A&R Quality Advisors is a small consulting firm offering quality audits and advising services to small and mid-sized manufacturing firms. Quality audits entail reviewing, checking, and documenting quality practices within a firm. Quality advising entails making recommendations for new or revised quality practices. Other firms in the area offer one or both of these services, although the competition for quality audit jobs is stronger than for quality advising.

In addition to senior executives, A&R employees are either staff or managers. Staff employees are usually younger with less experience. Managers, who oversee the staff on jobs, are more experienced. The average hourly wage is $60 for staff and $150 for managers. (Both staff and managers are paid an annual salary; these hourly costs are based on 2,000 average annual hours worked.) Staff are expected to spend at least 90 percent of their time on billable work. Because of administrative work associated with supervising the staff and the expectation that managers will spend a portion of their time seeking new business, managers are expected to spend about 50 percent of their time on billable work. A&R employs 10 staff and two managers.

In addition to staff and manager costs, A&R has

Selected information on billable hours expected for the next year follows:

| Billable Audit Hours | Billable Advising Hours | Total Billable Hours | ||||

|---|---|---|---|---|---|---|

| Staff | Manager | Staff | Manager | Staff | Manager | |

| Client 01 | 150 | 12 | 200 | 10 | 350 | 22 |

| Client 02 | 70 | 10 | 0 | 0 | 70 | 10 |

| Client 03 | 220 | 30 | 80 | 15 | 300 | 45 |

| ⋮ | ⋮ | ⋮ | ⋮ | ⋮ | ⋮ | ⋮ |

| Client 49 | 40 | 2 | 0 | 0 | 40 | 2 |

| Client 50 | 300 | 20 | 200 | 15 | 500 | 35 |

| Total | 8,500 | 1,200 | 9,500 | 800 | 18,000 | 2,000 |

Although not all clients use A&R for both services, about 70 percent do.

A&R bills audit services based on billable hours and advising services at a fixed fee. The cost for audit services is determined by multiplying the billable hours by the quoted employee rates. Staff rates for the following year are $200 per hour, and manager rates are $500 per hour. The rates are set to meet the competition in the area.

To determine the cost (not the price) of the job, A&R uses a

Total revenue at A&R next year is expected to be $8 million.

The two founding partners of A&R are looking at these

Required:

-

What is the predetermined overhead rate for costing jobs in the following year?

-

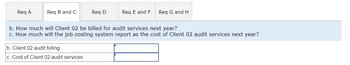

How much will Client 02 be billed for audit services next year?

-

How much will the job costing system report as the cost of Client 02 audit services next year?

-

What will be the total revenues from audit services next year based on the expected hours and the billing rates?

-

Based on the job costing system, what will the reported cost of audit services be next year?

-

Based on the job costing system, what will be the cost of advisory services?

-

What is the expected profit of audit services next year?

-

What is the expected profit of advisory services next year?

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

- Marin Company produces two software products (Cloud-X and Cloud-Y) in two separate departments (A and B). These products are highly regarded network maintenance programs. Cloud-X is used for small networks and Cloud-Y is used for large networks. Marin is known for the quality of its products and its ability to meet dates promised for software upgrades. Department A produces Cloud-X, and department B produces Cloud-Y. The production departments are supported by two support departments, systems design and programming services. The sources and uses of the support department time are summarized as follows: 1. Determine the total support costs allocated to each of the producing departments using (a) the direct method, (b) the step method (design department goes first), and (c) the reciprocal method.arrow_forwardThe Ferrell Transportation Company uses a responsibility reporting system to measure the performance of its three investment centers: Planes, Taxis, and Limos. Segment performance is measured usinga system of responsibility reports and return on investment calculations. The allocation of resources within the company and the segment managers' bonuses are based in part on the results shown in these reports. Recently, the company was the victim of a computer virus that deleted portions of the company's accounting records. This was discovered when the current period's responsibility reports were being prepared. The printout of the actual operating results appeared as follows. Determine the missing pieces of information below. (Round intermediate calculations and final answers to 0 decimal places, eg. 1,255.) Planes Taxis Limos Service revenue 24 $504,700 $4 Variable costs 5,502,300 296,900 Contribution margin 255.000 485 420arrow_forwardAaron is a cost accountant for Majik Systems Inc. Martin the VP of marketing has asked Aaron to meet with the represenatives of Majik Systems major competitor to discuss product cost data. Martin indicates that the sharing of data will enable Majik Systems to determin a fair and equitable price for its products. Would it be ethical for Aaron to attend the meeting and share the relevant cost data? Why or Why not?arrow_forward

