FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

do not give answer in image

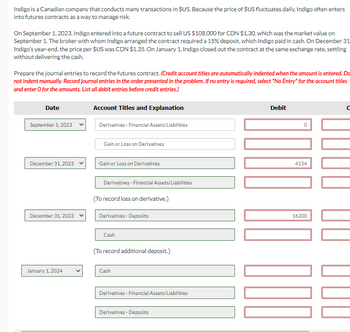

Transcribed Image Text:Indigo is a Canadian company that conducts many transactions in $US. Because the price of $US fluctuates daily, Indigo often enters

into futures contracts as a way to manage risk.

On September 1, 2023, Indigo entered into a future contract to sell US $108,000 for CDN $1.30, which was the market value on

September 1. The broker with whom Indigo arranged the contract required a 15% deposit, which Indigo paid in cash. On December 31

Indigo's year-end, the price per $US was CDN $1.35. On January 1, Indigo closed out the contract at the same exchange rate, settling

without delivering the cash.

Prepare the journal entries to record the futures contract. (Credit account titles are automatically indented when the amount is entered. Do

not indent manually. Record journal entries in the order presented in the problem. If no entry is required, select "No Entry" for the account titles

and enter o for the amounts. List all debit entries before credit entries.)

Date

September 1, 2023

December 31, 2023

December 31, 2023

January 1, 2024

Account Titles and Explanation

Derivatives - Financial Assets/Liabilities

Gain or Loss on Derivatives

Gain or Loss on Derivatives

Derivatives - Financial Assets/Liabilities

(To record loss on derivative.)

Derivatives - Deposits

Cash

(To record additional deposit.)

Cash

Derivatives - Financial Assets/Liabilities

Derivatives - Deposits

Debit

0

4154

16200

| 000

C

Expert Solution

This question hasn't been answered yet.

Check out a sample Q&A hereWhile we curate your solution, check out other similar questions below!

©

FINANCIAL ACCOUNTING

10th Edition

Knowledge Booster

Similar questions

- Blossom Inc. entered into a futures contract to sell grain for $1,120 in 30 days. This contract helps the company manage its market risk by locking in the amount it will get when it sells the grain. The contracts trade on an exchange and are net settleable. The broker requires a $220 initial margin (normally a percentage of the market value of the contract or a fixed amount multiplied by the number of contracts). This amount is deposited in cash with the broker. Like the forward, the futures contract would have a zero value up front. This is a non-financial derivative because the underlying is a non-financial commodity (grain). Blossom intends to settle on a net basis. Prepare the related journal entry at the acquisition date. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List debit entry before credit entry.) Account Titles Debit Creditarrow_forwardi need the answer quicklyarrow_forwardOn January 10, Volkswagen agrees to import auto parts worth $7 million from the U.S. The parts will be delivered on March 4 and are payable immediately in dollars. VW decides to hedge its dollar position by entering into IMM futures contracts. The spot rate is $1.3447/€ and the March futures price is $1.3502. On March 4, the spot rate turns out to be $1.3452/€, while the March futures price is $1.3468/€. Calculate VW’s net euro gain or loss on its futures position. $13,850 loss $13,850 gain $17,850 loss $17,850 gainarrow_forward

- Jordan Corp is a US manu8facturer of auto pats with branchoperatiopns in France. on December 31, 2018 wishesto use a foreign currency option to hedge a 10,000,000 euro denominated accounts receivable that is due in two years. Jordan plans to use fair value hedge accounting. Over the subsequent 4 quarters the following are the changes in fair value of the receivable and the forreign currency option hedge. 1) Quarter ended March 31, 2019: Euro receivable increases by $400,000 Option hedge declines by $350,000 2) Quater ended June 30, 2019: Euro receivable decreases by $500,000 Option hedge increases by $400,000 3) Quarter ended Sept 30, 2019: Euro receivable decreases by $800,000 Option hedge increases by $700,000 4) Quarter ended Dec. 31, 2019: Euro receivable increases by $200,000 Option hedge declines by $100,000 Identify by codification reference, e.g. xxx-xx-xx-xx, and attach and highlight the appropriate section(s) of FASB codification that describe the alternate criteria that can…arrow_forwardJordan Corp is a US manu8facturer of auto pats with branchoperatiopns in France. on December 31, 2018 wishesto use a foreign currency option to hedge a 10,000,000 euro denominated accounts receivable that is due in two years. Jordan plans to use fair value hedge accounting. Over the subsequent 4 quarters the following are the changes in fair value of the receivable and the forreign currency option hedge. 1) Quarter ended March 31, 2019: Euro receivable increases by $400,000 Option hedge declines by $350,000 2) Quater ended June 30, 2019: Euro receivable decreases by $500,000 Option hedge increases by $400,000 3) Quarter ended Sept 30, 2019: Euro receivable decreases by $800,000 Option hedge increases by $700,000 4) Quarter ended Dec. 31, 2019: Euro receivable increases by $200,000 Option hedge declines by $100,000 Questions: a) Structure the appropriate fair value hedge using an FX option. Answer must state whether Jordan is purchasing or selling an option, what is the expiration date…arrow_forwardAn FI is planning to hedge its one-year, 100 million Swiss franc (SF)-denominated loan against exchange rate risk. The current spot rate is $0.60/SF. A 1-year SF futures contract is currently trading at $0.58/SF. SF futures are sold in standardized units of SF125,000. Should the FI be worried about the SF appreciating or depreciating? Should it buy or sell futures to hedge against exchange rate risk exposure? How many futures contracts should it buy or sell if a regression of past spot exchange rates on changes in future exchange rates generates an estimated slope of 1.4? Show exactly how the FI is hedged if it repatriates its principal of SF100 million at year-end, the spot exchange rate of SF at year-end is $0.55/SF, and the forward exchange rate is $0.5443/SF.arrow_forward

