Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Fast pls solve this question correctly in 5 min pls I will give u like for sure

Svtrik

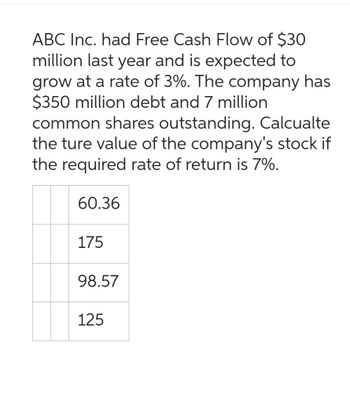

Transcribed Image Text:ABC Inc. had Free Cash Flow of $30

million last year and is expected to

grow at a rate of 3%. The company has

$350 million debt and 7 million

common shares outstanding. Calcualte

the ture value of the company's stock if

the required rate of return is 7%.

60.36

175

98.57

125

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Microsoft W X Risk Analy & X 1 (1) WhatsAp x ← → CO To get future Google Chrome updates, you'll need Windows 10 or later. This computer is using Windows 7. Microsoft Word - MGMT 2023_U8_Version1_new.docx e WACC-CheatSheet....pdf Assessing P X < Instant + A X ► ● Weighted x 2022.tle.courses.open.uwi.edu/pluginfile.php/108157/mod_resource/content/3/MGMT%202023%20_U8_Version1_new.pdf 6 / 11 100% + ▶ Cost of Debt, preferred stock and common equity Having read the recommended pages, please attempt the following problems and post your response to the discussion forum for review by your tutor and peers. Video Tutor X 1. Rick and Stacy Stark, a married couple, are interested in purchasing their first boat. They have decided to borrow the boat's purchase price of $100,000. The family is in the 28% federal income tax bracket. There are two choices for the Stark family: They can borrow the money from the boat dealer at an annual interest rate of 8%, or they could take out a $100,000 second…arrow_forwardHi I need help finding the monthly payment I think I have the right formula but dont know how to solve itarrow_forward22 https://my.pc ← → с 10 Mc Graw Hill 68°F Sunny x Final Examination i Consider the X Solutions and x Daube Indust X b Home | bartle x ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launch Url=https%253A%252F%252Fpost.blackboard.com%252Fwebapps%252F... Q Question 10- X Daube Industries' operations for the month of October are summarized as follows: A. Provided $5,400 of services in October on account. B. Received $3,000 cash from customers for services provided in October. C. Received $1,600 cash for services to be provided in November. D. Received $5,200 cash from customers on account for services provided in September. E. Paid September's warehouse rental bill on account in the amount of $1,300. F. Received October's warehouse rental bill of $1,100; set it aside to be paid at a later date. Required: a. Prepare journal entries to record the transactions identified among activities (A) through (F). b. Calculate the Net Income. Complete this question by entering…arrow_forward

- AutoSave OFF Home Insert X Paste E36 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 A Ready D 2 - C Draw Page Layout Calibri (Body) V 11 B I U A. V V B UDENCRUIVIIVIIL & FRITCITOU. CONSOLIDATED BALANCE SHEETS Formulas V fx (In millions, except par value amounts) ASSETS CURRENT ASSETS: Cash and Equivalents Marketable Securities Receivables Inventories Other Current Assets TOTAL CURRENT ASSETS PROPERTY AND EQUIPMENT, NET OTHER ASSETS TOTAL ASSETS CURRENT LIABILITIES: Accounts Payable Other Liabilities and Accrued Expenses Income Taxes Payable TOTAL CURRENT LIABILITIES NONCURRENT LIABILITIES: Long-Term Debt Other Liabilities TOTAL NONCURRENT LIABILITIES STOCKHOLDERS' EQUITY: Class A Common Stock, $0.01 par value: 150,000 shares authorized and 103,300 shares issued Additional Paid-In Capital Retained Earnings Accumulated Other Comprehensive Income (Loss) Treasury Stock, at Average Cost - 17,662 and 16,054 at December…arrow_forwardI Session 6 L Dashboard x Question 9 X G What is the X Login | bar x M (Alen A ezto.mheducation.com/ext/map/index.html?_con%3con&external_browser%3D0&launchUrl=https%253A%2521 - Z. M MKT 100 (Section 2. H QuickLaunchSSO : Homework Saved Asset W has an expected return of 13.6 percent and a beta of 1.37. If the risk-free rate is 4.62 percent, complete the following table for portfolios of Asset W and a risk-free asset. (Leave no cells blank - be certain to enter "O" wherever required. Do not round intermediate calculations. Enter your portfolio expected return answers as a percent rounded to 2 decimal places, e.g.., 32.16. Enter your portfolio beta answers rounded to 3 decimal places, e.g., 32.161.) Portfolio Expected Percentage of Portfolio in Asset W Portfolio Beta Return 0 % % 25 % 50 75 % 100 % 125 % 150 % ......Tarrow_forward1 2 m 4n 07 9. White 9 A Talk S Aint Ia O ENG 10 O Annota S Annota SAnnota M Recibic I Downl ssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false 台☆* + Facebook 6 Student Center Bb Blackboard WhatsApp Ggrammarly unemployment > |国Readi Maps Zoom Mark Turney owns Creative Corners. He does his banking at United Federal Bank (UFB) in Tucson, Arizona. The amounts in his general ledger for payroll taxes and the employee's withholding of Social Security, Medicare, and federal income tax as of April 15 of the current year show the following: Social Security tax payable (employer and employee), $3,020; Medicare tax payable (employer and employee), $734; FUTA tax payable, $84; SSUTA tax payable, $414; and Employees income tax payable, $4,622. Journalize the payment of the Form 941 deposit to UFB and the payment of the SUTA tax to the State of Arizona as of April 15, 20--. If an amount box does not require an entry, leave it blank. Page: POST. DATE DESCRIPTION…arrow_forward

