![**Educational Transcription:**

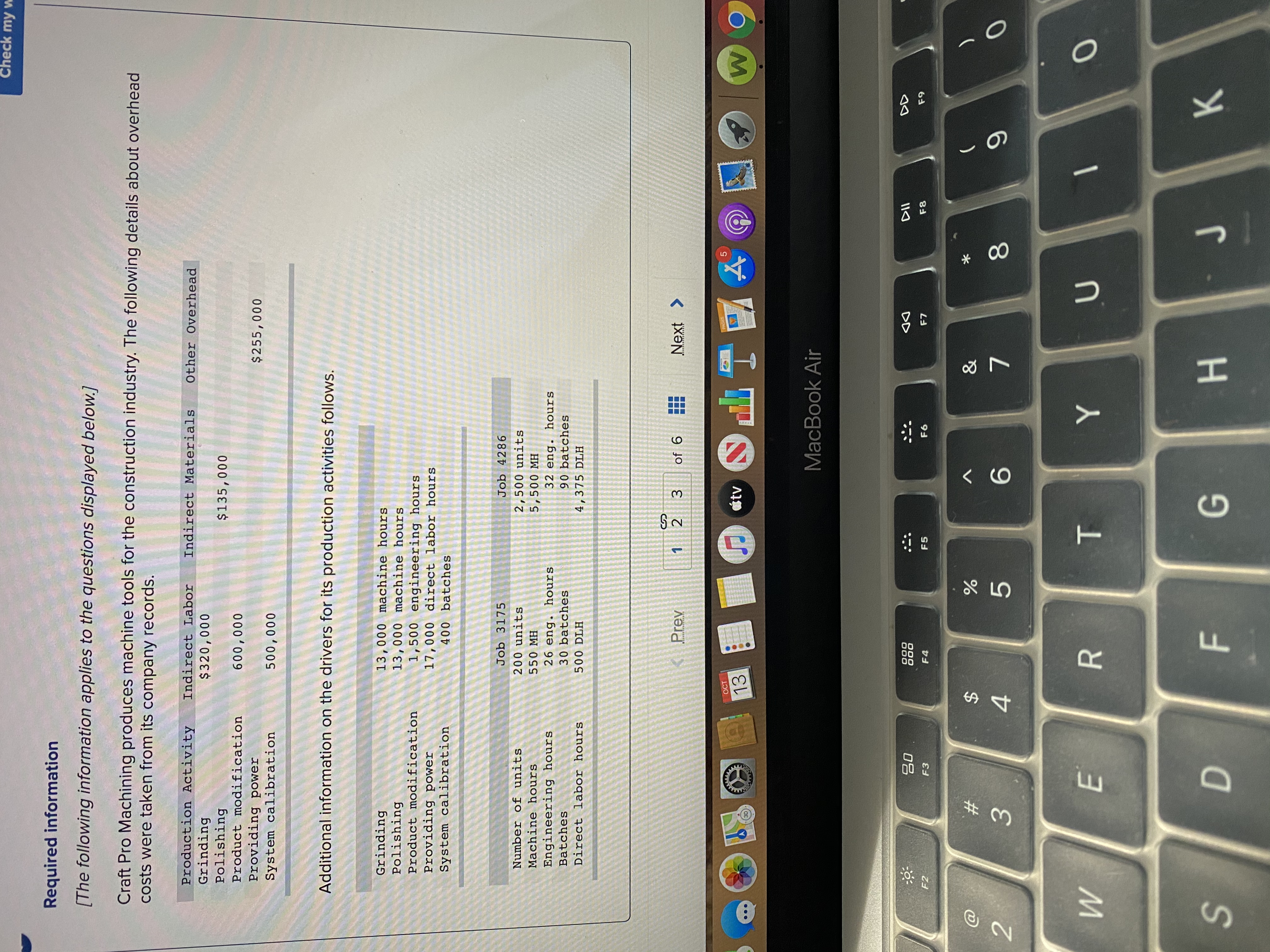

**Data Overview:**

- **Providing Power:**

- 17,000 direct labor hours

- **System Calibration:**

- 400 batches

**Job Details:**

- **Job 3175:**

- Number of units: 200 units

- Machine hours: 550 MH

- Engineering hours: 26 engineering hours

- Batches: 30 batches

- Direct labor hours: 500 DLH

- **Job 4286:**

- Number of units: 2,500 units

- Machine hours: 5,500 MH

- Engineering hours: 32 engineering hours

- Batches: 90 batches

- Direct labor hours: 4,375 DLH

**Task Requirement:**

1. **Classify each activity as unit level, batch level, product level, or facility level:**

- Grinding: [ ]

- Polishing: [ ]

- Product modification: [ ]

- Providing power: [ ]

- System calibration: [ ]

**Graph/Diagram Explanation:**

The document presents a table outlining data concerning two jobs (Job 3175 and Job 4286) with specifics on the number of units, machine hours, engineering hours, batches, and direct labor hours. Each job comprises different quantities, highlighting the scale of production and resource allocation.

Below the job data, a classification activity table lists several production-related tasks that need to be categorized by their level of impact (unit, batch, product, or facility) for business process analysis.](https://content.bartleby.com/qna-images/question/17e8d1d7-0817-4afa-b1d8-2cbedcad66ee/01888555-1224-4b54-98b7-960bab450f96/p6iymrg.jpeg)

Unit-level activity: Unit‐level activities occur every time a service is performed or a product is made. The costs of direct materials, direct labor, and machine maintenance are examples of unit‐level activities.

Product-level activity: These activities relate to specific products and must be carried out regardless of how many batches or units of product are produced or sold. For example, designing a product, advertising a product, and maintaining a product manager and staff are all product-level activities.

Batch-level activity: Batch‐level activities are costs incurred every time a group (batch) of units is produced or a series of steps are performed. Purchase orders, machine setup, and quality tests are examples of batch‐level activities.

Facility-level activities: Facility support activities are necessary for development and production to take place. These costs are administrative in nature and include building depreciation, property taxes, plant security, insurance, accounting, outside landscape and maintenance, and plant management's and support staff's salaries.

Step by stepSolved in 2 steps

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education