FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Prepare

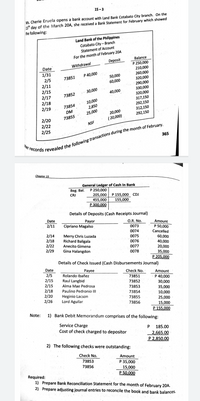

Transcribed Image Text:15 -3

Ms. Cherie Eruela opens a bank account with Land Bank Cotabato City branch. On the

15th day of the March 20A, she received a Bank Statement for February which showed

the following:

Land Bank of the Philippines

Cotabato City - Branch

Statement of Account

For the month of February 20A

Deposit

Balance

P 250,000

210,000

260,000

320,000

290,000

Withdrawal

Date

1/31

2/5

2/11

2/15

2/17

2/18

2/19

P 40,000

50,000

60,000

73851

330,000

320,000

317,150

292,150

312,150

292,150

30,000

40,000

73852

10,000

2,850

73854

DM

25,000

20,000

73855

( 20,000)

2/20

2/22

2/25

NSF

365

Her

Chapter 15

General Ledger of Cash In Bank

P 250,000

205,000

455,000

P 300,000

Beg. Bal.

CRJ

P 155,000 CDJ

155,000

Details of Deposits (Cash Receipts Journal)

Date

Payor

Cipriano Magalso

O.R. No.

Amount

2/11

0073

P 50,000

Cancelled

0074

2/14

2/18

2/22

2/29

Merry Chris Luzada

Richard Baligala

0075

60,000

40,000

20,000

35,000

P 205,000

0076

Anecito Gimena

0077

Gina Halangdon

0078

Details of Check Issued (Cash Disbursements Journal)

Date

Payee

Rolando Ibañez

Check No.

Amount

2/5

2/15

2/15

2/18

2/20

2/26

Raul Langbid

73851

P 40,000

73852

30,000

35,000

Alma Mae Pedrosa

73853

Paulino Pedronio III

73854

10,000

Heginio Lacson

Lord Aguilar

73855

25,000

73856

15,000

P 155,000

Note:

1) Bank Debit Memorandum comprises of the following:

Service Charge

Cost of check charged to depositor

185.00

2,665.00

P 2,850.00

2) The following checks were outstanding:

Check No.

Amount

73853

P 35,000

15,000

P 50,000

73856

Required:

1) Prepare Bank Reconciliation Statement for the month of February 2OA.

2) Prepare adjusting journal entries to reconcile the book and bank balances.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Sal's Surf Shop deposits all receipts in the bank and makes all payments by check. On July 31 the cash account had a balance of $6,105.42. The bank statement on July 31 reported a balance of $4,146.46. Upon comparing the bank statement to the books, the following items were found. а. A bank debit memo issued for an NSF check from a customer of $21.25. b. A bank credit memo issued for interest of $8.50 earned during the month. С. During the evening of July 31, a deposit of $1,948.25 was made, which is not shown on the bank statement. d. A bank debit memo issued for $18.50 for bank service charges. е. Checks for the amounts of $34.00, $17.85, and $93.25 were written during July but have not yet been received by the bank. f. The reconciliation from the previous month, June, showed outstanding checks of $260.80. One of these checks in the amount of $7.38 has not yet been received by the bank. g. After comparing the canceled checks to the bank statement, it was discovered that a check…arrow_forwardHelp with Correct Answerarrow_forwardBank reconciliation and entries Sunshine Interiors deposits all cash receipts each Wednesday and Friday in a night depository, after banking hours.The data required to reconcile the bank statement as of July 31, 20Y0, have been taken from various documents and records and are reproduced as follows.The sources of the data are printed in capital letters. All checks were written for payments on account. CASH ACCOUNT: Balance as of July 1 $9,578.00 CASH RECEIPTS FOR MONTH OF JULY 6,465.42 DUPLICATE DEPOSIT TICKETS: Date and amount of each deposit in July: Date Amount Date Amount Date Amount July 2 $569.50 July 12 $580.70 July 23 $713.45 5 701.80 16 600.10 26 601.50 9 819.24 19 701.26 31 1,777.87 CHECKS WRITTEN: Number and amount of each check issued in July: BANK RECONCILIATION FOR PRECEDING MONTH: Sunshine Interiors Bank Reconciliation June 30,20Y0 Cash balance according to bank statement $9,422.80…arrow_forward

- Match each item to a bank statement adjustment, a company books adjustment, or either. Question 8 options: NSF check Bank charges Outstanding checks Error in recording a check Interest revenue Deposit in transit Note collected by the bank 1. bank statement adjustment 2. company books adjustment 3. eitherarrow_forwardprepare a bank reconciliation report.arrow_forwardUse the following bank statement and T-account to prepare any journal entries needed as a result of the May 31 bank recor no entry Is requlred for a transactlon/event, select "No Journal Entry Requlred" In the first account fleld.) BANK STATEMENTarrow_forward

- Bank Reconciliation and Adjusting Entries (Appendix 6.1) Instructions Chart of Accounts Labels and Amount Descriptions Bank Reconciliation General Journal X Instructions Odum Corporation’s cash account showed a balance of $17,200 on March 31, 2019. The bank statement balance for the same date indicated a balance of $17,916.55. The following additional information is available concerning Odum’s cash balance on March 31: • Undeposited cash on hand on March 31 amounted to $724.50. • A customer’s NSF check for $180.80 was returned with the bank statement. • A note for $2,000 plus interest of $25 was collected for Odum by the bank during March. The bank notified Odum of this collection on the bank statement. • The bank service charge for March was $15. • A deposit of $950.75 mailed to the bank on March 31 did not appear on the bank statement. The following checks mailed to creditors had not been processed by the bank on March…arrow_forwardWhat is the cash balance per books at November 30, 2021?arrow_forwardAre 1 year certificates of deposit recorded on bank reconciliation?arrow_forward

- Problem Solving. Required: 1. Prepare a properly classified bank reconciliation statement for each of the problems given below.2. Prepare the necessary adjusting journal entries on the company’s book for book reconciling items.arrow_forwardA table for a monthly bank reconciliation dated September 30 is given below. For each item 1 through 12, indicate whether the item should be added to or subtracted from the book or bank balance, and whether it should or should not appear on the reconciliation. (Select the answers in the appropriate cells. Leave no cells blank. Be certain to select "NA" in fields which are not applicable.)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education