ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

can you let me know if these are correct? if its wrong please let me know the correct answer thanks

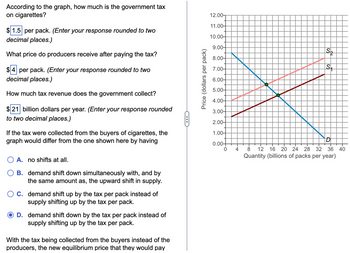

Transcribed Image Text:According to the graph, how much is the government tax

on cigarettes?

1.5 per pack. (Enter your response rounded to two

decimal places.)

What price do producers receive after paying the tax?

$4

per pack. (Enter your response rounded to two

decimal places.)

How much tax revenue does the government collect?

$ 21 billion dollars per year. (Enter your response rounded

to two decimal places.)

If the tax were collected from the buyers of cigarettes, the

graph would differ from the one shown here by having

A. no shifts at all.

B. demand shift down simultaneously with, and by

the same amount as, the upward shift in supply.

O C. demand shift up by the tax per pack instead of

supply shifting up by the tax per pack.

D. demand shift down by the tax per pack instead of

supply shifting up by the tax per pack.

With the tax being collected from the buyers instead of the

producers, the new equilibrium price that they would pay

Price (dollars per pack)

12.00

11.00-

10.00-

9.00-

8.00-

7.00-

6.00-

5.00-

4.00+

3.00-

2.00-

1.00-

0.00-

0

4

S₂

S₁

D

8 12 16 20 24 28 32 36 40

Quantity (billions of packs per year)

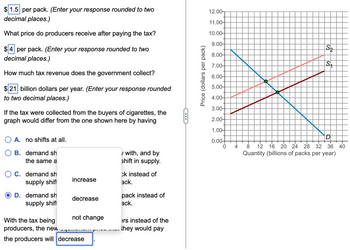

Transcribed Image Text:$1.5 per pack. (Enter your response rounded to two

decimal places.)

What price do producers receive after paying the tax?

$4 per pack. (Enter your response rounded to two

decimal places.)

How much tax revenue does the government collect?

$ 21 billion dollars per year. (Enter your response rounded

to two decimal places.)

If the tax were collected from the buyers of cigarettes, the

graph would differ from the one shown here by having

A. no shifts at all.

B. demand sh

the same a

C. demand sh

supply shift

D. demand sh

supply shift

increase

decrease

not change

With the tax being

producers, the new

the producers will decrease

/ with, and by

shift in supply.

ck instead of

ack.

pack instead of

ack.

ers instead of the

they would pay

Price (dollars per pack)

12.00-

11.00-

10.00-

9.00-

8.00-

7.00-

6.00-

5.00-

4.00-

3.00-

2.00-

1.00-

0.00+

0

S₂

S₁

D

4 8 12 16 20 24 28 32 36 40

Quantity (billions of packs per year)

Expert Solution

arrow_forward

Step 1: Introduction

The production of goods in the economy is associated with costs and benefits to society. If the consumption of any good affects the health of a consumer then the market for such goods should bear some extra costs. Such costs are imposed by the government in the form of tax on the market.

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 10 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Fill in the table below, giving a numerical value for letters A, B, C, and D. TC AFC AVC 50 1 90 A B D 30 2.arrow_forwardHigh quality information gruarantees that every decisions made will be a successful one that benefits the organizationarrow_forwardI cannot read the hand writing can someone tyoe this out for mr please ?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education