ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

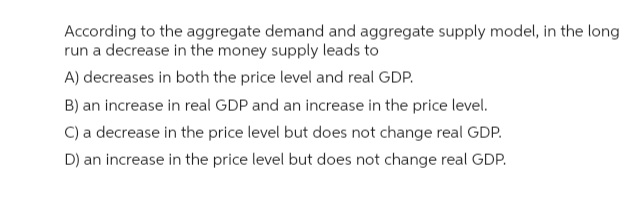

Transcribed Image Text:According to the aggregate demand and aggregate supply model, in the long

run a decrease in the money supply leads to

A) decreases in both the price level and real GDP.

B) an increase in real GDP and an increase in the price level.

C) a decrease in the price level but does not change real GDP.

D) an increase in the price level but does not change real GDP.

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- There are the three reasons why aggregate demand is downward slope: real wealth effect, interest rate effect, exchange rate effect. In a case scenario the market saw an increase in consumer spending when there is a boom in economy. Or the economic crisis makes the public bit shy to buy or consume any product. In the above two situations: the transfer payment does not make the part of government spending as the public will spend the money given as self-security and unemployment. Export situation gets worse as the foreigners are reluctant to buy expensive goods and the government will make some imports. The borrowing has become easy and loans are issued at a cheaper rate to buy car. Following the equation: Y = C + I + G + NX will the below examples increase or decrease the aggregate demand in Pakistan? What will be the shift in position for below situations? Widespread fear of recession The appreciation in the Pakistani Rupee rate A boom in the stock market An increase in transfer…arrow_forwardThis graph shows an increase in aggregate supply in a hypothetical economy where the currency is the dollar. Specifically, the short-run aggregate supply curve (SRAS) shifts to the right from SRAS1 to SRAS2, causing the quantity of output supplied at a price level of 125 to rise from $250 billion to $350 billion.arrow_forwardAccording to the aggregate demand and aggregate supply model, in the long run a decrease in the money supply leads to A) decreases in both the price level and real GDP. B) an increase in real GDP and an increase in the price level. C) a decrease in the price level but does not change real GDP. D) an increase in the price level but does not change real GDP.arrow_forward

- Concerning the Great Depression; the stock market crash of 1929, collapse of the banking system, and collapse of the money supply all were factors that could be modeled as a leftward shift of SRAS a rightward shift of SRAS a leftward shift of AD a rightward shift of ADarrow_forwardAccording to the aggregate demand and aggregate supply model, in the long run a decrease in the money supply leads to A) decreases in both the price level and real GDP. B) an increase in real GDP and an increase in the price level. C) a decrease in the price level but does not change real GDP. D) an increase in the price level but does not change real GDP.arrow_forwardDescribe the potential impact of increasing interest rates on the components of aggregate demand. Explain the potential impact, if any, on aggregate supply. Examine the impact on real GDP and the average price level of an increase in the interest rates.arrow_forward

- Assume a country’s economy is currently in recession. Draw a correctly labeled graph of the long-run aggregate supply, short-run aggregate supply, and aggregate demand curves, and show each of the following. Current real output, labeled Y1, and current price level, labeled PL1 Full employment output, labeled Yf Identify one action the central bank can take to help the economy recover from the recession. Draw a correctly labeled graph of the money market, and show the impact of the central bank’s action identified in part (b) on the nominal interest rate. On your graph for part (a), show the effect of the central bank’s action identified in part (b) on real output and the price level. Assume there is an increase in business confidence as a result of the central bank’s action. What will happen to the demand for capital goods? Draw a correctly labeled graph of the loanable funds market, and show the effect of the change identified in part (e)(i) on the real interest…arrow_forwardHow will an increase in aggregate demand most likely affect the economy in the long run? Because output is above full-employment level of output, unemployment is below the natural rate of unemployment. The nominal wage will be pushed upward thus increasing the cost of production and aggregate supply decreases. Real GDP returns to full employment and the price level decrease. Because output is below full-employment level of output, unemployment is above the natural rate of unemployment. The nominal wage will be pushed downwards thus reducing the cost of production and aggregate supply increases. Real GDP returns to full employment and the price level increase. Because output is above full-employment level of output, unemployment is below the natural rate of unemployment. The nominal wage will be pushed upward thus increasing the cost of production and aggregate supply decreases. Real GDP returns to full employment and the price level increases Because output is above full-employment…arrow_forwardSuppose the economy is in a situation of moderate unemployment, and then an exogenous increase of aggregate demand occurs. (Assume the aggregate demand schedule follows the pattern set out by the mainstream story.) Use short run aggregate supply and aggregate demand analysis to discuss in detail the effects of this demand change on the price level and real GDP in the short run. Explain how the situation could change in the long run after the happenings in the first part.arrow_forward

- Please let me know if my answer is correct. I am between C and D. If you can please also let me know why the other choices aren't correctarrow_forwardWithin the classical form of the quantity theory, the demand for money is given by Md = kPY. Suppose income (Y) is given at 400 units, and the money supply (M) is fixed at 200 units. Suppose k drops from its initial value of 0.5 to 0.25. What is the initial price level? What is the new price level after the change in k? Explain the process that leads to the change in the aggregate price level.arrow_forwardIf the central bank sells government securities from the private sector-money markets other things being equal, what would the effect be on the following? a)Aggregate demand b) Aggregate supply c)economic activity d)Inflation e)Unemploymentarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education