FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Please do not give solution in image format thanku

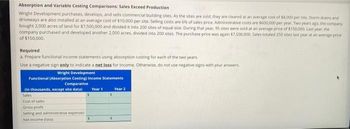

Transcribed Image Text:Absorption and Variable Costing Comparisons: Sales Exceed Production

Wright Development purchases, develops, and sells commercial building sites. As the sites are sold, they are cleared at an average cost of $8,000 per site. Storm drains and

driveways are also installed at an average cost of $10,000 per site. Selling costs are 6% of sales price. Administrative costs are $600,000 per year. Two years ago, the company

bought 2,000 acres of land for $7,500,000 and divided it into 200 sites of equal size. During that year. 95 sites were sold at an average price of $150,000. Last year, the

company purchased and developed another 2,000 acres, divided into 200 sites. The purchase price was again $7,500,000. Sales totaled 250 sites last year at an average price

of $150,000.

Required

a. Prepare functional income statements using absorption costing for each of the two years.

Use a negative sign only to indicate a net loss for income. Otherwise, do not use negative signs with your answers.

Wright Development

Functional (Absorption Costing) Income Statements

Comparative

(in thousands, except site data)

Sales

Cost of sales

Gross profit

Selling and administrative expenses

Net income doss)

5

Year 1

$

Year 2

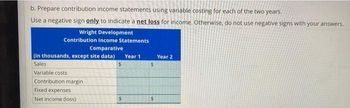

Transcribed Image Text:b. Prepare contribution income statements using variable costing for each of the two years.

Use a negative sign only to indicate a net loss for income. Otherwise, do not use negative signs with your answers.

Wright Development

Contribution Income Statements

Comparative

(in thousands, except site data)

Sales

Variable costs

Contribution margin

Fixed expenses

Net income (loss)

$

$

Year 1

$

Year 2

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- How is the access control list approach different from RBAC?arrow_forwardWhich of the following QBO features can be used to save a transaction that will be re-used in the future? Multiple Choice Saved transactions (+) New icon Recurring transactions None of the choices is correct.arrow_forwardPlease help me,arrow_forward

- Please don't use chat gpt and other ai other wise I give multiplie downvote Which of the following is sometimes called a currently attainable standard? O a. par b. normal standard O c. theoretical standard d. ideal standardarrow_forwardDoes a user view always require multiple tables to support it? Explain.arrow_forwardHow do you access the Power Query interface?arrow_forward

- Write me a human paragraph without using Al about what a memorandoms of understanding is and how it is usedarrow_forwardThe easiest way to change the order in a chart is in the __________. Multiple Choice underlying spreadsheet slicer chart options chart itselfarrow_forwardInformation that is reported free from error ________.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education