FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

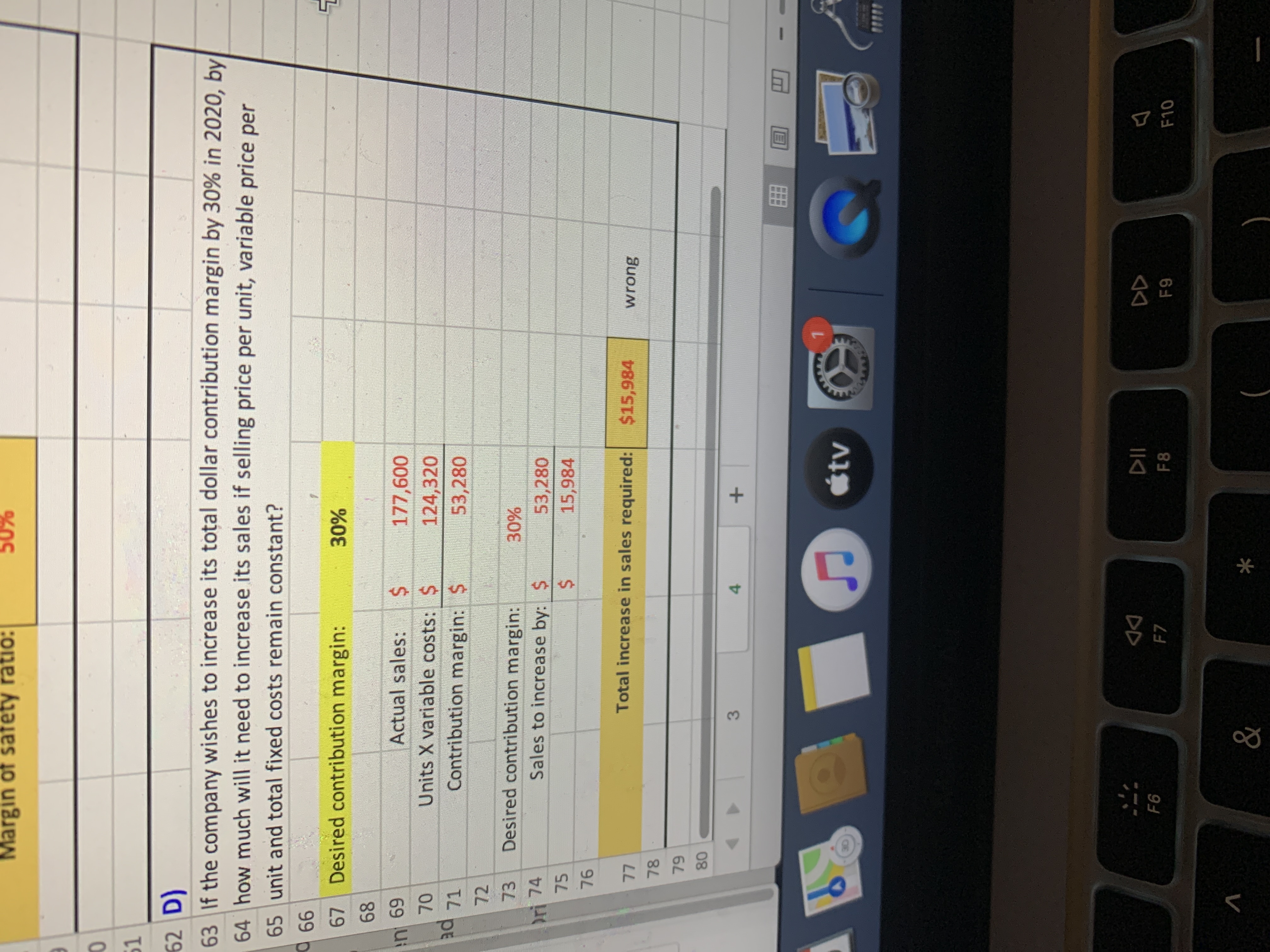

Need help figuring out part 2 of following question; I tried calculating it in excel but another student got a different answer, so I'm wrong.

"If the company wishes to increase its total dollar contribution margin by 30% in 2020, by how much will it need to increase its sales if selling price per unit, variable price per unit and total fixed costs remain constant?

total increase in sales required: ???"

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Highknob Co is thinking about introducing a new product.Below are the possible levels of unit sales and the probabilities of their occurrence. What is the expected value of the new product? Possible Market Reaction Sales in Units Probabilities Low Response 20 .10 Moderate Response 40 .20 High Response 65 .40 Very High Response 80 .30arrow_forward1-Due to an increase in labor rates, the company estimates that variable expenses will increase by $3 per ball next year. If this change takes place and the selling price per ball remains constant at $25, what will be the new CM ratio and break-even point in balls? 2. Refer to the data in (2) above. If the expected change in variable expenses takes place, how many balls will have to be sold next year to earn the same net operating income, $90,000, as last year? 3. Refer again to the data in (2) above. The president feels that the company must raise the selling price of its basketballs. If Northwood Company wants to maintain the same CM ratio as last year, what selling price per ball must it charge next year to cover the increased labor costs?arrow_forwardPlease help with 7 through 10. Thank you!:)arrow_forward

- 3) If demand for 2022 is instead 2,500 units should the company pay to increase their capacity? Why? Please explain your calculations and reference to the chart in Figure 1. Assume units are sold at the normal price. Please mention the concept of incremental profits. Hint: If you expand capacity, you will have to pay additional fixed costs of $25,000. Remember that fixed costs are fixed within the relevant range. If you expand capacity then you are outside this range. If you expand capacity then you can make revenue on 500 additional units at the normal price and would pay variable costs on 500 additional units. Please consider the incremental profit or loss of expanding capacity. The incremental profit is the increase in revenues minus the increase in costs of adding 500 more units. If the incremental profit of expanding capacity is positive then you should do so.arrow_forwardPlease do not give solution in image format ? And Fast answering please and explain proper steps by Step.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education