- sf Your session h X sf Career Opport x x - ( xoqui Birdledon Writi x O Brussels Alrline x myAU Portal N X Fall 2021 Seme X to.mheducation.com/ext/map/index.html?_con%3Dcon&external_browser=0&launchUrl=https%253A%252F%252Flms.mheducation.com%252F... seno TV erviews (Chapter 8) i Saved Help Save & Exit Which of the following service auditor reports provide evidence about the operating effectiveness of controls? Multiple Choice Type 1 report. Type 2 report. Comprehensive report. IT report. Next %24 < Prev 6. 9 jo Finacial Accounting... Finacial Account....pdf Finacial Account...pdf Finacial Account..pdf MacBook Airarrow_forward4Homework: Project Analysis As X 9 Question 2 - Homework: Projec X %3D heducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Flms.mheducation.com%252F... O * O Project Analysis Assignment i 1 Saved Help Save & Exit Submit Check my work A project currently generates sales of $18 million, variable costs equal 60% of sales, and fixed costs are $3.6 million. The firm's tax rate is 35%. Assume all sales and expenses are cash items. a. What are the effects on cash flow, if sales increase from $18 million to $19.8 million? (Input the amount as positive value. Enter your answer in dollars not in millions.) Cash flow increases by $ 47,000 b. What are the effects on cash flow, if variable costs increase to 70% of sales? (Input the amount as positive value. Enter your answer in dollars not in millions.) decreases | by s 2$ 117,000 Cash flowarrow_forwardI need all answers No chatgpt used i will give 5 upvotes typing pleasearrow_forward

- ACCTUZ Chapterz Miini Case Microsolt Word AaBbCcD AaBbCcD AaBbC AaBbCc AABI AaBbCcl AaBbCcD AaBbCcC IT Normal T No Spaci. Heading 1 Heading 2 Subtle Em... Title Subtitle Emphasis Styles Ehapter 22 Mini Case When math is required, to receive full credit- SHOW YOUR MATH, otherwise you will not receive credit (even if the answer is correct). You must submit your answer on a word document or spreadsheet. Hand written responses are not acceptable and will not receive credit. Submit on Blackboard, if submitted via email or another source you will not receive credit. If submitted late (after the due date and time) you will not receive credit. Sweet Suites, Inc. operates a hotel property that has 300 rooms. On average, 80% of Sweet Suites, Inc., rooms are occupied on weekday, and 40% are occupied during the weekend. The managerhas asked you to developa budget forthe housekeeping and restaurant staff forweekdays and weekends. You have determined that the housekeeping staff requires 30 minutes…arrow_forwardDocHub X D Unit 4 Project - TVM Calculator X b.com/claudiasirois1122/Xv7zYW5RnILBBINV2A9egx/unit-4-project-tvm-calculator-pdf?pg=6 > ✓Sign - O Ri + 4. Use the TVM Calculator to fill in the following table given that the APR is 6%. Round to 2 decimal places as needed. PV = PMT= FV = APR = Periods CHANGES = Compounding: CHANGES Principal Compounding Periods $1,000 D $1,000 $1,000 $1,000 $1,000 Annually Semiannually Monthly Weekly Daily 1 2 12 a. What did P represent in the compound interest formula? P = regular deposit amount 52 shift Amount after 1 year enter If we summarize the effect seen in the table, we see that more compoundings per year means that you will have more money in the account, but the amount of increase will eventually level off. Most banks publish the APY, or Annual Percentage Yield, instead of the APR to account for this effect. $1060 $1060.90 365 $1061.83 Extension 5. What are some financial goals that people save for? Some financial goals people save for are a…arrow_forwardI need typing clear urjent no chatgpt use i will give 5 upvotesarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education