FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Question a

Transcribed Image Text:ABC plc, a group operating retail stores, is compiling its budget statements for the

next year. In this exercise revenues and costs at each store A, B and C are predicted.

Additionally, all central costs of warehousing and a head office are allocated across

the three stores in order to arrive at a total cost and net profit of each store operation.

In earlier years the central costs were allocated in total based on the total sales

value of each store. But as a result of dissatisfaction expressed by some store man-

agers alternative methods are to be evaluated.

The predicted results before any re-allocation of central costs are as follows:

A

В

(£000)

(£000)

(000)

Sales

Costs of sales

Gross margin

Local operating expenses

Variable

5000

4000

3000

2800

2300

1700

1900

2200

1100

660

730

310

600

370

Fixed

700

500

Operating profit

840

290

The central costs which are to be allocated are:

(£000)

Warehouse costs:

Depreciation

Storage

Operating and despatch

Delivery

Head office:

Salaries

100

80

120

300

200

Advertising

Establishment

80

120

Total

1000

The management accountant has carried out discussions with staff at all locations

in order to identify more suitable 'cost drivers' of some of the central costs. So far

the following has been revealed.

A

В

Number of despatches

Total delivery distances (thousand miles)

Storage space occupied (%)

550

450

520

70

50

90

40

30

30

1.

An analysis of senior management time revealed that 10% of their time was

devoted to warehouse issues with the remainder shared equally between the

three stores.

2. It was agreed that the only basis on which to allocate the advertising costs was

sales revenue.

3. Establishment costs were mainly occupancy costs of senior management.

This analysis has been carried out against a background of developments in the com-

pany, for example, automated warehousing and greater integration with suppliers.

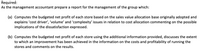

Transcribed Image Text:Required:

As the management accountant prepare a report for the management of the group which:

(a) Computes the budgeted net profit of each store based on the sales value allocation base originally adopted and

explains 'cost driver', 'volume' and 'complexity' issues in relation to cost allocation commenting on the possible

implications of the dissatisfaction expressed.

(b) Computes the budgeted net profit of each store using the additional information provided, discusses the extent

to which an improvement has been achieved in the information on the costs and profitability of running the

stores and comments on the results.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education