FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

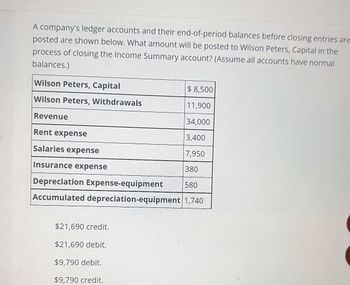

Transcribed Image Text:A company's ledger accounts and their end-of-period balances before closing entries are

posted are shown below. What amount will be posted to Wilson Peters, Capital in the

process of closing the Income Summary account? (Assume all accounts have normal

balances.)

Wilson Peters, Capital

Wilson Peters, Withdrawals

Revenue

$8,500

11,900

34,000

Rent expense

3,400

Salaries expense

7,950

Insurance expense

380

Depreciation Expense-equipment

580

Accumulated depreciation-equipment 1,740

$21,690 credit.

$21,690 debit.

$9,790 debit.

$9,790 credit.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- American Chip Corporation's reporting year-end is December 31. The following is a partial adjusted trial balance as of December 31, 2021. Account Title Debits Credits Retained earnings 80,000 Sales revenue 750,000 Interest revenue 3,000 Cost of goods sold 420,000 Salaries expense 100,000 Rent expense 15,000 Depreciation expense 30,000 Interest expense 5,000 Insurance expense 6,000 Required:Prepare the necessary closing entries at December 31, 2021.arrow_forwardPrepare closing entries from the following end-of-period spreadsheet. Austin Enterprises End-of-Period Spreadsheet For the Year Ended December 31 Account Title Cash Accounts Receivable Supplies Equipment Accumulated Depreciation Accounts Payable Wages Payable Don Austin, Capital Don Austin, Drawing Fees Earned Wages Expense Supplies Expense Depreciation Expense 43°F Cloudy Unadjusted Trial Balance Dr. 26,500 5,000 8,000 18.500 2,000 18,000 3 1,500 11,000 8,000 57.500 Adjustments Dr. 2,000 1,000 7.000 3.500 78.000 78.000 13.500 7,000 3,500 1,000 2,000 Adjusted Trial Balance Dr. 26,500 7,000 1,000 18,500 2.000 Cr. 5,000 11,000 1,000 8,000 59.500 19.000 7,000 3.500 13.500 84.500 84.500arrow_forwardplease dear expert need answer with calculation, explanation , formulation with steps for better understanding answer in text not imagearrow_forward

- Preparing closing entries from T-accounts Selected accounts for Kebby Photography at December 31, 2018, follow: Requirements Journalize Kebby Photography’s closing entries at December 31, 2018. Determine Kebby Photography’s ending Retained Earnings balance at December 31, 2018.arrow_forward8. The closing entry process consists of closing a. all asset and liability accounts. b. out the Owner's Capital account. C. all permanent accounts. d. all temporary accounts. 9. The final step in the accounting cycle is to prepare a. closing entries. b. financial statements. C. a post-closing trial balance. d. reversing entries. 10. The current ratio is expressed as a. current assets divided by current liabilities. b. current assets minus current liabilities. c. current liabilities divided by non-current liabilities. d. current assets minus owner's equity. ish (Canada)arrow_forwardSelected ledger account balances for Business Solutions follow. For Three Months Ended December 31, 2019 For Three Months Ended March 31, 2020 2$ Office equipment Accumulated depreciation-Office equipment Computer equipment Accumulated depreciation-Computer equipment Total revenue $ 8,400 8,400 420 840 20,000 1,250 31,984 83,560 20,000 2,500 44,500 120,368 Total assets Required: 1. Assume that Business Solutions does not acquire additional office equipment or computer equipment in 2020. Compute amounts for the year ended December 31, 2020, for Depreciation expense-Office equipment and for Depreciation expense-Computer equipment (assume use of the straight-line method). 2. Given the assumptions in part 1, what is the book value of both the office equipment and the computer equipment as of December 31, 2020? 3. Compute the three-month total asset turnover for Business Solutions as of March 31, 2020. Complete this question by entering your answers in the tabs below. Required 1 Required…arrow_forward

- What does Closing Entry #1 (clase revenues) include, based on the trial balance below for the year ending December 31, 2018? Account Cash Accounts Receivable Trucks Accumulated Depreciation Accounts Payable Wages Payable K. Wilson, Capital K. Wilson, Withdrawals Trucking Fees Earned Wages Expense Depreciation Expense Other Expenses Credit to Income Summary of $130,000 Debit to Income Summary of $130,000 O Credit to K. Wilson, Capital of $130,000 O Credit to Trucking Fees Earned of $130,000 Debit $ 96,000 17,500 172,000 Credit $ 36,000 65,000 4,000 175,000 20,000 130,000 61,000 23,500 20,000arrow_forwardClassifying balance sheet accounts For each account listed, identify the category in which it would appear on a classified balance sheet. Office Supplies Interest Payable Retained Earnings Copyrights Land Accumulated Depreciation—Furniture< Land (held for long-term investment purposes) Unearned Revenue</p> <p>i. Notes Payable (due in six years)arrow_forwardDo not provide answer in image formatarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education