FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Prepare the company’s Statement of Changes in Shareholders’ Equity for the year ended

December 31, 2021.

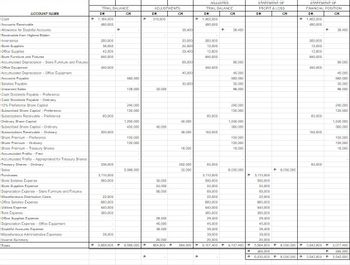

Transcribed Image Text:ACCOUNT NAME

Cash

Accounts Receivable

Allowance for Doubtful Accounts

Receivable from Highest Bidder

Inventories

Store Supplies

Office Supplies

Store Furniture and Fixtures

Accumulated Depreciation - Store Furniture and Fixtures

Office Equipment

Accumulated Depreciation - Office Equipment

Accounts Payable

Salaries Payable

Unearned Sales

Cash Dividends Payable - Preference

Cash Dividends Payable - Ordinary

12% Preference Share Capital

Subscribed Share Capital - Preference

Subscriptions Receivable - Preference

Ordinary Share Capital

Subscribed Share Capital - Ordinary

Subscriptions Receivable - Ordinary

Share Premium - Preference

Share Premium - Ordinary

Share Premium - Treasury Shares

Accumulated Profits - Free

Accumulated Profits - Appropriated for Treasury Shares

Treasury Shares - Ordinary

Sales

Purchases

Store Salaries Expense

Store Supplies Expense

Depreciation Expense - Store Furniture and Fixtures

Miscellaneous Distribution Costs

Office Salaries Expense

Utilities Expense

Rent Expense

Office Supplies Expense

Depreciation Expense - Office Equipment

Doubtful Accounts Expense

Miscellaneous Administrative Expenses

Income Summary

Totals

P

TRIAL BALANCE

DR

1,164,000

480,000

280,000

36,000

42,000

550,000

450,000

60,000

200,000

336,000

3,110,000

560,000

22,000

660,000

540,000

360,000

38,000

P

CR

582,000

128,000

240,000

120,000

1,200,000

400,000

100,000

120.000

5,990,000

D 8,888,000 P 8,888,000

P

D

P

ADJUSTMENTS

DR

318,000

32,000

40,000

30,000

24,000

88,000

29,400

45,000

38,400

20,000

664,800

CR

38,400

20,000

24,000

29,400

88,000

45,000

30,000

40,000

48,000

18,000

252,000

32,000

D 664,800

P

P

P

ADJUSTED

TRIAL BALANCE

DR

1,482,000

480,000

260,000

12,000

12,600

550,000

450,000

60,000

152,000

84,000

3,110,000

590,000

24,000

88,000

22,000

660,000

540,000

360,000

29,400

45,000

38,400

38,000

20,000

9,107,400

P

CR

38,400

88.000

45,000

582,000

30,000

96,000

240,000

120,000

1,240,000

360,000

100,000

120,000

18,000

6,030,000

D 9,107,400 P

P

。

STATEMENT OF

PROFIT & LOSS

DR

3,110,000

590,000

CR

6,030,000

P

STATEMENT OF

FINANCIAL POSITION

DR

CR

1,482,000

480,000

260,000

12,000

12,600

550,000

450,000

60,000

152,000

84,000

。

24,000

88,000

22,000

660,000

540,000

360,000

29,400

45,000

38,400

38,000

20,000

5,564,800 P 6,030,000 P 3,542,600 P

38,400

88,000

45,000

582,000

30,000

96,000

240,000

120,000

1,240,000

360,000

100,000

120,000

18,000

3,077,400

P 465.200

465,200

6,030,000 P 6,030,000 P 3,542,600 P 3,542,600

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Record the appropriation of $77000 of retained earnings on December 31, 2022, by Jack Inc. to establish an appropriation for bond retirement. Record the entry to establish appropriation.arrow_forwardMicrosoft Corporation's disclosure notes for the year ending June 30, 2020, included the following regarding its $0.00000625 par common stock: Employee Stock Purchase Plan-We have an ESPP for all eligible employees. Shares of our common stock may be purchased by employees at three-month intervals at 90% of the fair market value on the last trading day of each three-month period. Employees may purchase shares having a value not exceeding 15% of their gross compensation during an offering period. Employees purchased the following shares during the periods presented: (Shares in millions) Year Ended June 30, Shares purchased Average price per share 2020 2019 9 11 13 $142.22 $104.85 $76.40 2018 As of June 30, 2020, 96 million shares of our common stock were reserved for future issuance through the ESPP. Required: Prepare the journal entry that summarizes Microsoft's employee share purchases for the year ending June 30, 2020. Note: If no entry is required for a transaction/event, select "No…arrow_forwardThe Daily Corporation, a company whose securities are publicly traded, prepares monthly, quarterly, and annual financial statements for internal use but disseminates to external users only the annual financial statements. Agree or Disagree with the above statement?arrow_forward

- Ricci Corporation is preparing their financial statements for the year ending September 30, 2021. Ricci Corporation has two categories of stock; Preferred and Common. On September 25, 2021 Ricci Corporation declared dividends on the preferred stock which will be paid on October 18, 2021. In order to calculate EPS the staff accountant had the following information: 2021 Net Income: $4,000,000 Preferred Dividends Declared in September 25, 2021 $ 500,000 but not paid until October 18, 2021 Weighted Average Number of Common Shares Outstanding 125,000 shares The staff accountant has determined that since the preferred dividends were not paid prior to September 30, 2021 the preferred dividend should not be included in the 2021 EPS. Accounting Issue: In the calculation for EPS should Ricci Corporation include the preferred dividends not paid prior to September 30, 2021? Your Interpretation of the Guidance: Should Ricci Corporation include the preferred dividends in the calculation of EPS…arrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardHow do I do this?arrow_forward

- Recording Stock Dividends and Stock Splits The records of Dixie Corporation showed the following balances on November 1, 2020. Common stock, $10 par, 48,000 shares outstanding $480,000 Paid-in capital in excess of par 163,200 320,000 Retained earnings The fair value of its stock is $18 per share. Accounting for Stock Dividends Accounting for Stock Splits Prepare journal entries for the following three separate scenarios. a. The company declares (November 1, 2020) and issues (November 20, 2020) a 10% stock dividend. b. The company declares (November 1, 2020) and issues (November 20, 2020) a 10% stock dividend. Of the 4,800 stock dividend shares, 4,480 shares are whole shares and 320 shares are fractional shares. It is the company's policy to pay out fractional shares in cash. c. The company declares (November 1, 2020) and issues (November 20, 2020) a stock split effected in the form of a 100% stock dividend. • Note: List multiple debits (when applicable) in alphabetical order and list…arrow_forwarda) Prepare all the journal entries for the stated transactions b) Assume that the income for the year is $13,500,000. Prepare a statement of changes in shareholders' equity c) Prepare the shareholders' equity section of the balance sheet at the end of the yeararrow_forwardSHOW THE JOURNAL ENTRY OF G AND H! SHOW THE JOURNAL ENTRY OF G AND H!arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education