- Corcoran Heavy Industries Company (CHIC) is organized into four divisions, each of which operates in a different industry. The types of customer served and the method used to distribute products differ across all four of these industries. In addition, each division must comply with its own unique set of industry regulations related to issues such as safety and recyclability of materials.Operating profit before depreciation and amortization is the measure of profit regularly used by the chief operating decision maker for evaluating the performance of each of these divisions. In addition, information for each division on capital expenditures and depreciation and amortization is routinely provided by corporate headquarters to the chief operating decision maker. A summary of the information provided to the chief operating decision maker at the end of the current year is as follows:Required I. Prepare a report for CHIC's management evaluating whether the operating segments disclosures…arrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardA&R Quality Advisors is a small consulting firm offering quality audits and advising services to small and mid-sized manufacturing firms. Quality audits entail reviewing, checking, and documenting quality practices within a firm. Quality advising entails making recommendations for new or revised quality practices. Other firms in the area offer one or both of these services, although the competition for quality audit jobs is stronger than for quality advising. In addition to senior executives, A&R employees are either staff or managers. Staff employees are usually younger with less experience. Managers, who oversee the staff on jobs, are more experienced. The average hourly wage is $60 for staff and $150 for managers. (Both staff and managers are paid an annual salary; these hourly costs are based on 2,000 average annual hours worked.) Staff are expected to spend at least 90 percent of their time on billable work. Because of administrative work associated with supervising the…arrow_forward

- You are the Certified Managerial Accountant (CMA) for Southwood Company. You have worked for the company for several years and your responsibilities include working with managers to analyze business decisions by allocating production costs to goods, and creating budgets and production forecasts. You also provide information to the external accountant for preparation of the financial statements. Your opinion is well respected and you have successfully worked with management on several big projects in the past. Southwood Company manufactures a single line of footballs in a small plant. Management has been meeting on several ideas they are considering about expansion of the plant as well as your advice on which would be the best alternative for production. After you have prepared the journal entries and income statement for the current year, management has asked you to review the data related to the proposed scenarios and prepare a presentation for top management. Part One: Management has…arrow_forwardPace Company makes computer chips. Sam is manager of the company's maintenance department. Because his maintenance technicians are so well trained in maintaining expensive and sensitive circuit board stamping equipment, Sam has been authorized to contract to perform maintenance for outside customers. In this company, the maintenance department is likely organized as: a) A profit center. Ob) A revenue center. c) A cost center. d) An investment center.arrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

- Briefly explain two (2) potential pitfalls encountered in the design of performance indicators and measurement systems.arrow_forwardThe Carla Vista Burkett Company uses a responsibility reporting system to measure the performance of its three investment centers: Planes, Taxis, and Limos. Segment performance is measured using a system of responsibility reports and return on investment calculations. The allocation of resources within the company and the segment managers' bonuses are based in part on the results shown in these reports. Recently, the company was the victim of a computer virus that deleted portions of the company's accounting records. This was discovered when the current period's responsibility reports were being prepared. The actual operating results appeared as follows. Determine the missing amounts. (Round Return on Investment to 1 decimal place, e.g. 52.7%.) Service revenue Variable costs Contribution margin Controllable fixed costs Controllable margin Average operating assets Return on investment $ Planes 5,018,000 1,518,000 25,018,000 12% Taxis $459,000 $ 189,000 79,000 10% Limos 329,000 389,000…arrow_forwardYou are the Certified Managerial Accountant (CMA) for Southwood Company. You have worked for the company for several years and your responsibilities include working with managers to analyze business decisions by allocating production costs to goods, and creating budgets and production forecasts. You also provide information to the external accountant for preparation of the financial statements. Your opinion is well respected and you have successfully worked with management on several big projects in the past. Southwood Company manufactures a single line of footballs in a small plant. Management has been meeting on several ideas they are considering about expansion of the plant as well as your advice on which would be the best alternative for production. After you have prepared the journal entries and income statement for the current year, management has asked you to review the data related to the proposed scenarios and prepare a presentation for top management. Part One: Management has…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education