FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

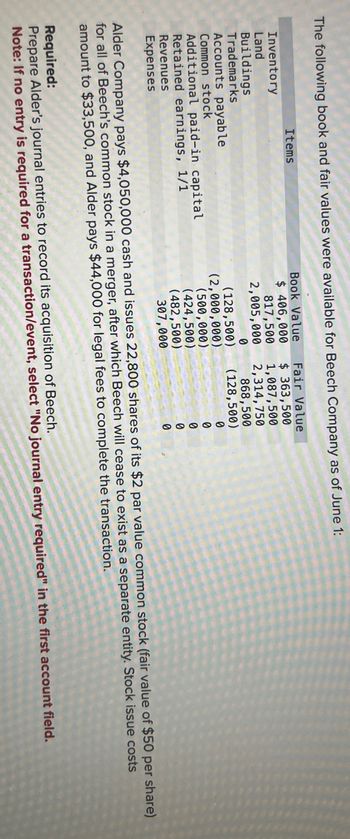

Transcribed Image Text:The following book and fair values were available for Beech Company as of June 1:

Inventory

Land

Buildings

Trademarks

Items

Accounts payable

Common stock

717

Additional paid-in capital

Retained earnings, 1/1

Revenues

Expenses

Book Value Fair Value

$ 406,000

817,500

2,005,000

0

$363,500

1,087,500

2,314,750

868,500

(128,500) (128,500)

(2,000,000)

(500,000)

(424,500)

(482,500)

307,000

0

0

0

9

0

Alder Company pays $4,050,000 cash and issues 22,800 shares of its $2 par value common stock (fair value of $50 per share)

for all of Beech's common stock in a merger, after which Beech will cease to exist as a separate entity. Stock issue costs

amount to $33,500, and Alder pays $44,000 for legal fees to complete the transaction.

Required:

Prepare Alder's journal entries to record its acquisition of Beech.

Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- PayNet Inc. (PayNet) and Shale Ltd. (Shale) had the following balance sheets on July 31, 2022:arrow_forwardThe following book and fair values were available for Westmont Company as of March 1 Book Value Fair Value Inventory $ 350,000 $ 298,250 Land 820,500 1,085,250 Buildings 2,040,000 2,361,000 Customer relationships 0 871,500 Accounts payable (105,000) (105,000) Commom stock (2,000,000) Additional paid-in capital (500,000) Retained earnings 1/1 (425,500) Revenues (496,000) Expenses 316,000 Aturo pays cash of $4,380,000 to acquire Westmont. No stock is issued and…arrow_forwardPresented below is information related to the purchases of common stock by Bridgeport Company during 2025. Fair Value (at December 31) $68,000 306,000 194,000 $568,000 Investment in Arroyo Company stock Investment in Lee Corporation stock Investment in Woods Inc. stock Total (a) (b) Cost (at purchase date) $90,000 252,000 (Assume a zero balance for any Fair Value Adjustment account at the beginning of 2025.) 184,000 (b) $526,000 What entry would Bridgeport make at December 31, 2025, to record the investment in Arroyo Company stock if it chooses to report this security using the fair value option? No. Account Titles and Explanation (a) What entry would Bridgeport make at December 31, 2025, to record the investments in the Lee and Woods corporations, assuming that Bridgeport did not select the fair value option for these investments? (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry…arrow_forward

- Pagle Corporation holds 80 percent of Standard Company's common shares. The companies report the following balance sheet data for December 31, 20X1: Assets Cash Accounts Receivable Inventory Buildings and Equipment Less: Accumulated Depreciation Investment in Standard Company Stock Total Assets Liabilities and Owners' Equity Accounts Payable Taxes Payable Preferred Stock ($10 par value) Common Stock: $10 par value $5 par value Retained Earnings Total Liabilities and Owners' Equity Pagle Corporation $ 53,000 85,000 126,000 700,000 (295,000) 160,000 $ 829,000 Basic earnings per share Diluted earnings per share $ 120,000 79,000 200,000 100,000 330,000 $ 829,000 Required: Compute basic and diluted EPS for the consolidated entity for 20X1. Note: Round your answers to 2 decimal places. Standard Company $ 43,000 65,000 76,000 330,000 (130,000) $ 384,000 $ 84,000 100,000 An 8 percent annual dividend is paid on the Pagle preferred stock and a 12 percent dividend is paid on the Standard…arrow_forwardDengerarrow_forwardRequired information Skip to question [The following information applies to the questions displayed below.] On May 1, Donovan Company reported the following account balances: Current assets $ 134,000 Buildings & equipment (net) 232,000 Total assets $ 366,000 Liabilities $ 110,500 Common stock 150,000 Retained earnings 105,500 Total liabilities and equities $ 366,000 On May 1, Beasley paid $425,800 in stock (fair value) for all of the assets and liabilities of Donovan, which will cease to exist as a separate entity. In connection with the merger, Beasley incurred $16,900 in accounts payable for legal and accounting fees. Beasley also agreed to pay $79,900 to the former owners of Donovan contingent on meeting certain revenue goals during the following year. Beasley estimated the present value of its probability adjusted expected payment for the contingency at $24,600. In determining its offer, Beasley noted the following:…arrow_forward

- A-6arrow_forwardArizona Corp. had the following account balances at 12/1/19: Receivables: $96,000; Inventory: $240,000; Land: $720,000; Building: $600,000; Liabilities: $480,000; Common stock: $120,000; Additional paid-in capital: $120,000; Retained earnings, 12/1/19: $840,000; Revenues: $360,000; and Expenses: $264,000. Several of Arizona's accounts have fair values that differ from book value. The fair values are: Land — $480,000; Building — $720,000; Inventory — $336,000; and Liabilities — $396,000. Inglewood Inc. acquired all of the outstanding common shares of Arizona by issuing 20,000 shares of common stock having a $6 par value, but a $66 fair value. Stock issuance costs amounted to $12,000. Imagine you are the decision maker at Inglewood Inc. Prepare a fair value allocation and goodwill schedule at the date of the acquisition. Determine in 525- words whether you would encourage acquiring Arizona Corp? Be sure to include your rationaarrow_forwardThe December 31, 20X8, balance sheets for Pint Corporation and its 70 percent-owned subsidiary Saloon Company contained the following summarized amounts: PINT CORPORATION AND SALOON COMPANY Balance Sheets December 31, 20x8 Pint Corporation Saloon Company Assets Cash and Receivables Inventory Buildings and Equipment (net) Investment in Saloon Company Total Assets Liabilities and Equity Accounts Payable Common Stock Retained Earnings Total Liabilities and Equity $ 118,000 162,000 315,000 224,900 $ 819,900 $ 115,900 185,000 $19,000 $ 819,900 $ 60,000 103,000 281,000 $ 444,000 $ 65,000 131,000 248,000 $ 444,003 Pint acquired the shares of Saloon Company on January 1, 20X8. On December 31, 20XB, assume Pint sold inventory to Saloon during 20X8 for $107,000 and Saloon sold inventory to Pint for $312,000. Pint's balance sheet contains inventory items purchased from Saloon for $97,000. The items cost Saloon $57,000 to produce. In addition, Saloon's inventory contains goods it purchased from…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education