FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Accounting

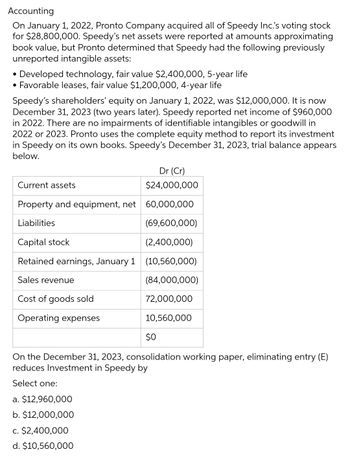

On January 1, 2022, Pronto Company acquired all of Speedy Inc.'s voting stock

for $28,800,000. Speedy's net assets were reported at amounts approximating

book value, but Pronto determined that Speedy had the following previously

unreported intangible assets:

Developed technology, fair value $2,400,000, 5-year life

• Favorable leases, fair value $1,200,000, 4-year life

●

Speedy's shareholders' equity on January 1, 2022, was $12,000,000. It is now

December 31, 2023 (two years later). Speedy reported net income of $960,000

in 2022. There are no impairments of identifiable intangibles or goodwill in

2022 or 2023. Pronto uses the complete equity method to report its investment

in Speedy on its own books. Speedy's December 31, 2023, trial balance appears

below.

Dr (Cr)

$24,000,000

Current assets

Property and equipment, net 60,000,000

Liabilities

(69,600,000)

Capital stock

(2,400,000)

Retained earnings, January 1 (10,560,000)

Sales revenue

(84,000,000)

Cost of goods sold

72,000,000

Operating expenses

10,560,000

$0

On the December 31, 2023, consolidation working paper, eliminating entry (E)

reduces Investment in Speedy by

Select one:

a. $12,960,000

b. $12,000,000

c. $2,400,000

d. $10,560,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Dengararrow_forwardDo not give answer in imagearrow_forwardIn January 1, 2011, Cullmon Company acquired an 80% interest in Toner Company for a purchase price that was $550,000 over the book value of Toner’s Stockholders’ Equity on the acquisition date. The Cullmon allocated the excess to the following [A] assets: [A] Asset Initial Fair Value Useful Life (years) Patent 300,000 10 Goodwill 250,000 Indefinite $550,000 Toner sells inventory to the Cullmon (upstream) which includes that inventory in products that it (Cullmon), ultimately, sells to customers outside of the controlled group. You have compiled the following data as of 2016 and 2017: 2016 2017 Transfer price for inventory sale $ 671,000 $ 733,000 Cost of goods sold (615,000) (653,000) Gross profit $ 56,000 $ 80,000 % inventory remaining 25% 35% Gross profit deferred $ 14,000 $ 28,000 EOY Receivable/Payable $ 90,000 $ 100,000 The inventory not…arrow_forward

- On September 1, 2017, Winans Corporation acquired Aumont Enterprises for a cash payment of $700,000, At the time of purchase, Aumont's Balance sheet showed assets of $620,000 Liabilities of $200.000 and owners equity of $420,000, The fair value of Aumonts assets is estimated to be $800 000. Compute the amount of good will acquired by Winans. O S80 000 O $100.000 O $180 000 O All of the abovearrow_forwardNonearrow_forwardSagararrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education