ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Only need help with the shadow price for the capacity constraint

Transcribed Image Text:### Optimizing Beer Stock for Super Bowl Sunday

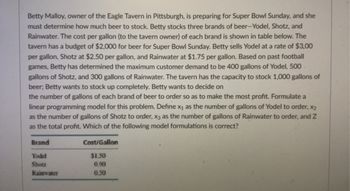

Betty Malloy, owner of the Eagle Tavern in Pittsburgh, is preparing for Super Bowl Sunday and must determine how much beer to stock. Betty stocks three brands of beer: Yodel, Shotz, and Rainwater. The cost per gallon (to the tavern owner) of each brand is shown in the table below. The tavern has a budget of $2,000 for beer for Super Bowl Sunday. Betty sells Yodel at a rate of $3.00 per gallon, Shotz at $2.50 per gallon, and Rainwater at $1.75 per gallon. Based on past football games, Betty has determined the maximum customer demand to be 400 gallons of Yodel, 500 gallons of Shotz, and 300 gallons of Rainwater. The tavern has the capacity to stock 1,000 gallons of beer. Betty wants to stock up completely.

Betty wants to decide on the number of gallons of each brand of beer to order so as to make the most profit. Formulate a linear programming model for this problem. Define \( x_1 \) as the number of gallons of Yodel to order, \( x_2 \) as the number of gallons of Shotz to order, \( x_3 \) as the number of gallons of Rainwater to order, and \( Z \) as the total profit. Which of the following model formulations is correct?

#### Cost Table

| Brand | Cost/Gallon |

|-----------|-------------|

| Yodel | $1.50 |

| Shotz | $0.90 |

| Rainwater | $0.50 |

### Problem Formulation

**Objective:** Maximize total profit \( Z \).

**Decision Variables:**

- \( x_1 \): Gallons of Yodel to order

- \( x_2 \): Gallons of Shotz to order

- \( x_3 \): Gallons of Rainwater to order

**Constraints:**

1. Budget constraint: \( 1.50x_1 + 0.90x_2 + 0.50x_3 \leq 2000 \)

2. Capacity constraint: \( x_1 + x_2 + x_3 \leq 1000 \)

3. Demand constraints:

- \( x_1 \leq 400 \) (for Yodel)

![### Question on Sensitivity Analysis

**Question:**

According to Excel’s sensitivity report for the previously formulated model (Eagle Tavern), the shadow price for the capacity constraint is:

- [ ] 0

- [ ] 1.25

- [ ] 1.5

- [ ] 1.6

**Explanation:**

This question assesses the understanding of sensitivity analysis, specifically the concept of shadow prices in linear programming models. The shadow price indicates the change in the objective function's value given a one-unit increase in the right-hand side of a constraint. Here, students need to identify the shadow price for the capacity constraint based on Excel's sensitivity report for the Eagle Tavern model.](https://content.bartleby.com/qna-images/question/0506d55b-bb84-43f9-9218-6fc41e3ed9b6/d85b00a0-3dad-4568-b6de-8709d20df620/4y9mh5c_thumbnail.jpeg)

Transcribed Image Text:### Question on Sensitivity Analysis

**Question:**

According to Excel’s sensitivity report for the previously formulated model (Eagle Tavern), the shadow price for the capacity constraint is:

- [ ] 0

- [ ] 1.25

- [ ] 1.5

- [ ] 1.6

**Explanation:**

This question assesses the understanding of sensitivity analysis, specifically the concept of shadow prices in linear programming models. The shadow price indicates the change in the objective function's value given a one-unit increase in the right-hand side of a constraint. Here, students need to identify the shadow price for the capacity constraint based on Excel's sensitivity report for the Eagle Tavern model.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- help please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardPlease help; I'm confused on this one. I got d as my answer, but I feel the correct answer should be (C), an increase in supply since the marginal cost is being increased due to work safety regulations.arrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forward

- help please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardSaved From 2010 to 2012, Johnny Deer exclusively grew com. Under the Food, Conservation, and Energy Act of 2008, Deer Multiple Choice was allowed to grow whatever crop he wanted in the next year, but would only receive direct payments from the federal government if the price of com fell below a targeted price had to grow something other than com the next year to qualify for direct payments from the federal government. was required to grow.com in the next year in order to receive direct payments from the federal government was eligible to receive countercyclical payments of the price of com fell below a targeted price, even though he did not grow corn in the next yeararrow_forwardNonearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education