FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

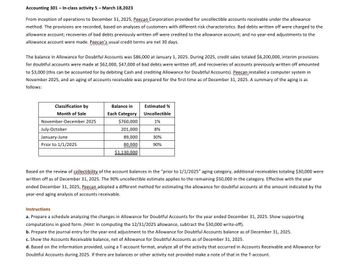

Transcribed Image Text:Accounting 301 - In-class activity 5 - March 18,2023

From inception of operations to December 31, 2025, Peecan Corporation provided for uncollectible accounts receivable under the allowance

method. The provisions are recorded, based on analyses of customers with different risk characteristics. Bad debts written off were charged to the

allowance account; recoveries of bad debts previously written off were credited to the allowance account; and no year-end adjustments to the

allowance account were made. Peecan's usual credit terms are net 30 days.

The balance in Allowance for Doubtful Accounts was $86,000 at January 1, 2025. During 2025, credit sales totaled $6,200,000, interim provisions

for doubtful accounts were made at $62,000, $47,000 of bad debts were written off, and recoveries of accounts previously written off amounted

to $3,000 (this can be accounted for by debiting Cash and crediting Allowance for Doubtful Accounts). Peecan installed a computer system in

November 2025, and an aging of accounts receivable was prepared for the first time as of December 31, 2025. A summary of the aging is as

follows:

Classification by

Month of Sale

November-December 2025

July-October

January-June

Prior to 1/1/2025

Balance in

Each Category

$760,000

201,000

89,000

80,000

$1,130,000

Estimated %

Uncollectible

1%

8%

30%

90%

Based on the review of collectibility of the account balances the "prior to 1/1/2025" aging category, additional receivables totaling $30,000 were

written off as of December 31, 2025. The 90% uncollectible estimate applies to the remaining $50,000 in the category. Effective with the year

ended December 31, 2025, Peecan adopted a different method for estimating the allowance for doubtful accounts at the amount indicated by the

year-end aging analysis of accounts receivable.

Instructions

a. Prepare a schedule analyzing the changes in Allowance for Doubtful Accounts for the year ended December 31, 2025. Show supporting

computations in good form. (Hint: In computing the 12/31/2025 allowance, subtract the $30,000 write-off).

b. Prepare the journal entry for the year-end adjustment to the Allowance for Doubtful Accounts balance as of December 31, 2025.

c. Show the Accounts Receivable balance, net of Allowance for Doubtful Accounts as of December 31, 2025.

d. Based on the information provided, using a T-account format, analyze all of the activity that occurred in Accounts Receivable and Allowance for

Doubtful Accounts during 2025. If there are balances or other activity not provided make a note of that in the T-account.

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Problem 7-4 (Bad Debt Reporting) From inception of operations to 31 December 2019, Fortner Corporation provided for uncollectible accounts receivable under the allowance method. The provisions were recorded based on analysis of customers with different risk characteristics. Bad debts written off were charged to the allowance account; recoveries of bad debts previously written off were credited to the allowance account; and no year-end adjustments to the allowance account were made. Fortner's usual credit terms are net 30 days. The balance in Allowance for Doubtful Accounts was $130,000 at 1 January 2019. During 2019, credit sales totalled $9,000,000, the provision for doubtful accounts was determined to be $180,000, $90,000 of bad debts were written off, and recoveries of accounts previously written off amounted to $15,000. Fortner installed a computer system in November 2019, and an aging of accounts receivable was prepared for the first time as of 31 December 2019. A summary of the…arrow_forward4 Indicate the classification, presentation and disclosure of Problem 8-12 (IAA) Lucid Company showed the following balances on December 31: Accounts receivable-unassigned Accounts receivable-assigned Allowance for doubtful accounts-January 1 Receivable from factor Note payable-bank 1,000,000 300,000 30,000 40,000 240,000 During the current year, the entity found itself in financial distress and decided to resort to receivable financing. On June 30, the entity factored P200,000 of accounts receivable to a finance entity. The finance entity charged a factoring fee of 5% of the accounts factored and withheld 20% of the amount factored. On December 31, the entity assigned P300,000 of accounts receivable to a bank under a nonnotification basis. The bank advanced 80% less a service fee of 5% of the accounts assigned. The entity signed a promissory note for the loan. On December 31, it is estimated that 5% of the outstanding accounts receivable may prove uncollectible. Required: the accounts…arrow_forwardExercise 7-11 (Algo) Uncollectible accounts; allowance method vs. direct write-off method (L07-5, 7-6] Johnson Company calculates its allowance for uncollectible accounts as 10% of its ending balance in gross accounts receivable. The allowance for uncollectible accounts had a credit balance of $12.000 at the beginning of 2021. No previously written-off accounts receivable were reinstated during 2021. At 12/31/2021, gross accounts receivable totaled $200,100, and prior to recording the adjusting entry to recognize bad debts expense for 2021, the allowance for uncollectible accounts had a debit balance of 22,000. Required: 1. What was the balance in gross accounts receivable as of 12/31/2020? 2. What journal entry should Johnson record to recognize bad debt expense for 2021? 3. Assume Johnson made no other adjustment of the allowance for uncollectible accounts during 2021. Determine the amount of accounts receivable written off during 2021. 4. If Johnson instead used the direct write-off…arrow_forward

- Required information Skip to question [The following information applies to the questions displayed below.] On December 31, Jarden Company's Allowance for Doubtful Accounts has an unadjusted credit balance of $14,500. Jarden prepares a schedule of its December 31 accounts receivable by age. Accounts Receivable Age of Accounts Receivable Expected Percent Uncollectible $ 820,000 Not yet due 1.25% 328,000 1 to 30 days past due 2.00 65,600 31 to 60 days past due 6.50 32,800 61 to 90 days past due 32.75 13,120 Over 90 days past due 68.00 Required:1. Compute the required balance of the Allowance for Doubtful Accounts at December 31 using an aging of accounts receivable.arrow_forwardRequired information [The following information applies to the questions displayed below.] On December 31, Jarden Company's Allowance for Doubtful Accounts has an unadjusted credit balance of $14,500. Jarden prepares a schedule of its December 31 accounts receivable by age. Accounts Receivable $ 830,000 Age of Accounts Receivable Not yet due 1 to 30 days past due Expected Percent Uncollectible 1.25% 254,000 2.00 86,000 31 to 60 days past due 6.50 38,000 12,000 61 to 90 days past due Over 90 days past due 32.75 68.00 3. On June 30 of the next year, Jarden concludes that a customer's $4,750 receivable is uncollectible and the account is written off. Does this write-off directly affect Jarden's net income? Affects Jarden's net incomearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education