FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

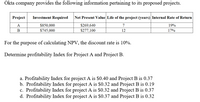

Transcribed Image Text:Okta company provides the following information pertaining to its proposed projects.

Project

Investment Required

Net Present Value Life of the project (years) Internal Rate of Return

A

$850,000

$269,640

7

19%

В

$745,000

$277,100

12

17%

For the purpose of calculating NPV, the discount rate is 10%.

Determine profitability Index for Project A and Project B.

a. Profitability Index for project A is $0.40 and Project B is 0.37

b. Profitability Index for project A is $0.32 and Project B is 0.19

c. Profitability Index for project A is $0.32 and Project B is 0.37

d. Profitability Index for project A is $0.37 and Project B is 0.32

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Question: Altro Corporation is considering the following three investment projects: Project R Project S Project T Investment required $33,000 Present value of cash inflows $33,333 Required: $40,000 $46,800 $97,000 $112,520 Rank the projects according to the profitability index, from most profitable to least profitable. (Ignore income taxes in this problem)arrow_forwardMonroe, Inc., is evaluating a project. The company uses a 13.8 percent discount rate for this project. Cost and cash flows are shown in the table. What is the NPV of the project? Year0 ($11,368,000)1 $2,112,5892 $3,787,5523 $3,300,6504 $4,115,8995. $ 4,556,424 Round to two decimal places. For year 0 , its initial investment .arrow_forwardDuo Corporation is evaluating a project with the following cash flows: Year 0 PO12345 Cash Flow -$ 29,300 11,500 14,200 16,100 13,200 -9,700 The company uses a discount rate of 11 percent and a reinvestment rate of 8 percent on all of its projects. a. Calculate the MIRR of the project using the discounting approach. (Do not round Intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. Calculate the MIRR of the project using the reinvestment approach. (Do not round Intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) c. Calculate the MIRR of the project using the combination approach. (Do not round Intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) a. Discounting approach MIRR b. Reinvestment approach MIRR c. Combination approach MIRR % % %arrow_forward

- Refer to two projects with the following cash flows: Year Project A Project B 0 -$110 -$110 1 45 55 2 45 55 3 45 55 4 45 If the opportunity cost of capital is 11%, what is the profitability index for each project?arrow_forwardMonroe, Inc., is evaluating a project. The company uses a 13.8 percent discount rate for this project. Cost and cash flows are shown in the table. What is the NPV of the project? Year Project 0 ($11,368,000) 1 $ 2,127,589 2 $ 3,787,552 3 $ 3,125,650 4 $ 4,115,899 5 $ 4,556,424 Round to two decimal places.arrow_forwardA firm evaluates all of its projects by using the NPV decision rule. Year Cash Flow 0 -$ 27,000 1 23,000 14,000 8,000 a. At a required return of 25 percent, what is the NPV for this project? 2 WN 3 NPV b. At a required return of 34 percent, what is the NPV for this project? NPVarrow_forward

- Case 1: Assume you are evaluating two mutually exclusive projects,the cash flows of which appear below, and that your company uses a cost of capital of 8 percent to evaluate projects such as these. Time Project A Cash Flow Project B Cash Flow 0 -$650 -$700 1 100 300 2 250 -200 3 250 550 4 200 200 5 100 80 a. Calculate the payback of Project A. b. Calculate the discounted payback of Project A. c. Calculate the IRR of Project A. d. Using the NPV method and assuming a cost of capital of 8 percent, which of these projects should be accepted?arrow_forwardThe Company has three potential projects from which to choose. Selected information on each of the three projects follows: Project A Project B Project C Investment required $44,400 $55,700 $53,100 Net present value of project $49,100 $74,100 $69,100 Using the profitability index, rank the projects from most profitable to least profitable. A, B, C B, A, C B, C, A C, B, Aarrow_forwardExercise 24-10 (Algo) Net present value, unequal cash flows, and profitability Index LO P3 Following is information on two alternative investment projects being conside return from its investments. (PV of $1, FV of $1. PVA of $1, and FVA of $1) Note: Use appropriate factor(s) from the tables provided. y Tiger Company. The company requires a 4% Initial investment Project X1 $ (130,000) Project X2 $ (220,000) Net cash flows in: Year 1 Year 2 Year 3 50,000 97,500 60,500 87,500 85,500 77,500 a. Compute each project's net present value. b. Compute each project's profitability index. c. If the company can choose only one project, which should it choose on the basis of profitability index? Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required A Required B Required C Compute each project's net present value. Note: Round your final answers to the nearest dollar. Net Cash Flowe Present Value of 1 at 4% Present Value of Net Cash…arrow_forward

- Carland, Incorporated, has a project available with the following cash flows. If the required return for the project is 7.9 percent, what is the project's NPV? Year Cash Flow 0 -$ 258,000 1 66, 300 2 90, 400 3 117,800 4 70,900 5-12,000 $35, 378.61 $18, 968.78 $27, 173.69 $15, 173.69 $13,276.98arrow_forwardces Duo Corporation is evaluating a project with the following cash flows: Year 0 Cash Flow -$ 29,100 -2345 1 11,300 14,000 15,900 13,000 -9,500 The company uses a discount rate of 12 percent and a reinvestment rate of 7 percent on all of its projects. a. Calculate the MIRR of the project using the discounting approach. (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. Calculate the MIRR of the project using the reinvestment approach. (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) c. Calculate the MIRR of the project using the combination approach. (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) a. Discounting approach MIRR b. Reinvestment approach MIRR % c. Combination approach MIRR %arrow_forwardThe following are the cash flows of two projects: Year 2234O 0 1 Project A $ (380) 210 210 210 210 Project B $ (380) 280 280 280 If the opportunity cost of capital is 11%, what is the profitability index for each project? Note: Do not round intermediate calculations. Round your answers to 4 decimal places. Project A B Answer is complete but not entirely correct. Profitability Index 1.7145 X 1.8006arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education