FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

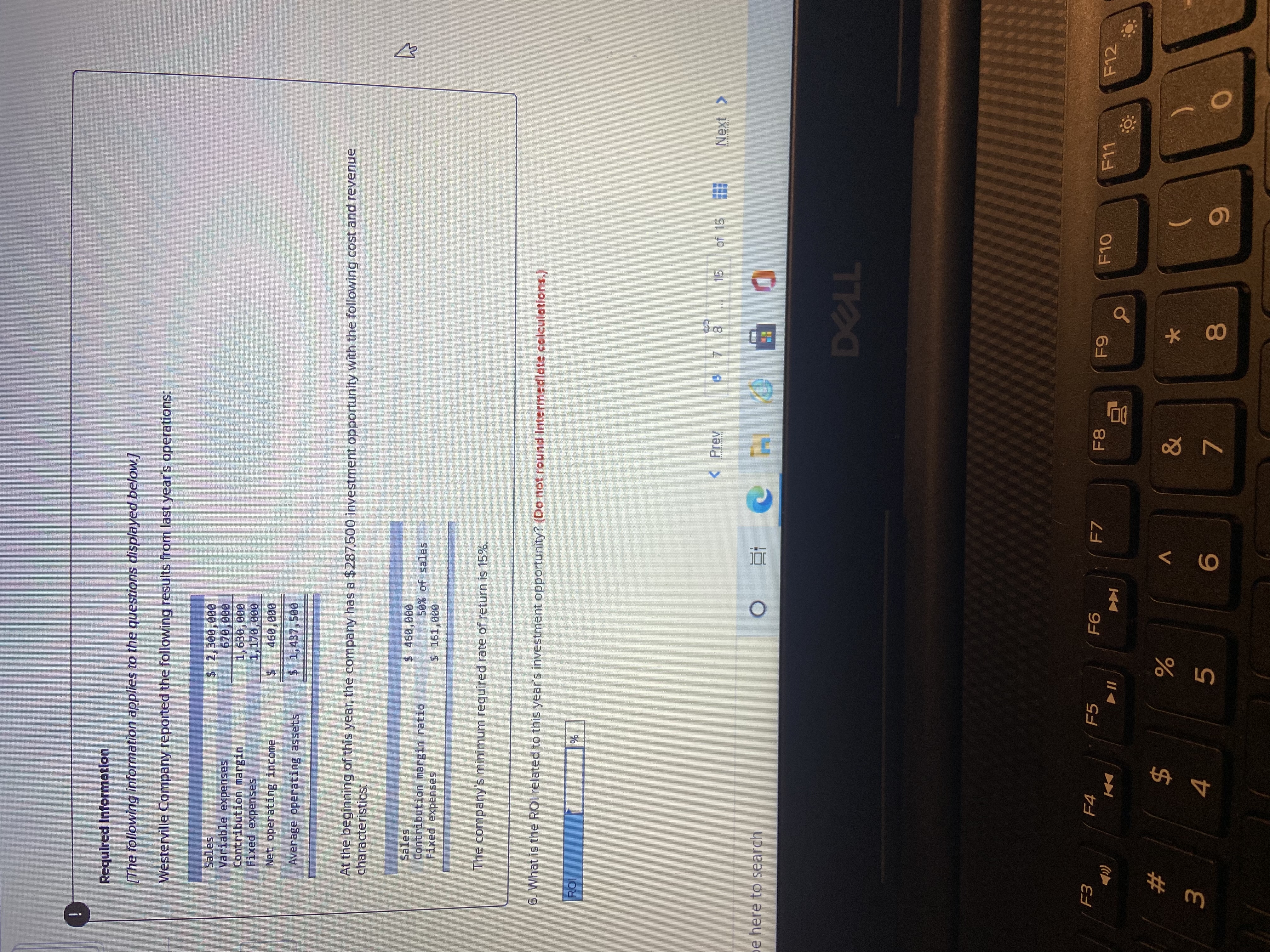

Transcribed Image Text:### Required Information

**The following information applies to the questions displayed below:**

Westerville Company reported the following results from last year’s operations:

- **Sales:** $2,300,000

- **Variable expenses:** $780,000

- **Contribution margin:** $1,520,000

- **Fixed expenses:** $1,170,000

- **Net operating income:** $350,000

- **Average operating assets:** $1,437,500

At the beginning of this year, the company has a $287,500 investment opportunity with the following cost and revenue characteristics:

- **Sales:** $460,000

- **Contribution margin ratio:** 50% of sales

- **Fixed expenses:** $161,000

The company’s minimum required rate of return is 15%.

**6. What is the ROI related to this year’s investment opportunity?** *(Do not round intermediate calculations.)*

- **ROI: ________%**

This section introduces a financial problem involving company financial metrics and calculates the Return on Investment (ROI) for potential investment.