- On January 1, 2024, Avalanche Corporation borrowed $122,000 from First Bank by issuing a two-year, 8% fixed-rate note with annual interest payments. The principal of the note is due on December 31, 2025. Avalanche wanted to hedge against declines in general interest rates, so it also entered into a two-year SOFR-based interest rate swap agreement on January 1, 2024, and designates it as a fair value hedge. Because the swap is entered at market rates, the fair value of the swap is zero at inception. The agreement called for the company to receive fixed interest at the current SOFR swap rate of 5% and pay floating interest tied to SOFR. This arrangement results in an effective variable rate on the note of SOFR + 3%. The contract specifies that the floating rate resets each year on June 30 and December 31 for the net settlement that is due the following period. In other words, the net cash settlement is calculated using beginning- of-period rates. The SOFR rates on the swap reset dates…arrow_forwardYou enter into a futures contract to buy €125,000 at $1.53 per euro. The spot exchange rate when you enter the contract is $1.63. Your initial performance bond is $6,100 and your maintenance level is $2,400. At what settle price will you get a demand for additional funds to be posted to your account? 1.6596 1.7596 1.8896 1.5004 1.5596 1.6004arrow_forwardNGW, a consumer gas provider, estimates a rather cold winter. as a result it decides to enter into a futures contract on the nymex for natural gas on november 2, 2016. the trading unit is 10,000 million british thermal units (mmbtu). the three-month futures contract rate is $7.00 per mmbtu, so each contract will cost ngw $70,000. in addition, the exchange requires a $5,000 deposit on each contract. ngw enters into 20 such contracts. REQUIRED: why is this futures contract likely to be considered an effective hedge and therefore qualified for hedge accounting? why would this transaction be accounted for as a cash-flow hedge? assume that the december 31, 2016, futures contract rate is $6.75 for delivery on february 2, 2017, and the spot rate on february 2, 2017, is $6.85. assume that ngw sells all of the gas on february 3, 2017, for $8.00 per mmbtu. prepare all the necessary journal entries from november 2, 2016, through february 3, 2017, to account for this hedge situation.arrow_forward

- Sysco corporation has purchased currency call options to hedge a 4,320,000 Swedish krona payable. The premium is $0.015 (per unit of Swedish krona) and the exercise price of the option is $0.097 per Swedish krona. If the spot rate at the time of maturity is S0.105 per Swedish krona, what is the total amount paid by the corporation if it acts rationally (after accounting for the premium paid)? Question 27 options: S 419,040. $354,240. $518,400. S453,600. $483,840.arrow_forwardThe Kasapreko Company Limited has a debt of nzd 100,000, which is repayable intwelve months. The company’s controller, Kweku Manu is having trouble sleepless atnight knowing that the debt is unhedged. The current ghs/nzd exchange rate is 20, andp.a. interest rates are 21 percent on ghs and 10 percent on nzd. Kweku is considering aforward hedge (at Ft,T = 20 × 1.21/1.10 = 22), but a friend tells him that he recentlybought a call on nzd 100,000 with X = 20, and is willing to sell it to him at the historiccost, ghs 1 per nzd or ghs 100,000 for the total contract. What should he do?arrow_forwardPrudence Bank is a regular borrower in the interbank market. On the 9th of August 2023, the head of the Global Markets operations makes the decision to hedge the bank's interest cost on a three-month Eurodollar issuance of US$30 million, which is planned for November 2023. On 9 August, the bank could issue US$30 million in three-month Eurodollars at 4.61%. The corresponding futures rates for the three-month Eurodollar futures contracts are 4.83% (December 2023), 5.01% (March 2024), and 5.38% (June 2024).REQUIRED:A.What is the bank’s specific cash market risk that it should be concerned with on 9 August 2023? B.Should the bank buy or sell Eurodollar futures to hedge its borrowing costs? Which Eurodollar futures contract should the bank use? Explain why it is best. C.Assume that the bank takes the futures position that you recommended above at the rate available on 9 August 2023. On 6 November 2023, the bank issues US$30 million in Eurodollars at 6.25%. Coincidently, it closes out…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education