FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:=

ACC 104 Exam 2 Part Two version 1(2) (2) Compatibility... ✓

Search

Layout References Mailings Review

View Help

A A Aa Po

AA

Б

Normal

Heading 1

Heading 2

V

V

T

Paragraph

Styles

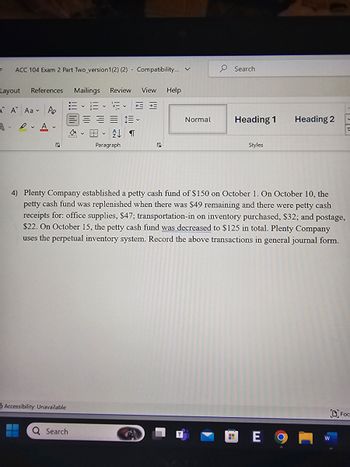

4) Plenty Company established a petty cash fund of $150 on October 1. On October 10, the

petty cash fund was replenished when there was $49 remaining and there were petty cash

receipts for: office supplies, $47; transportation-in on inventory purchased, $32; and postage,

$22. On October 15, the petty cash fund was decreased to $125 in total. Plenty Company

uses the perpetual inventory system. Record the above transactions in general journal form.

Accessibility: Unavailable

Q Search

E 9

W

DFOC

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Question 5 of 6 View Policies Date Receipt No. 3/5 7 Current Attempt in Progress Sheridan Company uses an imprest petty cash system. The fund was established on March 1 with a balance of $105. During March, the following petty cash receipts were found in the petty cash box. 9 11 14 1 2 3 4 For Stamps Freight-Out Miscellaneous Expense Travel Expense Miscellaneous Expense Amount $32 13 14 31 -/12 7 : The fund was replenished on March 15 when the fund contained $5 in cash. On March 20, the amount in the fund was increased to $200.arrow_forwardRequired information Problem 6-24A (Algo) Petty cash fund LO 6-4 [The following information applies to the questions displayed below.) Austin Company established a petty cash fund by issuing a check for $286 and appointing Steve Mack as petty cash custodian. Mack had vouchers for the following petty cash payments during the month. Stamps Miscellaneous items Employee supper money Taxi fare Window-washing service $50 24 65 45 81 There was $20 of currency in the petty cash box at the time it was replenished. The four distinct accounting events affecting the petty cash fund for the period were (1) establishment of the fund, (2) reimbursements made to employees, (3) recognition of expenses, and (4) replenishment of the fund. Assume the company uses a traditional approach to petty cash expense recognition and replenishment.arrow_forwardA. Started a petty cash fund in the amount of $250.B. Replenished petty cash fund using the following expenses: Auto Expense $72, Office Expense $82, Postage Expense $90, Miscellaneous Expense $6. Cash on hand is $10.C. Increased petty cash by $100. Record these transactions. If an amount box does not require an entry, leave it blank. A. Petty Cash Petty Cash Cash Cash B. Auto Expense Auto Expense Office Expense Office Expense Postage Expense Postage Expense Miscellaneous Expense Miscellaneous Expense Cash Over and Short Cash Over and Short Cash Cash C. Petty Cash Petty Cash Cash Casharrow_forward

- A $220 petty cash fund has cash of $10 and receipts of $206. The journal entry to replenish the account would include a credit to a.Cash Short and Over for $4. b.Petty Cash for $216. c.Cash for $210. d.Cash for $10.arrow_forwardProblem 9.1A (Static) Journalizing cash receipts, cash short or over, and posting to the general ledger. LO 9-1 Candy’s Cupcakes, a retail business, started business on June 25, 20X1. It keeps a $300 change fund in its cash register. The cash receipts for the period from June 25 to June 30, 20X1, are below. DATE TRANSACTIONS June 25 Cash sales per the cash register tape, $1,238. Cash count, $1,529. 26 Cash sales per the cash register tape, $1,346. Cash count, $1,640. 27 Cash sales per the cash register tape, $1,359. Cash count, $1,661. 28 Cash sales per the cash register tape, $1,288. Cash count, $1,582. 29 Cash sales per the cash register tape, $1,135. Cash count, $1,439. 30 Cash sales per the cash register tape, $1,374. Cash count, $1,668. Required: Record the cash receipts from June 25 to June 30, 20X1, in a general journal. Post the amounts for Cash Short or Over in the journal entries to the general ledger.…arrow_forwardI need help with A, B and C pleasearrow_forward

- Exercise 6-10 (Algo) Petty cash fund accounting LO P2 Palmona Company establishes a $160 petty cash fund on January 1. On January 8, the fund shows $71 in cash along with receipts for the following expenditures: postage, $36; transportation-in, $13; delivery expenses, $15; and miscellaneous expenses, $25. Palmona uses the perpetual system in accounting for merchandise inventory. 1. Prepare the entry to establish the fund on January 1. 2. Prepare the entry to reimburse the fund on January 8 under two separate situations: a. To reimburse the fund. b. To reimburse the fund and increase it to $210. Hint. Make two entries.arrow_forwardunc.1 At end of the day, the cash register's record shows $180, but the count of cash in the cash register is $177. The correct entry to record the cash sales for the day is: A. Dr Cash 177Dr Cash over and short 3Cr Sales 180 B. Dr Cash 180Cr Cash over and short 3Cr Sales 177 C. Dr Cash 177 Cr Sales 177 D. Dr Cash 180 Cr Sales 180arrow_forwardA $210 petty cash fund has cash of $40 and receipts of $167. The journal entry to replenish the account would include a credit to a.Cash for $170. b.Cash for $40. c.Cash Short and Over for $3. d.Petty Cash for $207.arrow_forward

- Please help solve itarrow_forwardEntry for Cash Sales; Cash Short The actual cash received from cash sales was $35,699, and the amount indicated by the cash register total was $35,731. Journalize the entry to record the cash receipts and cash sales. If an amount box does not require an entry, leave it blank. Cash fill in the blank 2 fill in the blank 3 Cash Short and Over fill in the blank 5 fill in the blank 6 Sales fill in the blank 8 fill in the blank 9arrow_forwardWhat is the journal entry to replenish the petty cash fund if expenses were Auto Expenses $75, Office Expenses $25, Postage $11. and cash on hand is $389. The Petty Cash fund started with $500. Edit View Insert Format Tools Table |BIUAv eu Ti v|: 12pt v Paragraph v hp 16 fa 19 ho 144 IOI 4 00arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education