Expert Solution

arrow_forward

Step 1

Solution

Operating income of investment opportunity = Contribution margin - fixed expenses

= 460000*50% - 161000

= $69,000

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- From the following information, compute percent change in operating income for the current year. Sales for the previous year $210,000 Contribution margin 181,000 Fixed costs 125,000 Operating income 36,000 Assume that sales for the current year increased by 17%. a.86% b.92% c.74% d.96%arrow_forwardDu Pont Analysis TRP has total receiveables of $3,000, which represents 20 days sales. Total assets are $75,000. The operating profit margin is 5%. Find the firms ROA and its assets turnover ratio.arrow_forwardSw.arrow_forward

- Calculating Residual Income East Mullett Manufacturing earned operating income last year as shown in the following income statement: Sales $3,750,000 Cost of goods sold 2,250,000 Gross margin $1,500,000 Selling and administrative expense 1,200,000 Operating income $ 300,000 Less: Income taxes (@ 40%) 120,000 Net income $ 180,000 At the beginning of the year, the value of operating assets was $1,600,000. At the end of the year, the value of operating assets was $1,400,000. East Mullett requires a minimum rate of return of 5%. What is the residual income?arrow_forwardRequired information [The following information applies to the questions displayed below.] Westerville Company reported the following results from last year's operations: Sales Variable expenses Contribution margin Fixed expenses $ 1,600,000 700,000 900,000 660,000 Net operating income $4 240,000 Average operating assets $ 1,000,000 At the beginning of this year, the company has a $325,000 investment opportunity with the characteristics: Sales Contribution margin ratio Fixed expenses $ 520,000 70 % of sales $ 312,000 The company's minimum required rate of return is 15%. 9. If the company pursues the investment opportunity and otherwise performs the same as last year, wha (Round your percentage answer to 1 decimal place (i.e., 0.1234 should be considered as 12.3%.)) ROI % ( Prev 1O Pr Ps to search RELSarrow_forwardRequired information Skip to question [The following information applies to the questions displayed below.] Westerville Company reported the following results from last year's operations: Sales $ 1,500,000 Variable expenses 730, 000 Contribution margin 770, 000 Fixed expenses 470,000 Net operating income $ 300,000 Average operating assets $ 937,500 At the beginning of this year, the company has a $362, 500 investment opportunity with the following cost and revenue characteristics: Sales $ 580,000 Contribution margin ratio 70% of sales Fixed expenses $ 319,000 The company's minimum required rate of return is 10%. 8. If the company pursues the investment opportunity and otherwise performs the same as last year, what turnover will it earn this year? (Round your answer to 2 decimal places.)arrow_forward

- Elway Company provided the following income statement for the last year: Sales $714,390,000 Less: Variable expenses 557,689,000 Contribution margin $156,701,000 Less: Fixed expenses 195,362,000 Operating income $-38,661,000 At the beginning of last year, Elway had $38,657,000 in operating assets. At the end of the year, Elway had $41,360,000 in operating assets. Required: 1. Compute average operating assets.$fill in the blank 1 2. Compute the margin (as a percent) and turnover ratios for last year. If required, round your answers to two decimal places. Margin fill in the blank 2 % Turnover fill in the blank 3 3. Compute ROI as a percent. Use the part 2 final answers in these calculations and round the final answer to two decimal places.fill in the blank 4 % 4. ROI measures a company’s ability to generate relative to its investment in assets. The greater the ROI, the efficiently the company is generating from its assets. 5. CONCEPTUAL CONNECTION Comment…arrow_forwardWesterville Company reported the following results from last year's operations: Sales Variable expenses Contribution margin Fixed expenses Net operating income Average operating assets ROI At the beginning of this year, the company has a $300,000 investment opportunity with the following cost and revenue characteristics: Sales $ 480,000 $ 336,000 The company's minimum required rate of return is 15%. $ 1,400,000 680,000 720,000 440,000 $ 280,000 $ 875,000 Contribution margin ratio Fixed expenses 9. If the company pursues the investment opportunity and otherwise performs the same as last year, what ROI will it earn this year? (Do not round intermediate calculations. Round your percentage answer to 1 decimal place (i.e., 0.1234 should be entered as 12.3).) 37.3 % 80% of salesarrow_forwardCalculating Economic Value Added Barnard Manufacturing earned operating income last year as shown in the following income statement: Sales $4,000,000 Cost of goods sold 2,100,000 Gross margin $1,900,000 Selling and administrative expense 1,100,000 Operating income $800,000 Less: Income taxes (@ 40%) 320,000 Net income $480,000 At the beginning of the year, the value of operating assets was $2,700,000. At the end of the year, the value of operating assets was $2,300,000. Total capital employed equaled $1,400,000. Barnard’s actual cost of capital is 12%. Required: Calculate the EVA for Barnard Manufacturing.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education