FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

question 4

attached

ss

below

42toi4jt2oi4

2

ijt24io2g

4

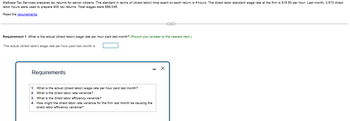

Transcribed Image Text:Malbasa Tax Services prepares tax returns for senior citizens. The standard in terms of (direct labor) time spent on each return is 4 hours. The direct labor standard wage rate at the firm is $16.50 per hour. Last month, 3,570 direct

labor hours were used to prepare 900 tax returns. Total wages were $66,045.

Read the requirements.

Requirement 1. What is the actual (direct labor) wage rate per hour paid last month? (Round your answer to the nearest cent.)

The actual (direct labor) wage rate per hour paid last month is

Requirements

1. What is the actual (direct labor) wage rate per hour paid last month?

2. What is the direct labor rate variance?

3. What is the direct labor efficiency variance?

4. How might the direct labor rate variance for the firm last month be causing

direct labor efficiency variance?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Question 7 Answer saved Points out of 1.0 P Flag question The MID function in Excel requires how many arguments? Select one: O a. 5 O b. 4 O c. 2 d. 3 Clear my choicearrow_forwardJ 7 Choose from list of answer choices and show/explain work.arrow_forwardUTF 8 Ch x Book 4 xisx Bb Signature E UTF-8Lece Connect p.mheducation.com/ext/map/indexhtml?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fperustatecollege.blackboard.com%252Fwebapps%252Fportal%2= Question 2 B Chapter 7E x 8 BUS 214 14 x Ques Chapters 7-9) 6 Saved Help Brian May, quitarist for Queen, does not know how to price his signature Antique Cherry Special that cost him £290 to make, He knows he wants 80% markup on cost. What price should Brian May ask for the guitar? Price aw -> %23 %24 4. 5 6. 2. 3. t y. e r karrow_forward

- Accounting Questionarrow_forwardQuestion list O Question 1 O Question 2 O Question 3 O Question 4 More Info N 1 2 3 4 5 6 7 8 9 10 To Find F Given P FIP 1.1200 1.2544 1.4049 1.5735 1.7623 1.9738 2.2107 2.4760 2.7731 3.1058 K 0.8929 0,7972 0.7118 0.6355 0.5674 0.5066 0.4523 0.4039 Most likely estimates for a project are as follows. 0.3606 0.3220 To Find P Given F PIF Choose the correct choice below. Determine whether the statement "This project (based upon the most likely estimates) is profitable." is true or false. ✔Click the icon to view the relationship between the PW and the percent change in parameter. Click the icon to view the interest and annuity table for discrete compounding when the MARR is 12% per year False O True To Find F Given A FIA 1.0000 2.1200 3.3744 4.7793 6.3528 8.1152 10.0890 12.2997 14.7757 17.5487 To Find P Given A PIA 0.8929 1.6901 2.4018 3.0373 3.6048 4.1114 4.5638 4.9676 5.3282 5.6502 To Find A Given F AIF 1.0000 04717 0.2963 0.2092 0.1574 0.1232 0.0991 0.0813 0.0877 0.0570 To Find A Given P…arrow_forwardred Question 11 4) Listen Use the graphs below to categorize the statements to describe either Graph A or Graph B. 3 Graph A Graph B 0 #12 " 3/2 2x 0 */2 3/2 2 -1 T graph a graph b Add an answer item! Add an answer item! Answer Bank amplitude = 1 midline is y=3 f(x)= cos(x)+3 amplitude =3 f(x)=3sin(x)+1 midline is y=1 All Changearrow_forward

- M Question 1-QUIZ- CH 17-C X Chapter 5: Customers and Sal x + o.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.tulsacc.edu%2... H17 2 S Saved Exercise 17-42 (Algo) Taguchi Quality Loss Function (QLF) Analysis [LO 17-4] Flextronchip, an OEM manufacturer, has a fifth-generation chip for cell phones, with chip specification of 0.2 ± 0.0002 mm for the distance between two adjacent pins. The loss due to a defective chip has been estimated as $20. Required: 1. Compute the value of k, the cost coefficient in the Taguchi quality loss function (QLF), L(x) = (x-7)². 2. Assume that the quality control manager takes a sample of 100 chips from the production process. The results are as follows: Measurement Frequency 3 0.1996 0.1997 5 0.1998 15 0.1999 14 0.2000 35 0.2001 14 0.2002 6 0.2003 5 0.2004 3 a. & b. Use the appropriate Taguchi quality loss function, L(x), to calculate the estimated quality loss for each of the observed measurements.…arrow_forward2 pleasearrow_forwardQuickLaun X 1 Session 6 L Dashboard x 6 Question G What is th X b Login | bar x M (Alert] Suc x -> A ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Flms. unch Meeting - Z. M MKT 100 (Section 2. H QuickLaunchSSO : Chapter 11 Homework Saved Help Consider the following information: Rate of Probability of State Return nts State of if State Occurs Economy Recession Normal Boom of Economy 23 -10 eBook 46 12 31 31 Print Ferences Calculate the expected return. (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Expected return % Warrow_forward

- Bookmarks People Tab Window Help 192.168.1.229 60 83% Wed 12:20 PM Chapter 10 Homework (Applice X CengageNOWv2 | Online teach x lim/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false ☆ 青N Login Common A... A Common Black Co... *No Fear Shakespe... b Hamlet, Prince of... E 12th Grade PVA H.. O Paraphrasing Tool.. eBook Labor Variances. Verde Company produces wheels for bicycles. During the year, 656,000 wheels were produced. The actual labor used was 364,000 hours at $9.20 per hour. Verde has the following labor standards: 1) $10.40 per hour; 2) 0.48 hour per wheel. Required: 1. Compute the labor rate variance. 2. Compute the labor efficiency variance. Previous Next Check My Workarrow_forwardent II - Chapter 5 Saved Help Save & E 13 1.46853 0.68095 14 1.51259 0.66112 15 1.55797 0.64186 16 1.60471 0.62317 15.6178 10.63496 16.0863 10.95400 17.0863 11.29607 18.5989 11.93794 17.5989 11.63496 19.1569 12.29607 20.1569 12.56110 20.7616 12.93794 Monica wants to sell her share of an investment to Barney for $140,000 in 4 years. If money is wOrth 6% compounded semiannually, what would Monica accept today? Multiple Choice 110,517 $ 109.263 ( Prev 7 of 15 Next>arrow_forwardBb UTF-8 Ch Book 4 xisx X Bb Signature E X E UTF-8'Lecs x Connect a ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fperustatecollege.blackboard.com%252Fwebapps%252Fporta O Question 2 O Chapter 7 EX 8 BUS 214 14 x iz 3 (Chapters 7-9) A Saved A local Barnes and Noble paid a $79.88 net price for each hardbound atlas. The publisher offered a 10% trade discount, What was the publisher's list price? (Round your answer to the nearest cent.) List price Mc Graw Hill 5 of 15 E DII @ 23 %24 8. 7. 3. e r a : ||- | m Cc 00 Aarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education