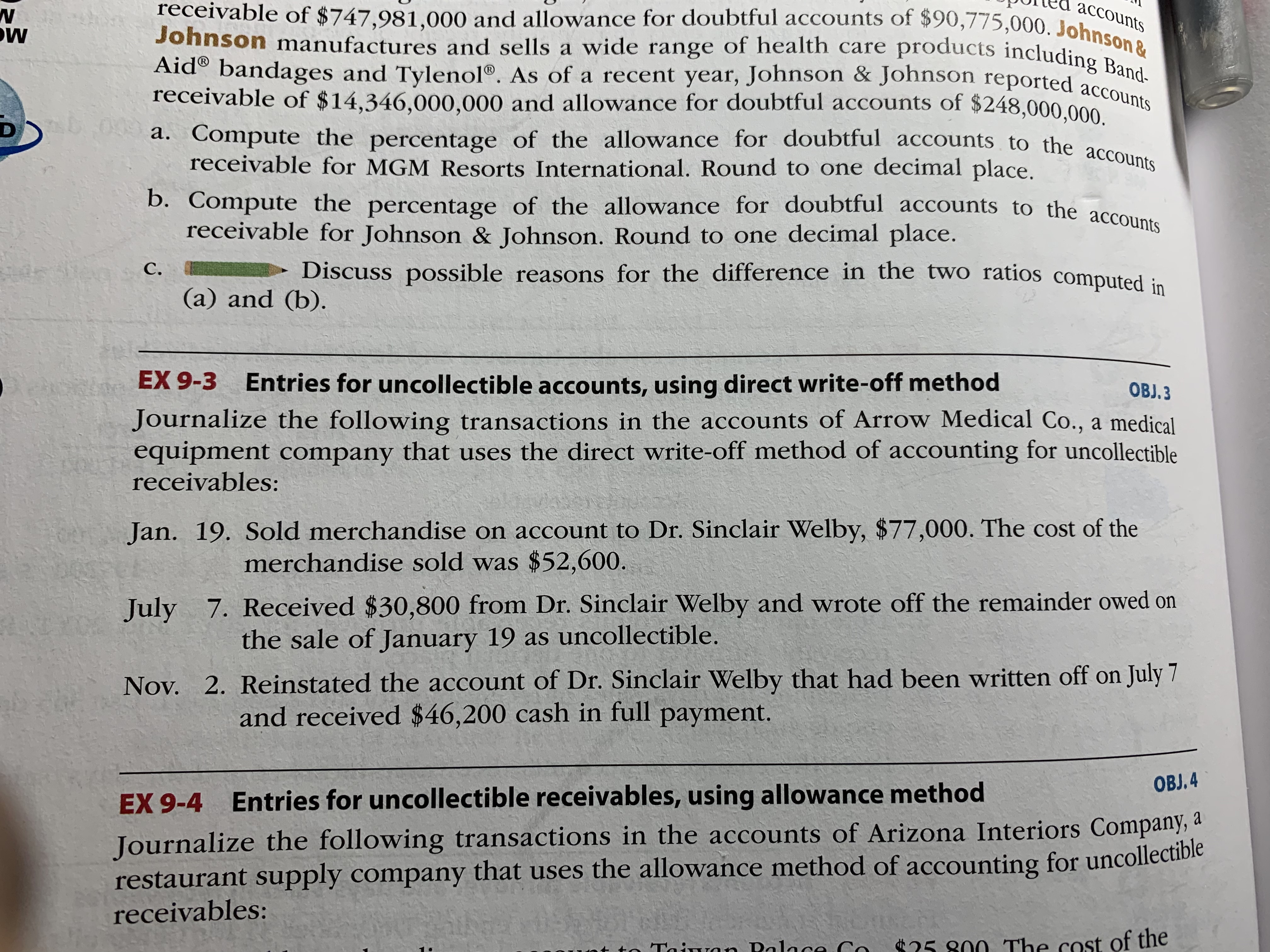

Transcribed Image Text:receivable of $747,981,000 and allowance for doubtful accounts of $90,775,000. Johnson &

Johnson manufactures and sells a wide range of health care products including Band-

Aid® bandages and Tylenol®. As of a recent year, Johnson & Johnson reported accounts

a. Compute the percentage of the allowance for doubtful accounts to the accounts

accounts

Aid® bandages and Tylenol®. As of a recent year, Johnson & Johnson reported accond-

receivable of $14,346,000,000 and allowance for doubtful accounts of $248,000.000

a. Compute the percentage of the allowance for doubtful accounts to the aces

receivable for MGM Resorts International. Round to one decimal place.

b. Compute the percentage of the allowance for doubtful accounts to the accous

receivable for Johnson & Johnson. Round to one decimal place.

C.

Discuss possible reasons for the difference in the two ratios computed :-

(a) and (b).

EX 9-3 Entries for uncollectible accounts, using direct write-off method

OBJ. 3

Journalize the following transactions in the accounts of Arrow Medical Co., a medical

equipment company that uses the direct write-off method of accounting for uncollectible

receivables:

Jan. 19. Sold merchandise on account to Dr. Sinclair Welby, $77,000. The cost of the

merchandise sold was $52,600.

July 7. Received $30,800 from Dr. Sinclair Welby and wrote off the remainder owed on

the sale of January 19 as uncollectible.

Nov. 2. Reinstated the account of Dr. Sinclair Welby that had been written off on July 7

and received $46,200 cash in full payment.

OBJ. 4

EX 9-4 Entries for uncollectible receivables, using allowance method

Journalize the following transactions in the accounts of Arizona Interiors Company, a

restaurant supply company that uses the allowance method of accounting for uncollectible

receivables:

Taiwan Polace Co

*25 800 The cost of the

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- 12-10arrow_forwardb. 15800 is not correct - what is the correct answer?arrow_forwardUse the following information to solve for both the levered and unleved NPV & IRR.. Please note: mortgage and income numbers are to be annual numbers, not monthly. Potential Investment Purchase Price: $700,000.00 Years: 30 LTV: 80.0% Rate: 7.0% PAID ANNUALLY Origination Expenses: 3.0% of the loan amount NOI $75,000.00 Per Year Required Return Levered: Required Return Un-Levered: Expected Price Appreciation: Selling expenses: 13.0% 10.0% 4.0% Years 5.0% of the sale price Expected holding period: 2 Years Workspace:arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education